In 2015 Jim Riddell was appointed CEO of Paramount Resources Ltd. (TSE:POU). First, this article will compare CEO compensation with compensation at similar sized companies. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for Paramount Resources

How Does Jim Riddell's Compensation Compare With Similar Sized Companies?

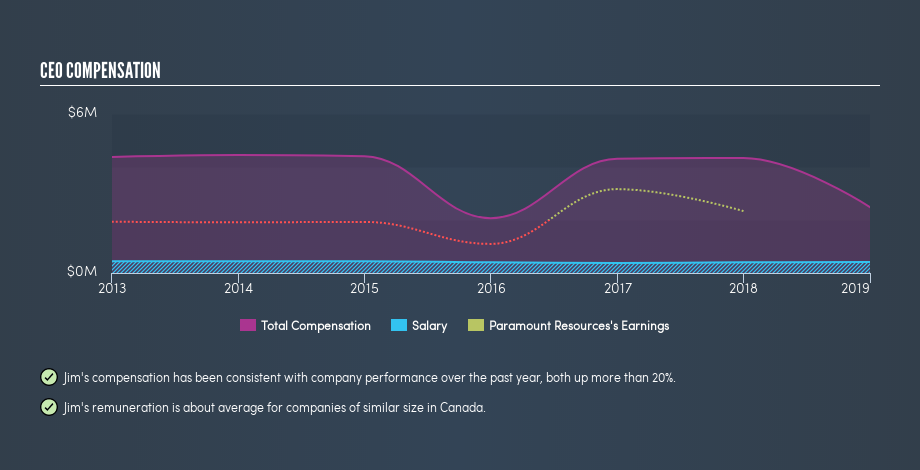

At the time of writing our data says that Paramount Resources Ltd. has a market cap of CA$885m, and is paying total annual CEO compensation of CA$2.5m. (This figure is for the year to January 2019). While we always look at total compensation first, we note that the salary component is less, at CA$411k. We looked at a group of companies with market capitalizations from CA$526m to CA$2.1b, and the median CEO total compensation was CA$2.1m.

So Jim Riddell is paid around the average of the companies we looked at. Although this fact alone doesn't tell us a great deal, it becomes more relevant when considered against the business performance.

The graphic below shows how CEO compensation at Paramount Resources has changed from year to year.

Is Paramount Resources Ltd. Growing?

Over the last three years Paramount Resources Ltd. has shrunk its earnings per share by an average of 8.0% per year (measured with a line of best fit). It achieved revenue growth of 31% over the last year.

The reduction in earnings per share, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for earnings growth. It's hard to reach a conclusion about business performance right now. This may be one to watch.

Has Paramount Resources Ltd. Been A Good Investment?

Given the total loss of 43% over three years, many shareholders in Paramount Resources Ltd. are probably rather dissatisfied, to say the least. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

Jim Riddell is paid around what is normal the leaders of comparable size companies.

The company cannot boast particularly strong per share growth. And it's hard to argue that the returns over the last three years have delighted. So it would take a bold person to suggest the pay is too modest. CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Paramount Resources (free visualization of insider trades).

If you want to buy a stock that is better than Paramount Resources, this free list of high return, low debt companies is a great place to look.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:POU

Paramount Resources

An energy company, explores for and develops conventional and unconventional petroleum and natural gas reserves and resources in Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026