- Canada

- /

- Oil and Gas

- /

- TSX:HWX

With EPS Growth And More, Headwater Exploration (TSE:HWX) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Headwater Exploration (TSE:HWX). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Headwater Exploration

How Fast Is Headwater Exploration Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that Headwater Exploration's EPS went from CA$0.0045 to CA$0.44 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

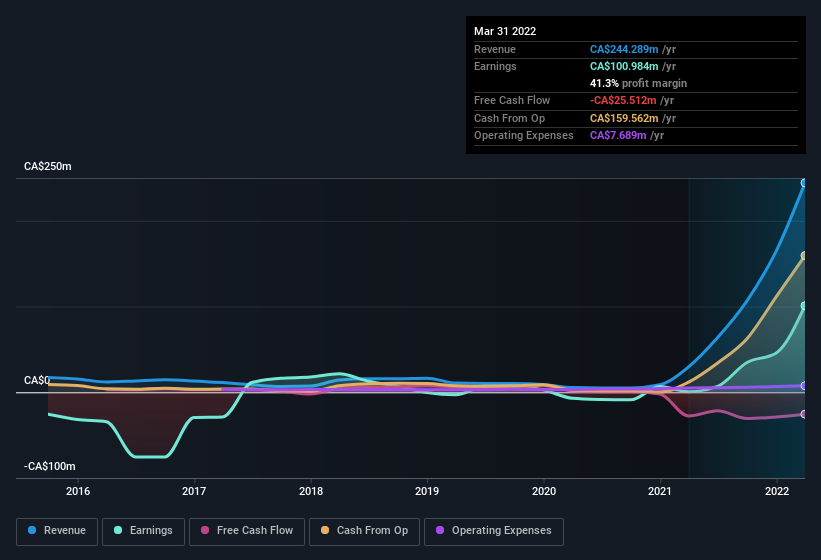

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the revenue front, Headwater Exploration has done well over the past year, growing revenue by 722% to CA$244m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Headwater Exploration's future profits.

Are Headwater Exploration Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Headwater Exploration shares worth a considerable sum. Given insiders own a significant chunk of shares, currently valued at CA$83m, they have plenty of motivation to push the business to succeed. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Headwater Exploration with market caps between CA$523m and CA$2.1b is about CA$2.1m.

The Headwater Exploration CEO received total compensation of just CA$755k in the year to December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Headwater Exploration To Your Watchlist?

Headwater Exploration's earnings per share growth have been climbing higher at an appreciable rate. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Big growth can make big winners, so the writing on the wall tells us that Headwater Exploration is worth considering carefully. However, before you get too excited we've discovered 4 warning signs for Headwater Exploration (1 is concerning!) that you should be aware of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Headwater Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HWX

Headwater Exploration

Engages in the exploration, development, and production of petroleum and natural gas in Canada.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives