- Canada

- /

- Oil and Gas

- /

- TSX:FRU

If EPS Growth Is Important To You, Freehold Royalties (TSE:FRU) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Freehold Royalties (TSE:FRU). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Freehold Royalties

Freehold Royalties' Improving Profits

Over the last three years, Freehold Royalties has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Freehold Royalties' EPS grew from CA$0.53 to CA$1.39, over the previous 12 months. Year on year growth of 163% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

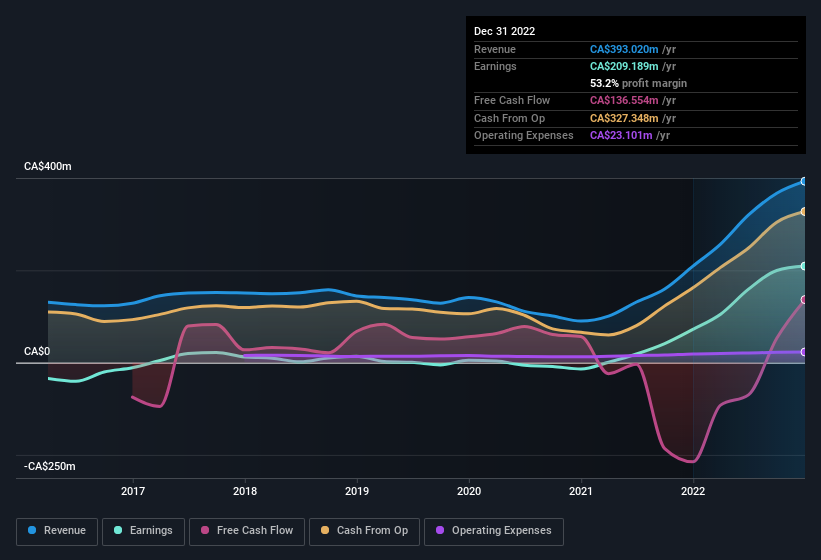

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Freehold Royalties shareholders is that EBIT margins have grown from 47% to 66% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Freehold Royalties?

Are Freehold Royalties Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see Freehold Royalties insiders walking the walk, by spending CA$704k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. It is also worth noting that it was President David Spyker who made the biggest single purchase, worth CA$276k, paying CA$13.83 per share.

Recent insider purchases of Freehold Royalties stock is not the only way management has kept the interests of the general public shareholders in mind. Specifically, the CEO is paid quite reasonably for a company of this size. The median total compensation for CEOs of companies similar in size to Freehold Royalties, with market caps between CA$1.4b and CA$4.4b, is around CA$3.1m.

The CEO of Freehold Royalties only received CA$624k in total compensation for the year ending December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Freehold Royalties Worth Keeping An Eye On?

Freehold Royalties' earnings per share growth have been climbing higher at an appreciable rate. Not to mention the company's insiders have been adding to their portfolios and the CEO's remuneration policy looks to have had shareholders in mind seeing as it's quite modest for the company size. It could be that Freehold Royalties is at an inflection point, given the EPS growth. If so, then its potential for further gains probably merit a spot on your watchlist. Still, you should learn about the 2 warning signs we've spotted with Freehold Royalties (including 1 which is a bit concerning).

The good news is that Freehold Royalties is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FRU

Freehold Royalties

Acquires and manages royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Canada and the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives