- Canada

- /

- Oil and Gas

- /

- TSX:EFR

Energy Fuels (TSX:EFR) Surges 16.1% After Upsized $600M Convertible Note Offering for Rare Earth Ambitions

Reviewed by Sasha Jovanovic

- Energy Fuels Inc. recently completed a private placement of US$600 million in 0.75% Convertible Senior Notes due 2031, upsizing the offering from US$550 million, with the notes structured as senior unsecured obligations and callable and convertible features for institutional buyers under Rule 144A.

- This substantial financing reflects institutional confidence in the company’s rare earth element expansion strategy amid global supply chain pressures and increasing U.S. government action to secure critical minerals.

- With the successful US$600 million convertible notes offering, we'll explore how new capital access impacts Energy Fuels' long-term growth outlook and project risk profile.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Energy Fuels Investment Narrative Recap

To be comfortable holding Energy Fuels, investors need to believe in the company’s potential to emerge as a leading North American supplier of rare earth elements and uranium, supported by western government policies and robust demand for critical minerals. The recent US$600 million convertible notes financing delivers substantial new capital, helping to address the company’s funding needs for project build-out. However, it does not immediately resolve the biggest near-term constraint: reliable access to rare earth feedstock, which remains the most important risk until diversified supply is secured.

The September announcement of high-purity dysprosium oxide production is highly relevant here, as it demonstrates Energy Fuels’ technical capability to process heavy rare earths, an important milestone for future revenue, contingent upon securing consistent feedstock supplies after this financing boost. Yet, significant progress on the Donald and Toliara projects, including securing offtakes or long-term supply agreements, will remain critical catalysts to watch in the months ahead.

On the flip side, investors should be aware that despite the funding strength, the ongoing lack of guaranteed rare earth feedstock continues to present obstacles for commercial-scale production...

Read the full narrative on Energy Fuels (it's free!)

Energy Fuels' narrative projects $553.4 million revenue and $237.8 million earnings by 2028. This requires 104.1% yearly revenue growth and a $330.9 million increase in earnings from the current $-93.1 million.

Uncover how Energy Fuels' forecasts yield a CA$22.35 fair value, a 21% downside to its current price.

Exploring Other Perspectives

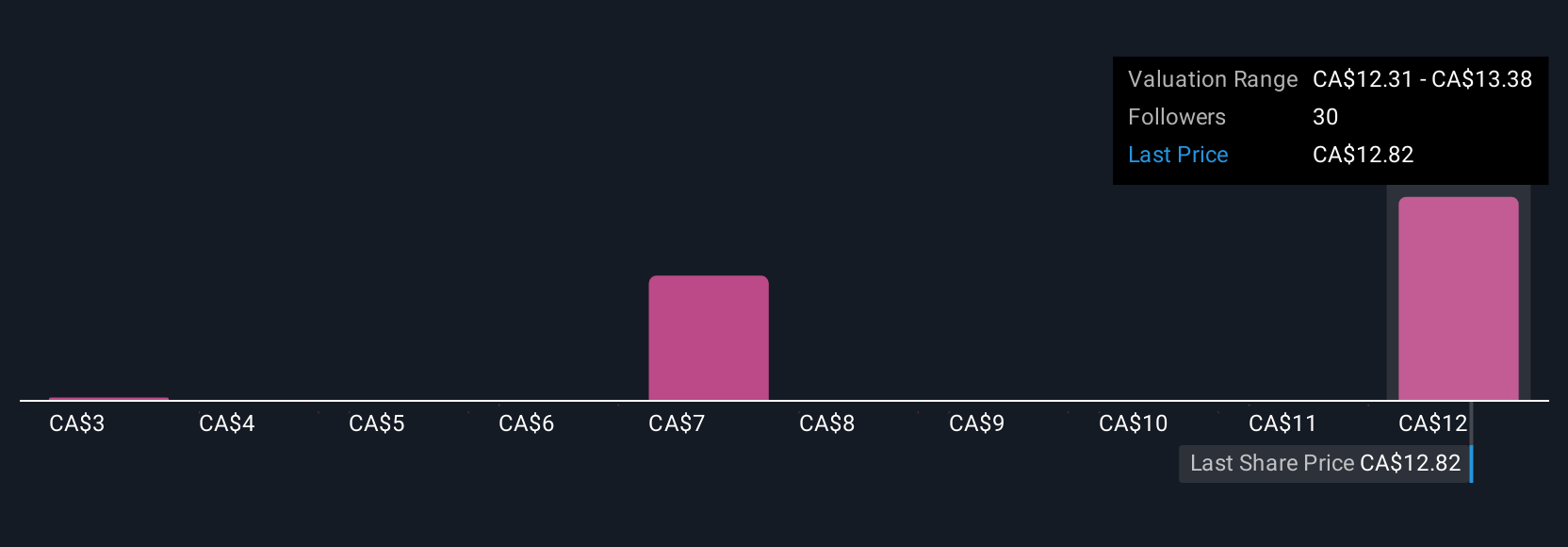

Fair value estimates from the Simply Wall St Community range widely, from US$2.73 to US$146.07 based on 11 investor opinions. As focus shifts to project execution and securing feedstock, your outlook may differ greatly from the consensus, so it pays to review multiple viewpoints.

Explore 11 other fair value estimates on Energy Fuels - why the stock might be worth less than half the current price!

Build Your Own Energy Fuels Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Energy Fuels research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Energy Fuels research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Energy Fuels' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Fuels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026