The board of Imperial Oil Limited (TSE:IMO) has announced that it will be increasing its dividend on the 1st of July to CA$0.27. This takes the annual payment to 2.5% of the current stock price, which unfortunately is below what the industry is paying.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Imperial Oil's stock price has increased by 44% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for Imperial Oil

Imperial Oil's Distributions May Be Difficult To Sustain

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Imperial Oil is unprofitable despite paying a dividend, and it is paying out 114% of its free cash flow. This is quite a strong warning sign that the dividend may not be sustainable.

Over the next year, EPS might fall by 18.1% based on recent performance. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

Imperial Oil Has A Solid Track Record

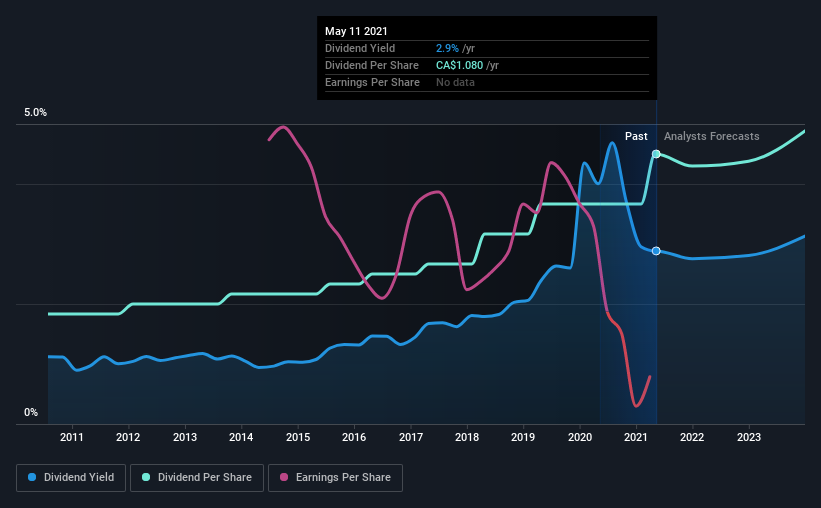

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2011, the dividend has gone from CA$0.44 to CA$1.08. This implies that the company grew its distributions at a yearly rate of about 9.4% over that duration. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, initial appearances might be deceiving. Over the past five years, it looks as though Imperial Oil's EPS has declined at around 18% a year. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

Imperial Oil's Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Imperial Oil's payments are rock solid. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 2 warning signs for Imperial Oil that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:IMO

Imperial Oil

Engages in exploration, production, and sale of crude oil and natural gas in Canada.

Undervalued with excellent balance sheet and pays a dividend.