- Canada

- /

- Oil and Gas

- /

- TSX:IMO

Imperial Oil (TSX:IMO) Valuation Spotlight as Restructuring Reshapes Long-Term Prospects

Reviewed by Kshitija Bhandaru

Imperial Oil (TSX:IMO) is making significant moves with a sweeping restructuring plan that includes selling its Calgary head office, consolidating operations, and cutting its workforce by 20% over the next two years.

See our latest analysis for Imperial Oil.

Recent restructuring news has fueled plenty of conversation around Imperial Oil’s future, but the share price has mostly held steady, with total shareholder return of just 0.2% over the past year and significant long-term gains for patient investors. While momentum has cooled compared to prior years, the company’s cost-cutting push and production upgrades at core assets like Kearl keep long-term potential in focus.

If you’re watching energy stocks shake things up, it might be smart to broaden your horizons and check out fast growing stocks with high insider ownership.

Given these sweeping changes, the central question for investors is whether Imperial Oil’s share price still offers hidden value or if the recent rally means all the upside from restructuring is already reflected. Could this be a real buying opportunity, or has the market priced in future growth?

Most Popular Narrative: 15.9% Overvalued

Imperial Oil’s share price currently stands above the fair value estimate in the narrative, hinting that expectations may have outpaced fundamentals. Let’s look at what’s driving the controversial outlook and what could really matter for investors.

Major efficiency improvements at Kearl, including unit cash cost reductions (~$2/bbl YoY), productivity upgrades, and extension of turnaround intervals, position Imperial Oil for sustained margin expansion and higher ROIC as production targets increase toward 300,000 bbl/d. These developments are set to improve future net margins and earnings. Ramped-up production and expansion of solvent-assisted SAGD at Cold Lake, as well as new projects with decades of inventory, are expected to drive long-term production growth and lower per-barrel emissions and costs. This supports both higher revenue and better regulatory risk management.

Wondering how such bold operational upgrades fuel this premium valuation? The narrative hinges on aggressive production goals, cost efficiencies, and margin resilience. Want to see the exact financial forecast that sets this price? Only the full narrative reveals the numbers behind the optimism.

Result: Fair Value of $108.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on carbon-intensive oil sands and fluctuations in global oil prices could threaten Imperial Oil’s earnings momentum if industry conditions worsen.

Find out about the key risks to this Imperial Oil narrative.

Another View: What Does the SWS DCF Model Suggest?

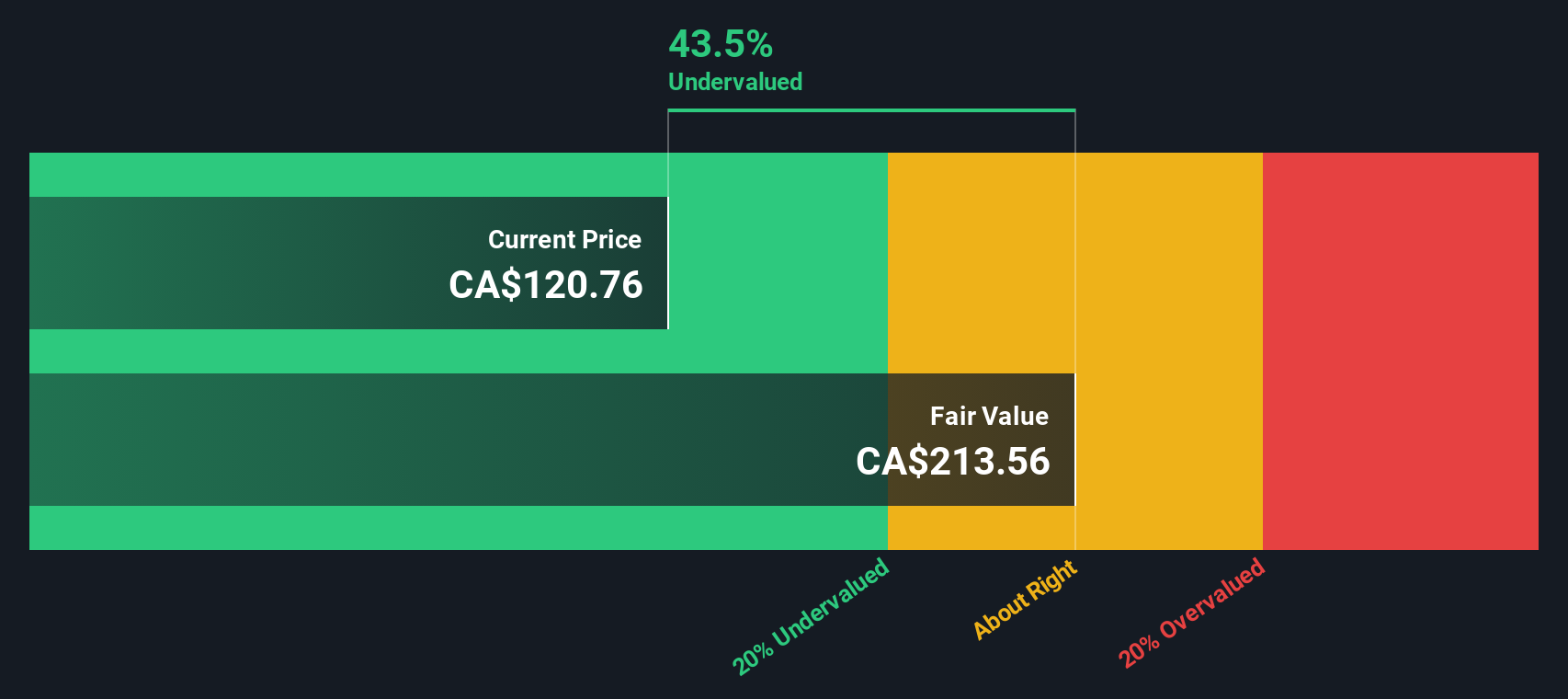

While analysts see Imperial Oil as overvalued based on future earnings, our DCF model offers a different perspective. According to the SWS DCF model, Imperial Oil is actually trading at a substantial discount to its estimated fair value. This suggests there could be more upside than consensus forecasts indicate. Which method best reflects reality: market sentiment or long-term cash flow fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Imperial Oil for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Imperial Oil Narrative

If you have a different perspective or want to dig into the numbers yourself, you’re free to analyze the data directly and shape your own view in just a few minutes. Do it your way.

A great starting point for your Imperial Oil research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for the usual stocks when unique opportunities are just a click away. Take advantage of fresh data and spot winners before the crowd does.

- Uncover hidden potential by reviewing these 896 undervalued stocks based on cash flows, which leverages strong cash flows and appealing value metrics not yet recognized by the market.

- Tap into the future of healthcare by checking out these 31 healthcare AI stocks, where breakthroughs in AI-driven medicine are reshaping the industry landscape.

- Seize opportunities in the world of digital finance through these 78 cryptocurrency and blockchain stocks, as innovative companies embrace blockchain technology and the growth of cryptocurrencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IMO

Imperial Oil

Engages in exploration, production, and sale of crude oil and natural gas in Canada.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives