- Canada

- /

- Metals and Mining

- /

- TSX:DC.A

Discover 3 TSX Penny Stocks With Market Caps Over CA$100M

Reviewed by Simply Wall St

The Canadian market has experienced some pullback recently, with the TSX index losing about 6.5% since its peak, amid political uncertainties and leadership transitions. Despite this volatility, the underlying economic fundamentals remain strong, offering potential opportunities for investors willing to navigate these fluctuations. Penny stocks, while often considered a niche area of investment due to their association with smaller or newer companies, can still present valuable opportunities when backed by solid financials and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$116.52M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$948.57M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.19 | CA$393.48M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$227.38M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.31 | CA$167.46M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$178.48M | ★★★★★☆ |

Click here to see the full list of 958 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Dundee (TSX:DC.A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dundee Corporation is a publicly owned investment manager with a market cap of CA$131.44 million.

Operations: The company generates revenue from its Mining Services segment, which accounts for CA$1.73 million.

Market Cap: CA$131.44M

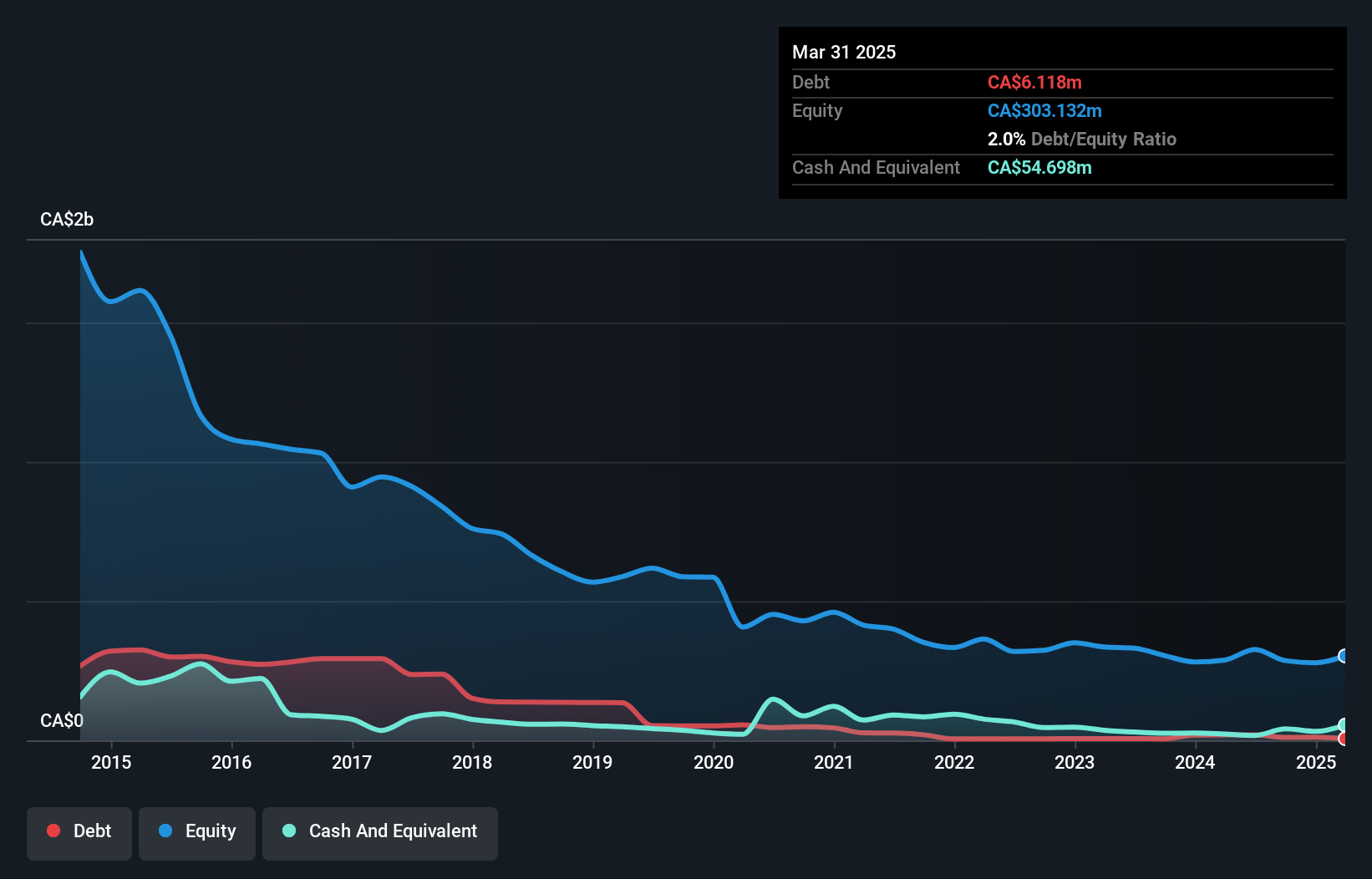

Dundee Corporation, with a market cap of CA$131.44 million, has recently become profitable, reporting net income of CA$67.33 million for the nine months ended September 30, 2024. Despite limited revenue from its Mining Services segment (CA$1.73 million), Dundee's Return on Equity is high at 22.2%, and its Price-To-Earnings ratio is notably low at 2x compared to the Canadian market average of 13.9x. The company has reduced its debt-to-equity ratio over five years and maintains more cash than total debt, though operating cash flow remains negative, indicating some financial challenges ahead despite profitability improvements.

- Unlock comprehensive insights into our analysis of Dundee stock in this financial health report.

- Review our historical performance report to gain insights into Dundee's track record.

Foraco International (TSX:FAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Foraco International SA, along with its subsidiaries, offers drilling services across multiple regions including North America, Europe, the Middle East, Africa, South America, and the Asia Pacific; it has a market cap of CA$227.38 million.

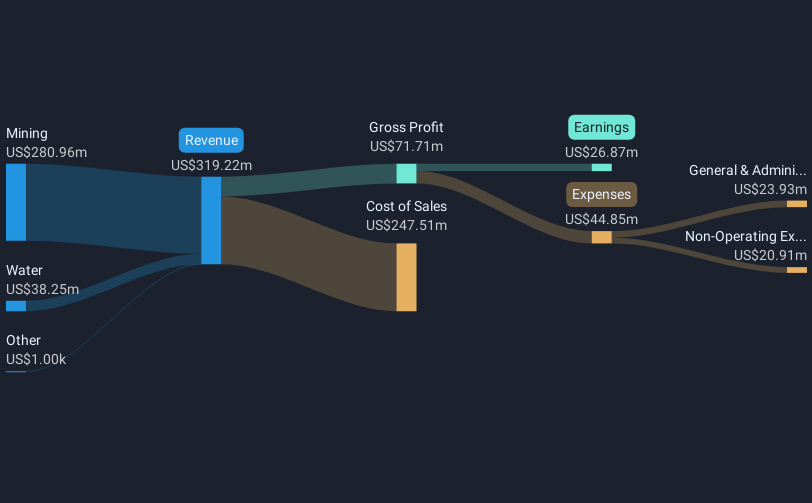

Operations: The company's revenue is derived from two main segments: Mining, which contributes $280.96 million, and Water, accounting for $38.25 million.

Market Cap: CA$227.38M

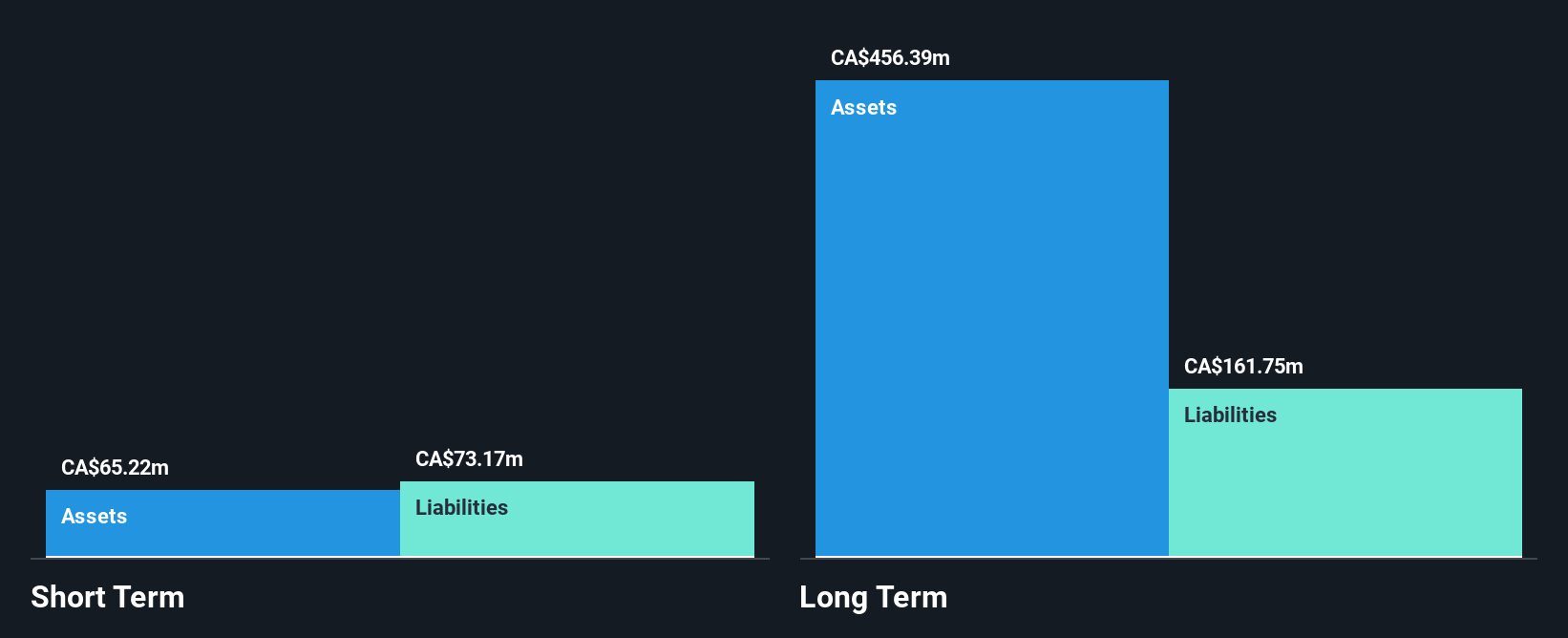

Foraco International, with a market cap of CA$227.38 million, operates across multiple regions and derives significant revenue from its Mining segment (US$280.96 million) and Water segment (US$38.25 million). Despite a decline in earnings over the past year, the company maintains high-quality earnings and has not diluted shareholders recently. Its financial position is supported by operating cash flow covering 43.6% of its debt, though it carries a high net debt to equity ratio of 77.3%. Recent buyback activity reflects confidence but hasn't significantly impacted share count or capital structure yet.

- Click to explore a detailed breakdown of our findings in Foraco International's financial health report.

- Review our growth performance report to gain insights into Foraco International's future.

InPlay Oil (TSX:IPO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: InPlay Oil Corp. is involved in the acquisition, exploration, development, and production of petroleum and natural gas properties in Canada with a market cap of CA$145.99 million.

Operations: The company generates revenue of CA$140.26 million from its oil and gas exploration and production activities.

Market Cap: CA$145.99M

InPlay Oil Corp., with a market cap of CA$145.99 million, faces challenges as its profit margins have declined from 25.6% to 13.4% over the past year, alongside negative earnings growth. Despite this, the company maintains high-quality earnings and has reduced its debt-to-equity ratio from 29.5% to 19.1% over five years, indicating improved financial health with operating cash flow covering debt well (143.3%). However, short-term assets fall short of covering liabilities (CA$24.8M vs CA$41M), and dividends remain unsustainable against free cash flows despite being consistently declared monthly at CA$0.015 per share recently.

- Navigate through the intricacies of InPlay Oil with our comprehensive balance sheet health report here.

- Understand InPlay Oil's earnings outlook by examining our growth report.

Taking Advantage

- Discover the full array of 958 TSX Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DC.A

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives