- Canada

- /

- Oil and Gas

- /

- TSX:PEY

Assessing Peyto Exploration & Development (TSX:PEY) Valuation After New Analyst Attention and “Top Pick” Recognition

Reviewed by Simply Wall St

Recent analyst commentary and a high profile portfolio manager naming Peyto Exploration & Development (TSX:PEY) as a top pick have pushed the stock back onto investors’ radar, especially those focused on Canadian natural gas.

See our latest analysis for Peyto Exploration & Development.

That renewed attention is landing on a stock that has already been in motion, with a roughly 28% 3 month share price return helping lift Peyto to CA$22.98 and supporting a 52% 1 year total shareholder return that suggests momentum is building rather than fading.

If Peyto’s run has you rethinking where energy fits in your portfolio, it could be a good moment to compare it with other Canadian producers and broaden your search through fast growing stocks with high insider ownership.

With the shares hovering just below analyst targets but trading at a deep discount to some intrinsic value estimates, investors now face a pivotal question: is Peyto still a buyable mispricing, or is the market already banking on further growth?

Most Popular Narrative: 30% Overvalued

With Peyto’s shares closing at CA$22.98 against a narrative fair value of about CA$22.91, the story leans toward a mildly stretched valuation that still hinges heavily on execution.

Analysts are assuming Peyto Exploration & Development's revenue will grow by 16.6% annually over the next 3 years.

Analysts assume that profit margins will shrink from 34.2% today to 31.1% in 3 years time.

Want to see how steady growth, gently tightening margins and a richer earnings multiple still add up to an overvaluation call? The full narrative unpacks the tension between robust top line assumptions, moderating profitability and a future valuation multiple that must hold up in a cyclical commodity business.

Result: Fair Value of $22.91 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, longer-term gains still hinge on commodity prices holding up and regulatory or infrastructure costs not eroding those carefully managed margins.

Find out about the key risks to this Peyto Exploration & Development narrative.

Another Angle: Multiples Paint a Cheaper Picture

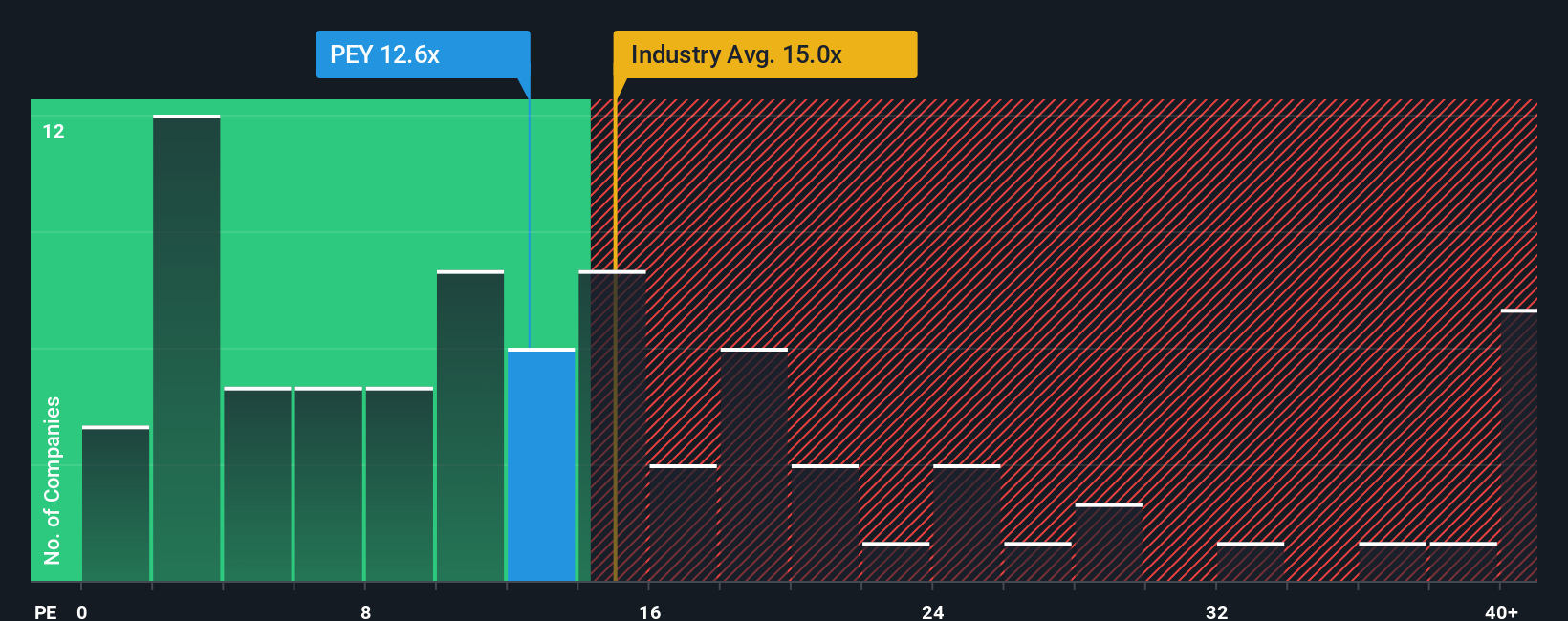

While the narrative model says Peyto looks about 30% overvalued, its 12.6x price to earnings sits well below the industry’s 15x and peers at 37.9x, and under our 14.6x fair ratio. This hints the market may be underpricing its earnings power.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Peyto Exploration & Development Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a full Peyto story yourself in just a few minutes: Do it your way.

A great starting point for your Peyto Exploration & Development research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity when you can quickly scan fresh ideas across sectors, valuations, and themes that other investors could easily overlook.

- Explore potential mispricings by targeting undervalued cash flow machines through these 908 undervalued stocks based on cash flows that may offer alternative opportunities to well known names.

- Review these 26 AI penny stocks involved in the AI transformation, including intelligent software, automation, and data driven platforms.

- Evaluate your income strategy by focusing on reliable payouts from these 13 dividend stocks with yields > 3% that aim to balance yield with quality fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PEY

Peyto Exploration & Development

Engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta’s deep basin.

Undervalued with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)