- Canada

- /

- Energy Services

- /

- TSX:ESI

Ensign Energy Services Inc.'s (TSE:ESI) Stock Retreats 28% But Revenues Haven't Escaped The Attention Of Investors

The Ensign Energy Services Inc. (TSE:ESI) share price has fared very poorly over the last month, falling by a substantial 28%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 18% in that time.

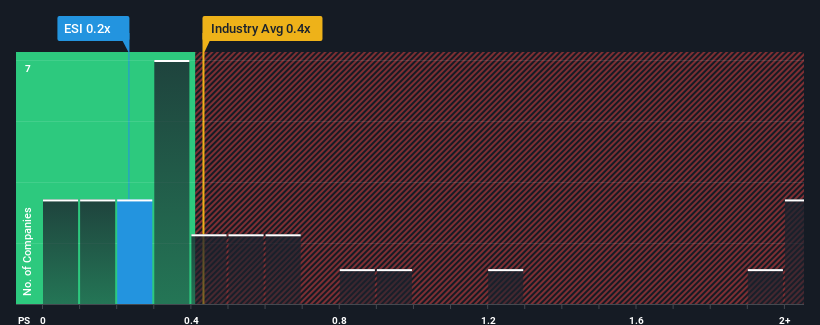

Although its price has dipped substantially, it's still not a stretch to say that Ensign Energy Services' price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Energy Services industry in Canada, where the median P/S ratio is around 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Ensign Energy Services

How Has Ensign Energy Services Performed Recently?

While the industry has experienced revenue growth lately, Ensign Energy Services' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Ensign Energy Services will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Ensign Energy Services' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 6.0% decrease to the company's top line. Even so, admirably revenue has lifted 69% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 4.0% per year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 3.9% per year, which is not materially different.

With this information, we can see why Ensign Energy Services is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Ensign Energy Services' P/S?

Ensign Energy Services' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Ensign Energy Services' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Energy Services industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Ensign Energy Services with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Ensign Energy Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Ensign Energy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ESI

Ensign Energy Services

Provides oilfield services to the oil and natural gas industries in Canada, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026