- Canada

- /

- Energy Services

- /

- TSX:NOA

North American Construction Group Ltd.'s (TSE:NOA) Shares Not Telling The Full Story

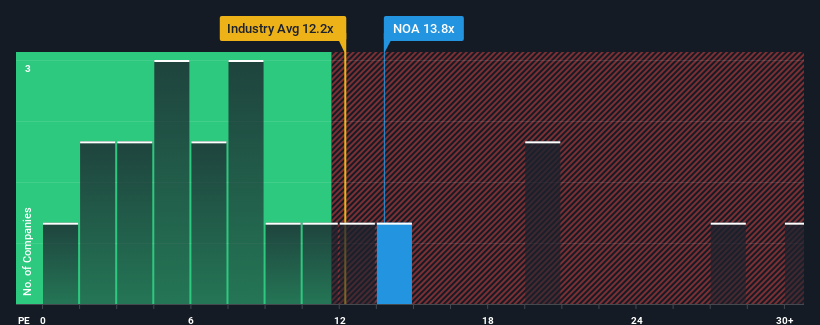

There wouldn't be many who think North American Construction Group Ltd.'s (TSE:NOA) price-to-earnings (or "P/E") ratio of 13.8x is worth a mention when the median P/E in Canada is similar at about 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times haven't been advantageous for North American Construction Group as its earnings have been falling quicker than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for North American Construction Group

How Is North American Construction Group's Growth Trending?

In order to justify its P/E ratio, North American Construction Group would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 20% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 126% as estimated by the five analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 20%, which is noticeably less attractive.

With this information, we find it interesting that North American Construction Group is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of North American Construction Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for North American Construction Group (1 makes us a bit uncomfortable!) that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if North American Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NOA

North American Construction Group

Provides mining and heavy civil construction services to customers in the resource development and industrial construction sectors in Australia, Canada, and the United States.

Moderate with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives