- Canada

- /

- Oil and Gas

- /

- TSX:IMO

A Look at Imperial Oil’s (TSX:IMO) Valuation After Major Restructuring and Workforce Reduction Plans

Reviewed by Kshitija Bhandaru

Imperial Oil (TSX:IMO) is streamlining its operations by announcing a 20% workforce cut as part of a major restructuring plan. The company expects this move will drive meaningful annual savings and support its long-term financial strategy.

See our latest analysis for Imperial Oil.

Imperial Oil’s decision to slim down its workforce comes during a year of accelerating share price momentum, with a strong year-to-date gain of 37.3%. The stock’s one-year total shareholder return stands at 22.3%. Over the past five years, investors have seen a remarkable 731.6% total return, reflecting both operational progress and changing sentiment in the energy sector.

If efficiency improvements in energy caught your attention, take the next step and discover fast growing stocks with high insider ownership

With the stock posting large long-term gains but current prices sitting above analyst targets, investors are left to consider whether there is untapped value remaining here or if Imperial’s future is already reflected in the share price.

Most Popular Narrative: 12% Overvalued

Imperial Oil’s current share price sits above what the narrative sees as a fair valuation, setting the stage for major debate over how much future growth and operational progress is already priced in. The spotlight is on recent advances across Imperial’s refining and production network. Can these developments justify the valuation premium?

Major efficiency improvements at Kearl, including unit cash cost reductions (about $2 per barrel year over year), productivity upgrades, and extension of turnaround intervals, position Imperial Oil for sustained margin expansion and higher ROIC as production targets increase toward 300,000 barrels per day. This improves future net margins and earnings. Ramped-up production and expansion of solvent-assisted SAGD at Cold Lake, as well as new projects with decades of inventory, are expected to drive long-term production growth and lower per-barrel emissions and costs, supporting both higher revenue and better regulatory risk management.

Think you know what’s driving this premium? The narrative is fueled by bold volume targets, lower operating costs, and ambitious earnings assumptions. What specific forecasts push this fair value above today’s price? Find out what numbers analysts are betting on and see if you agree.

Result: Fair Value of $109.76 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could quickly shift if decarbonization pressures intensify or if oil price volatility begins to weigh more heavily on margins and future growth.

Find out about the key risks to this Imperial Oil narrative.

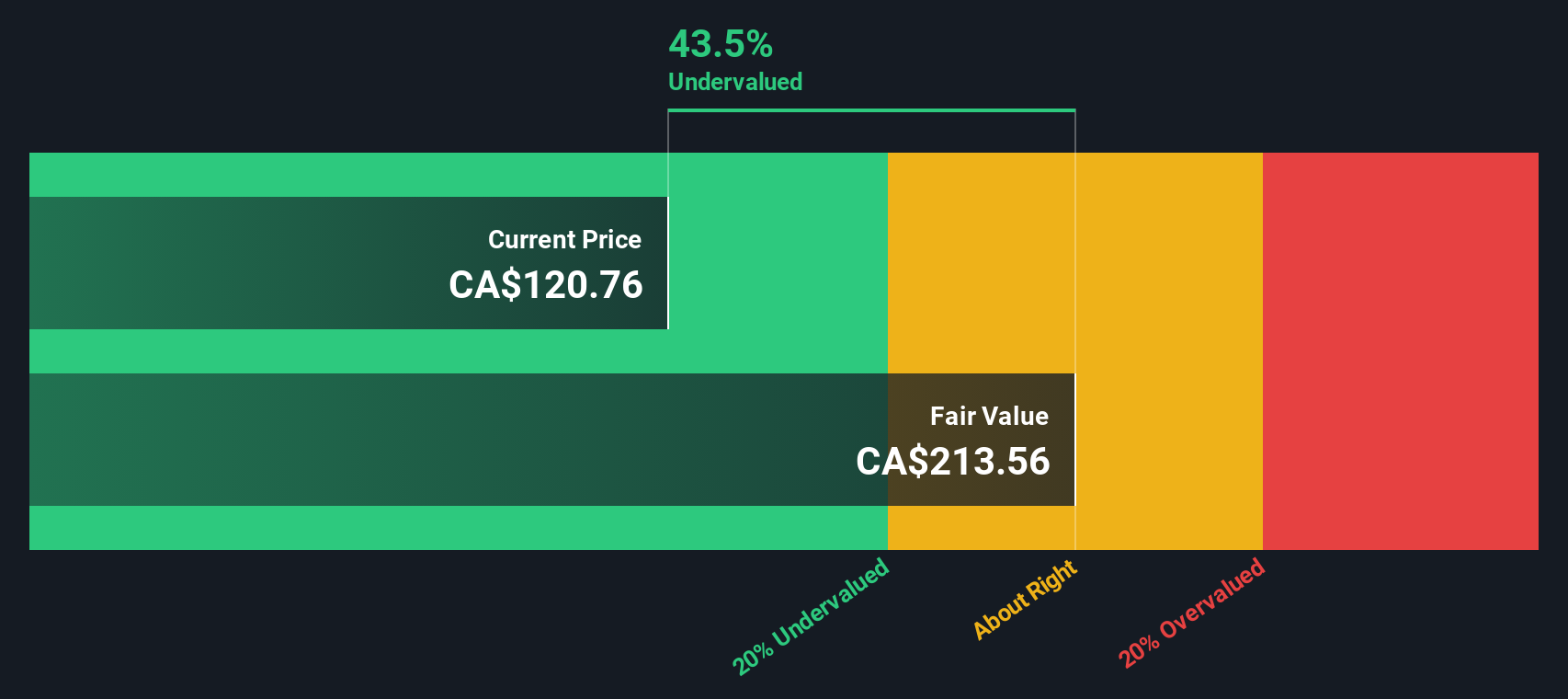

Another View: Discounted Cash Flow Perspective

While common valuation ratios suggest Imperial Oil is priced on the high side, our SWS DCF model presents a different perspective. According to this approach, shares are trading significantly below the model’s estimate of fair value. This may indicate that the market is overlooking Imperial’s long-term cash flow potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Imperial Oil for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Imperial Oil Narrative

Not convinced by the fair value debate or want to follow your own reasoning? Dive into the numbers and build your own view of Imperial Oil in just minutes: Do it your way.

A great starting point for your Imperial Oil research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Broaden your horizons and make the most of your portfolio with these powerful stock ideas from Simply Wall Street:

- Turbocharge your returns by evaluating high-yield companies through these 18 dividend stocks with yields > 3% with payouts above 3% and a track record of reliability for steady income.

- Spot tomorrow’s innovation leaders and get ahead of the crowd by checking out these 25 AI penny stocks driving the evolution of artificial intelligence in today’s market.

- Capitalize on overlooked gems by reviewing these 881 undervalued stocks based on cash flows that the market may have missed, offering attractive upside based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IMO

Imperial Oil

Engages in exploration, production, and sale of crude oil and natural gas in Canada.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives