- Canada

- /

- Healthcare Services

- /

- TSX:QIPT

3 TSX Penny Stocks With Market Caps Under CA$200M

Reviewed by Simply Wall St

The Canadian stock market has shown resilience recently, with the TSX gaining over 2% despite ongoing tariff uncertainties impacting global markets. In such a fluctuating landscape, investors often explore opportunities beyond well-known names, considering smaller or newer companies that might offer unique growth potential. While the term "penny stocks" may seem outdated, these stocks continue to attract attention for their affordability and potential for significant returns when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.56 | CA$58.67M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.58 | CA$65.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.60 | CA$389.2M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.20 | CA$627.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.74 | CA$280.75M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.56 | CA$503.32M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.52 | CA$121.91M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.39 | CA$72.8M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.485 | CA$14.61M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.16 | CA$42.46M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 924 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

DIRTT Environmental Solutions (TSX:DRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DIRTT Environmental Solutions Ltd. is a Canadian interior construction company with a market cap of CA$191.53 million.

Operations: The company generates revenue primarily from its Building Products segment, totaling $174.31 million.

Market Cap: CA$191.53M

DIRTT Environmental Solutions has shown promising developments in the penny stock arena, achieving profitability with a net income of US$14.77 million for 2024, reversing a previous loss. The company's revenue forecast for 2025 is between US$194 million and US$209 million, indicating potential growth. Despite its relatively inexperienced board, DIRTT maintains strong financial health with cash exceeding debt and short-term assets covering liabilities. Its return on equity is high at 34.7%, though interest coverage by EBIT remains below ideal levels at 2.4 times. Recent share buybacks suggest confidence in future prospects amidst stable weekly volatility.

- Dive into the specifics of DIRTT Environmental Solutions here with our thorough balance sheet health report.

- Gain insights into DIRTT Environmental Solutions' future direction by reviewing our growth report.

Pulse Seismic (TSX:PSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulse Seismic Inc. acquires, markets, and licenses 2D and 3D seismic data for the energy sector in Canada, with a market cap of CA$121.91 million.

Operations: The company's revenue is primarily generated from its Oil Well Equipment & Services segment, totaling CA$37.36 million.

Market Cap: CA$121.91M

Pulse Seismic Inc. has demonstrated financial resilience within the penny stock sector, highlighted by a substantial net income increase to CA$13.38 million in Q1 2025 from CA$2.68 million a year prior. The company operates debt-free, enhancing its financial stability and flexibility, with short-term assets significantly exceeding liabilities. Despite negative earnings growth last year, Pulse's return on equity remains outstanding at 68.6%, indicating efficient use of capital. Recent initiatives include a share repurchase program and increased dividends, reflecting strong cash flow management and shareholder value focus amidst stable weekly volatility levels over the past year.

- Click to explore a detailed breakdown of our findings in Pulse Seismic's financial health report.

- Examine Pulse Seismic's past performance report to understand how it has performed in prior years.

Quipt Home Medical (TSX:QIPT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quipt Home Medical Corp., operating through its subsidiaries, provides durable and home medical equipment and supplies in the United States, with a market cap of CA$122.81 million.

Operations: The company generates revenue of $244.72 million from its durable and home medical equipment and supplies segment in the United States.

Market Cap: CA$122.81M

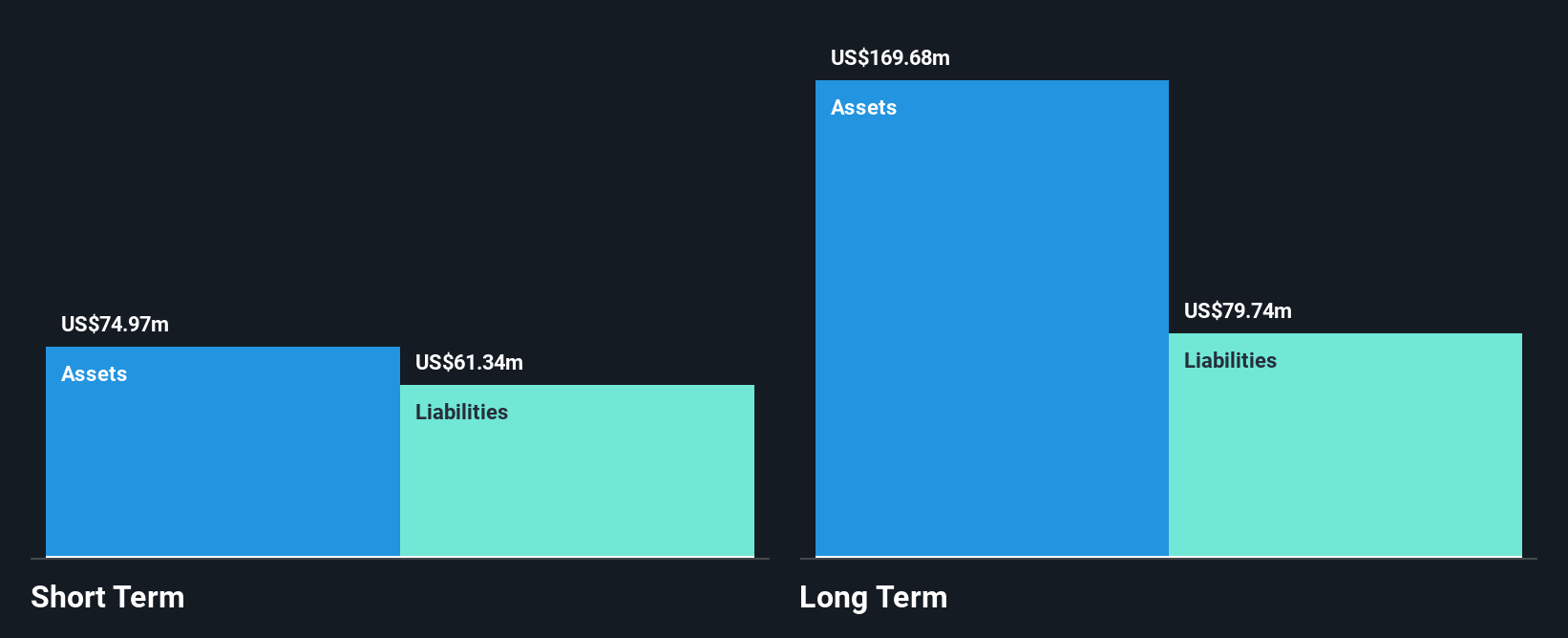

Quipt Home Medical Corp., while unprofitable, maintains a strong cash runway exceeding three years due to positive free cash flow. The company recently reported a slight decrease in revenue and net loss compared to the previous year, with sales at US$24.32 million for Q1 2025. Despite high net debt to equity ratio of 62.4%, short-term assets cover liabilities comfortably, suggesting some financial stability. Recent investor activism led to an agreement with Kanen Wealth Management, granting board access and establishing a committee for governance improvements, reflecting proactive corporate governance efforts amidst ongoing operational challenges.

- Click here to discover the nuances of Quipt Home Medical with our detailed analytical financial health report.

- Learn about Quipt Home Medical's future growth trajectory here.

Next Steps

- Gain an insight into the universe of 924 TSX Penny Stocks by clicking here.

- Contemplating Other Strategies? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quipt Home Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QIPT

Quipt Home Medical

Through its subsidiaries, engages in the provision of durable and home medical equipment and supplies in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives