- Canada

- /

- Oil and Gas

- /

- TSX:IMO

News Flash: Analysts Just Made A Notable Upgrade To Their Imperial Oil Limited (TSE:IMO) Forecasts

Shareholders in Imperial Oil Limited (TSE:IMO) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

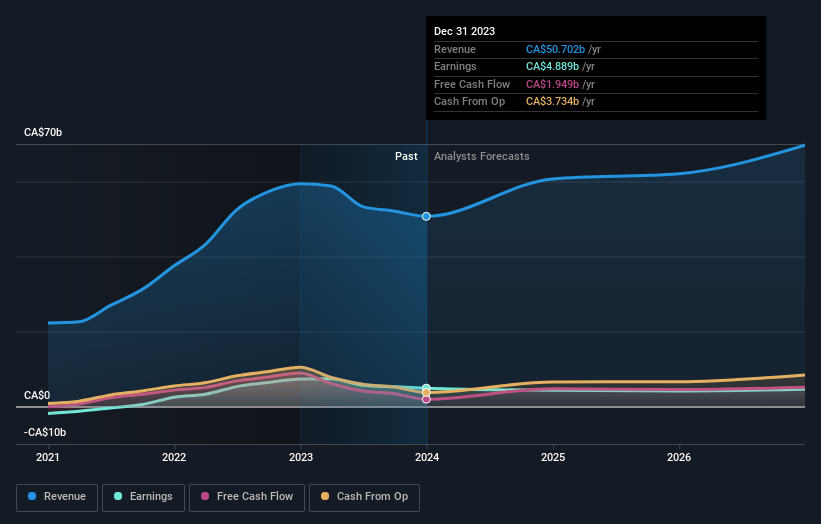

Following the upgrade, the latest consensus from Imperial Oil's six analysts is for revenues of CA$61b in 2024, which would reflect a solid 20% improvement in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing CA$50b of revenue in 2024. The consensus has definitely become more optimistic, showing a considerable lift to revenue forecasts.

View our latest analysis for Imperial Oil

There was no particular change to the consensus price target of CA$86.96, with Imperial Oil's latest outlook seemingly not enough to result in a change of valuation.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting Imperial Oil's growth to accelerate, with the forecast 20% annualised growth to the end of 2024 ranking favourably alongside historical growth of 15% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 5.4% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Imperial Oil to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts lifted their revenue estimates for this year. They're also forecasting more rapid revenue growth than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Imperial Oil.

Looking for more information? At least one of Imperial Oil's six analysts has provided estimates out to 2026, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you're looking to trade Imperial Oil, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IMO

Imperial Oil

Engages in exploration, production, and sale of crude oil and natural gas in Canada.

Undervalued with excellent balance sheet and pays a dividend.