- Philippines

- /

- Food and Staples Retail

- /

- PSE:RRHI

Global Undervalued Small Caps With Recent Insider Activity

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced challenges amid escalating geopolitical tensions and fluctuating economic indicators. Despite declines in indexes like the S&P MidCap 400 and Russell 2000, improved business sentiment and easing inflationary pressures provide a cautiously optimistic backdrop for identifying potential opportunities in undervalued small caps. A good stock in this environment often exhibits resilience through sound fundamentals and strategic insider activity that suggests confidence in its long-term prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hemisphere Energy | 5.3x | 2.2x | 7.36% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 38.61% | ★★★★☆☆ |

| AKVA group | 18.4x | 0.8x | 48.25% | ★★★★☆☆ |

| Saturn Oil & Gas | 2.7x | 0.5x | -64.87% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.6x | 39.71% | ★★★★☆☆ |

| Fuller Smith & Turner | 12.0x | 0.9x | -55.12% | ★★★☆☆☆ |

| SmartCraft | 43.6x | 7.8x | 30.41% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 9.4x | 0.6x | 13.74% | ★★★☆☆☆ |

| H+H International | 32.2x | 0.7x | 46.62% | ★★★☆☆☆ |

| AInnovation Technology Group | NA | 2.4x | 47.10% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

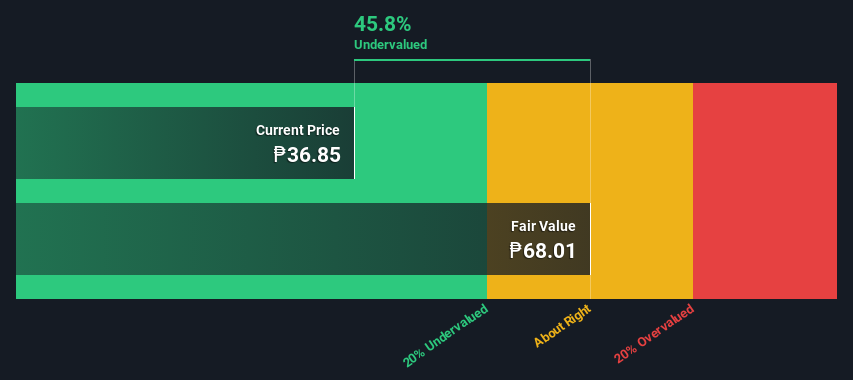

Robinsons Retail Holdings (PSE:RRHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Robinsons Retail Holdings operates a diverse range of retail businesses including food, department stores, specialty stores, drugstores, and DIY outlets with a market capitalization of ₱1.35 billion.

Operations: Robinsons Retail Holdings generates revenue primarily from its Food and Drug Store divisions, with significant contributions from Department Stores, Specialty Stores, and DIY segments. The company has seen fluctuations in its gross profit margin, which reached 24.20% by March 2025. Operating expenses are a substantial part of the cost structure, with general and administrative expenses being a major component.

PE: 7.2x

Robinsons Retail Holdings, a small company in the retail sector, has recently experienced insider confidence with James Gokongwei purchasing 640,200 shares valued at ₱22.9 million. Despite a decline in net income to ₱760 million for Q1 2025 from ₱5.08 billion the previous year, sales increased slightly to ₱47.82 billion from ₱45.89 billion. The company declared a cash dividend of PHP 2 per share payable on June 9, 2025, reflecting steady shareholder returns amidst executive changes and potential growth prospects with forecasted earnings growth of nearly 7% annually.

- Click here and access our complete valuation analysis report to understand the dynamics of Robinsons Retail Holdings.

Learn about Robinsons Retail Holdings' historical performance.

Obsidian Energy (TSX:OBE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Obsidian Energy is an oil and gas exploration and production company with operations primarily focused on the Western Canadian Sedimentary Basin, holding a market cap of CA$0.58 billion.

Operations: The primary revenue stream comes from the exploration and production of oil and gas, generating CA$755.60 million. Cost of Goods Sold (COGS) was CA$285.70 million, leading to a gross profit margin of 62.19%. Operating expenses were recorded at CA$688.70 million, with notable non-operating expenses impacting net income figures significantly over recent periods.

PE: -2.9x

Obsidian Energy, a smaller player in the energy sector, has shown insider confidence with Edward Kernaghan purchasing 489,300 shares for C$3.5 million between January and May 2025. This indicates potential belief in the company's prospects amidst its ongoing operational successes. Recent developments include achieving record production highs at Peace River and successful drilling programs at HVS and Dawson fields. The company also repurchased over 3.5 million shares for C$24.5 million this year, reflecting strategic capital allocation efforts while managing debt effectively with reduced borrowing on its credit facility to approximately C$30 million as of April 2025.

- Click here to discover the nuances of Obsidian Energy with our detailed analytical valuation report.

Assess Obsidian Energy's past performance with our detailed historical performance reports.

Vermilion Energy (TSX:VET)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vermilion Energy is an oil and gas exploration and production company with a market cap of CA$3.85 billion.

Operations: The company's revenue primarily stems from its oil and gas exploration and production activities, with recent figures showing CA$1.86 billion in revenue. The cost of goods sold (COGS) for the same period was CA$667.54 million, resulting in a gross profit margin of 64.18%.

PE: -50.7x

Vermilion Energy, a smaller energy player, shows potential as an undervalued investment despite some financial challenges. Recent production guidance for 2025 indicates a focus on natural gas, with expected output between 120,000 to 125,000 boe/d. The company repurchased 1.6 million shares for CAD 19.1 million from January to May 2025, suggesting management's confidence in its value proposition. However, earnings are forecasted to decline significantly over the next few years due to reliance on external borrowing and interest coverage concerns.

- Click to explore a detailed breakdown of our findings in Vermilion Energy's valuation report.

Gain insights into Vermilion Energy's past trends and performance with our Past report.

Turning Ideas Into Actions

- Access the full spectrum of 172 Undervalued Global Small Caps With Insider Buying by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:RRHI

Robinsons Retail Holdings

Operates as a multi-format retail company in the Philippines.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives