- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

Potential Upside For Canadian Natural Resources Limited (TSE:CNQ) Not Without Risk

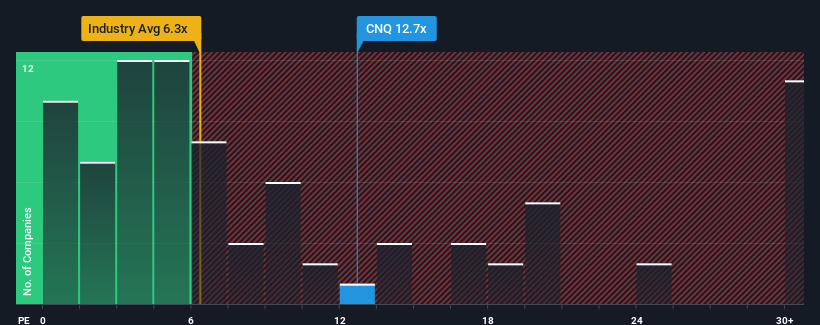

With a median price-to-earnings (or "P/E") ratio of close to 12x in Canada, you could be forgiven for feeling indifferent about Canadian Natural Resources Limited's (TSE:CNQ) P/E ratio of 12.7x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Canadian Natural Resources has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Canadian Natural Resources

Is There Some Growth For Canadian Natural Resources?

In order to justify its P/E ratio, Canadian Natural Resources would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 37%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 14% each year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 11% per year, which is noticeably less attractive.

In light of this, it's curious that Canadian Natural Resources' P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Canadian Natural Resources' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Canadian Natural Resources that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CNQ

Canadian Natural Resources

Acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs).

Undervalued established dividend payer.