- Canada

- /

- Oil and Gas

- /

- TSX:EFR

Why Energy Fuels (TSX:EFR) Is Up 14.1% After Pilot Dysprosium Oxide Milestone and What's Next

Reviewed by Simply Wall St

- Earlier this month, Energy Fuels Inc. announced it achieved pilot-scale production of high-purity Dysprosium oxide at its White Mesa Mill, the only commercial U.S. facility currently producing heavy rare earth oxides from mined ores.

- This development highlights the company's advancement in rare earth processing and its potential role in enhancing domestic supply of critical materials like Dysprosium and Terbium.

- We'll explore how Energy Fuels' progress in U.S. Dysprosium oxide production could shape its investment thesis and growth outlook.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Energy Fuels Investment Narrative Recap

To be a shareholder of Energy Fuels today, you need to believe in its growth as a producer of critical rare earths and uranium, driven by the strategic capabilities at its White Mesa Mill. The company's pilot-scale Dysprosium oxide production marks technical progress toward scaling its rare earth business, but has little immediate effect on the most important short-term catalyst, uranium market sales, and does not materially change the primary risk of cash flow pressures if uranium prices remain subdued.

The recent announcement about the Government of Victoria’s approval for the Donald Rare Earth Project ties directly to Energy Fuels’ rare earth ambitions, as it secures a future supply stream for White Mesa Mill and underpins the company’s plans for expanded rare earth separation, including Dysprosium and Terbium oxides.

However, investors should pay close attention to the risk that if uranium prices do not improve soon, the company’s inventory strategy could...

Read the full narrative on Energy Fuels (it's free!)

Energy Fuels' outlook projects $373.5 million in revenue and $82.0 million in earnings by 2028. This would require a 75.1% annual revenue growth rate and an earnings increase of $159.7 million from current earnings of -$77.7 million.

Uncover how Energy Fuels' forecasts yield a CA$15.38 fair value, a 19% upside to its current price.

Exploring Other Perspectives

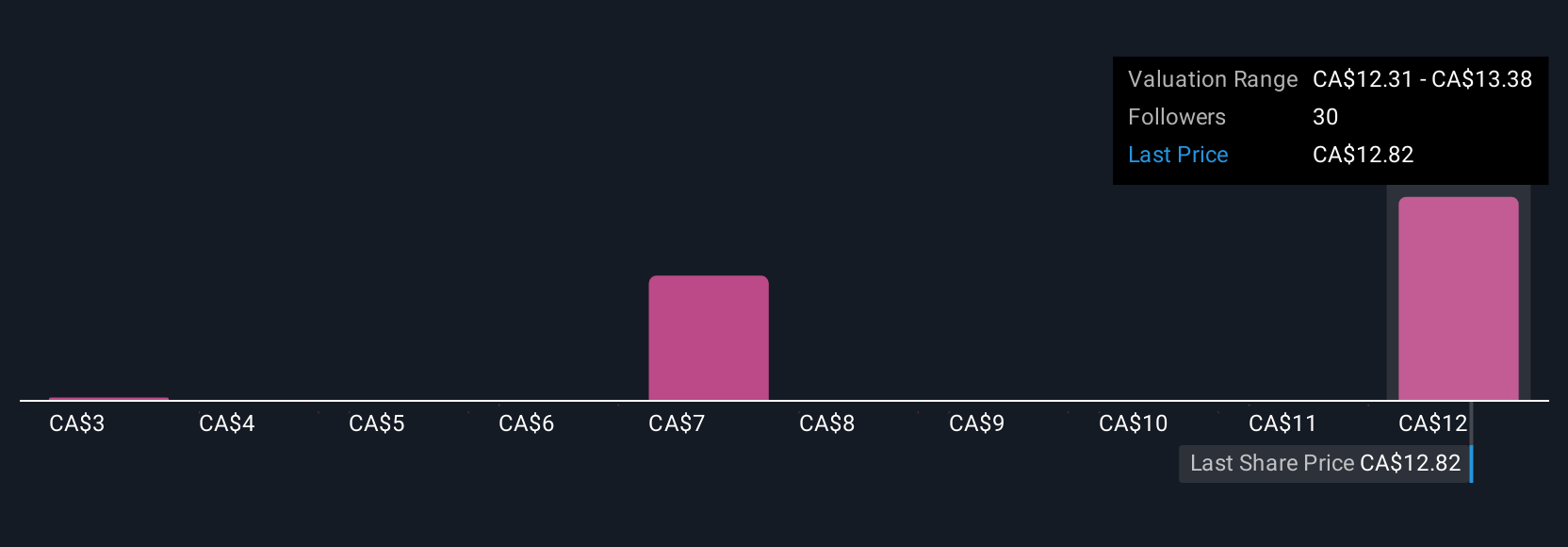

Six fair value estimates from the Simply Wall St Community for Energy Fuels range from US$2.73 to US$103.26, reflecting wide variation in outlook. While revenue from commercial rare earth production is a catalyst, the sizable spread in these estimates shows just how differently participants assess the impact, consider reviewing several views before forming your own conclusions.

Build Your Own Energy Fuels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Energy Fuels research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Energy Fuels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Energy Fuels' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Fuels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives