- Canada

- /

- Oil and Gas

- /

- TSX:CVE

Cenovus Energy (TSX:CVE): Evaluating Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Cenovus Energy (TSX:CVE) has recently drawn attention among investors following its latest market performance trends. With its stock seeing movement over the past month, many are now looking for clues on the company’s outlook in the energy sector.

See our latest analysis for Cenovus Energy.

Cenovus Energy’s share price has climbed more than 20% over the past three months, signaling growing optimism and a steady build in momentum. While the 1-year total shareholder return sits close to 2.5%, investors who stuck with the company over the last five years have enjoyed a remarkable 460% total return. This underscores its ability to deliver long-term value even through cycles of volatility and shifting sector sentiment.

If energy’s recent momentum has you curious, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

But with shares trading close to analysts’ price targets and growth in both revenue and income, the question remains: Is Cenovus Energy now undervalued, or is the market already pricing in its future potential?

Most Popular Narrative: 12.3% Undervalued

Cenovus Energy’s current share price sits at a notable discount to the most widely followed narrative’s fair value projection. This raises a debate about whether the market is fully factoring in the company’s strategic catalysts.

Successful completion of key growth projects such as Narrows Lake, West White Rose, and the Foster Creek optimization is set to deliver significant new, stable, long-life production with lower steam-oil ratios and reduced capital spending needs moving forward. This positions the company for higher free cash flow and earnings as global energy demand remains robust.

How do bold production upgrades, future profitability leaps, and strategic reinvestments shape this ambitious valuation? The narrative quietly relies on some surprisingly aggressive assumptions. Curious what numbers drive these forecasts? Click to see just how bullish the projections behind this target really are.

Result: Fair Value of $27.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory uncertainty and higher carbon costs in Canada could make long-term profitability more challenging. These factors may potentially limit Cenovus’s upside despite bullish forecasts.

Find out about the key risks to this Cenovus Energy narrative.

Another View: Multiples Tell a Cautious Story

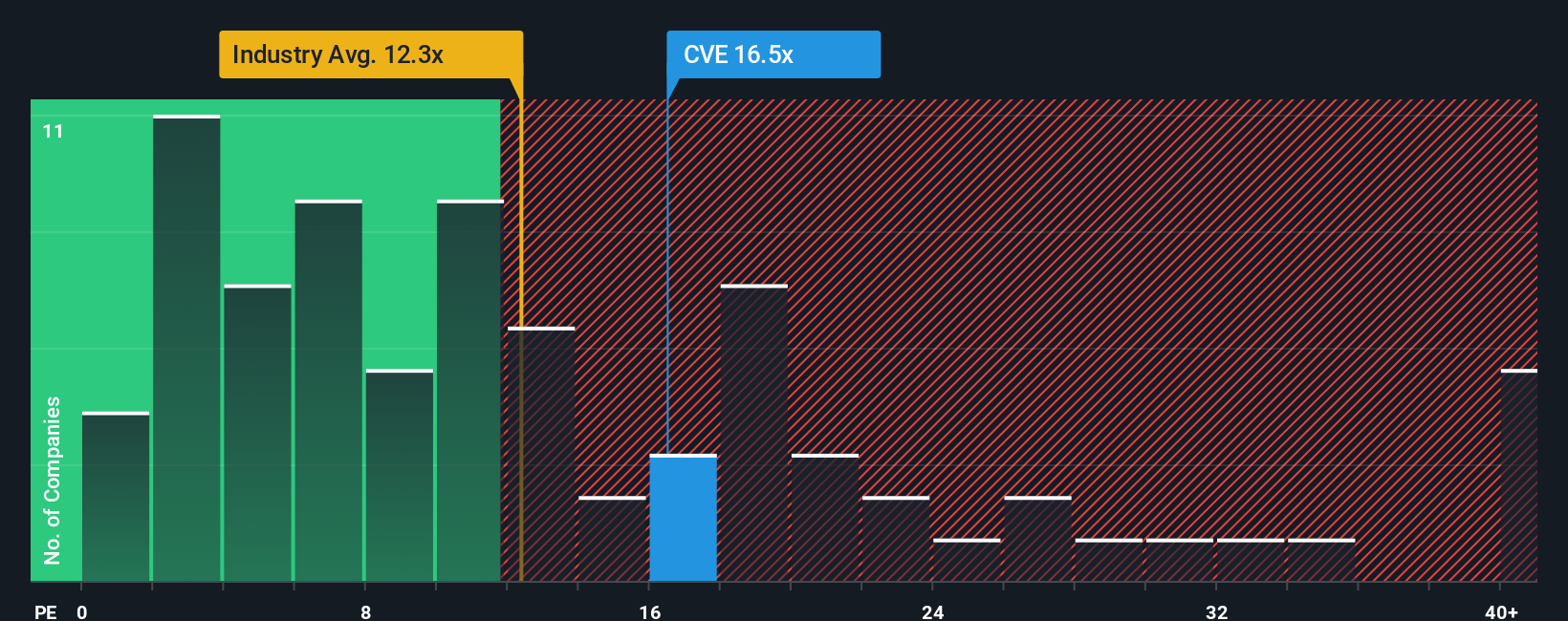

Looking at Cenovus Energy through the lens of its price-to-earnings ratio, the market appears less optimistic. The current ratio of 16.5 times earnings is higher than both the Canadian industry average (11.9x) and the peer group (15.4x). This could signal a premium with a greater downside risk if expectations are not met. However, compared to the fair ratio of 17.2x, there may still be some upside if the market shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cenovus Energy Narrative

Prefer to dig into the numbers firsthand? You can explore the data and craft your own Cenovus Energy story in just a few minutes. Do it your way

A great starting point for your Cenovus Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to get ahead of the curve. Lively investment themes are waiting for you, each with a unique edge and growth story you won't want to miss.

- Capture reliable income by checking out these 19 dividend stocks with yields > 3% with high yields that stand out in today’s market.

- Jump into the AI wave early and see which leaders power the next technological leap through these 24 AI penny stocks.

- Maximize your search for overlooked value. Snap up hidden gems at bargain prices among these 898 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CVE

Cenovus Energy

Develops, produces, refines, transports, and markets crude oil, natural gas, and refined petroleum products in Canada, the United States, and China.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives