- Canada

- /

- Metals and Mining

- /

- TSX:PRYM

December 2024 TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market has experienced a pullback recently, with the TSX index declining by about 6.5% since its peak in early December, amid political uncertainties and leadership transitions. Despite these challenges, investors remain optimistic due to strong economic growth and easing inflation, which provide a solid backdrop for exploring investment opportunities. Penny stocks, though often associated with earlier market days, continue to attract attention as they represent smaller or newer companies that may offer surprising value and potential upside when backed by robust financials and clear growth trajectories.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$116.52M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$948.57M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.19 | CA$393.48M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$227.38M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.31 | CA$167.46M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$178.48M | ★★★★★☆ |

Click here to see the full list of 958 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Probe Gold (TSX:PRB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Probe Gold Inc. is a precious metal exploration company focused on acquiring, exploring, and developing gold properties in Canada, with a market cap of CA$307.95 million.

Operations: Probe Gold Inc. does not report any revenue segments as it is primarily engaged in the exploration and development of gold properties in Canada.

Market Cap: CA$307.95M

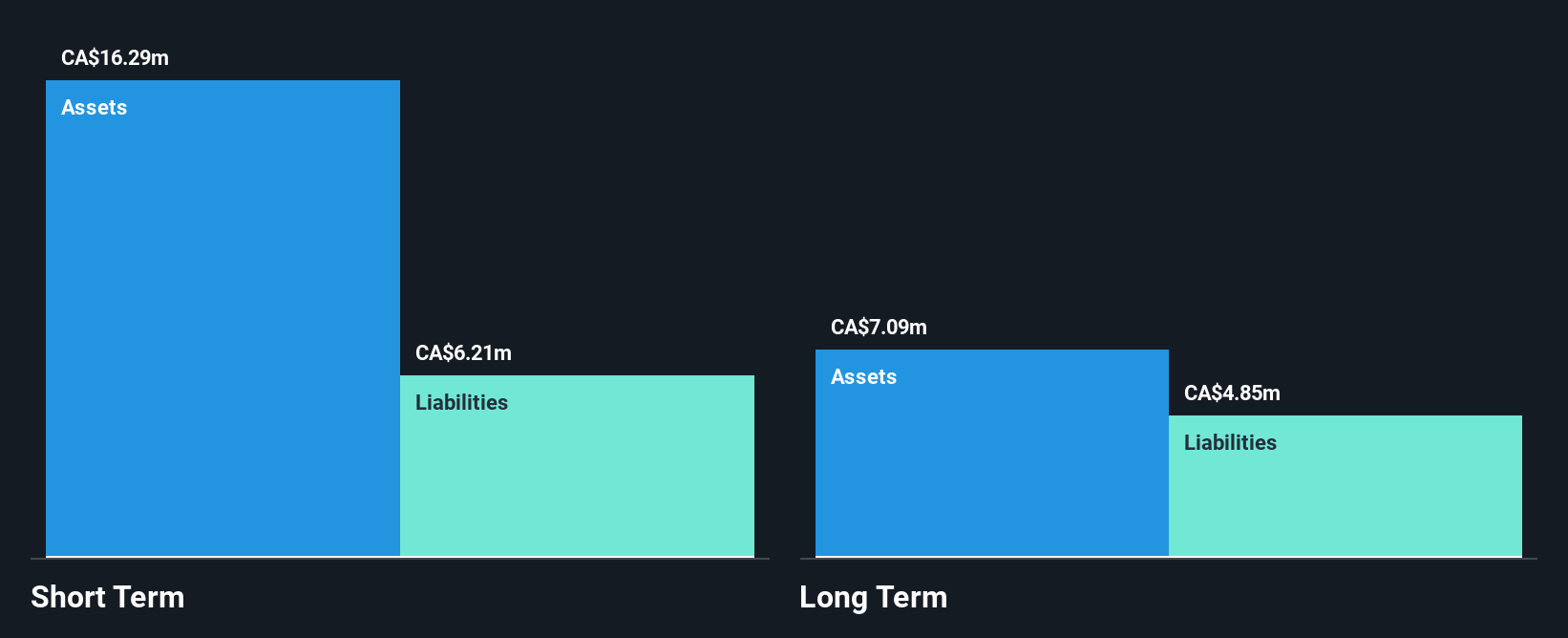

Probe Gold Inc., with a market cap of CA$307.95 million, remains pre-revenue as it focuses on gold exploration and development in Canada. The company is debt-free and its short-term assets exceed both short-term and long-term liabilities, indicating solid financial management despite ongoing losses. Recent strategic moves include acquiring the Bermont Claims to expand its Novador Development Project, highlighting potential for resource growth. Probe's seasoned management team continues to advance environmental studies crucial for project permitting, while maintaining active stakeholder engagement to secure social license for operations. However, shareholder dilution has occurred over the past year as part of financing activities.

- Click here and access our complete financial health analysis report to understand the dynamics of Probe Gold.

- Understand Probe Gold's earnings outlook by examining our growth report.

Prime Mining (TSX:PRYM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Prime Mining Corp. focuses on acquiring, exploring, and developing mineral resource properties in Mexico with a market cap of CA$221.87 million.

Operations: Prime Mining Corp. does not report any revenue segments as it is primarily engaged in the acquisition, exploration, and development of mineral resource properties in Mexico.

Market Cap: CA$221.87M

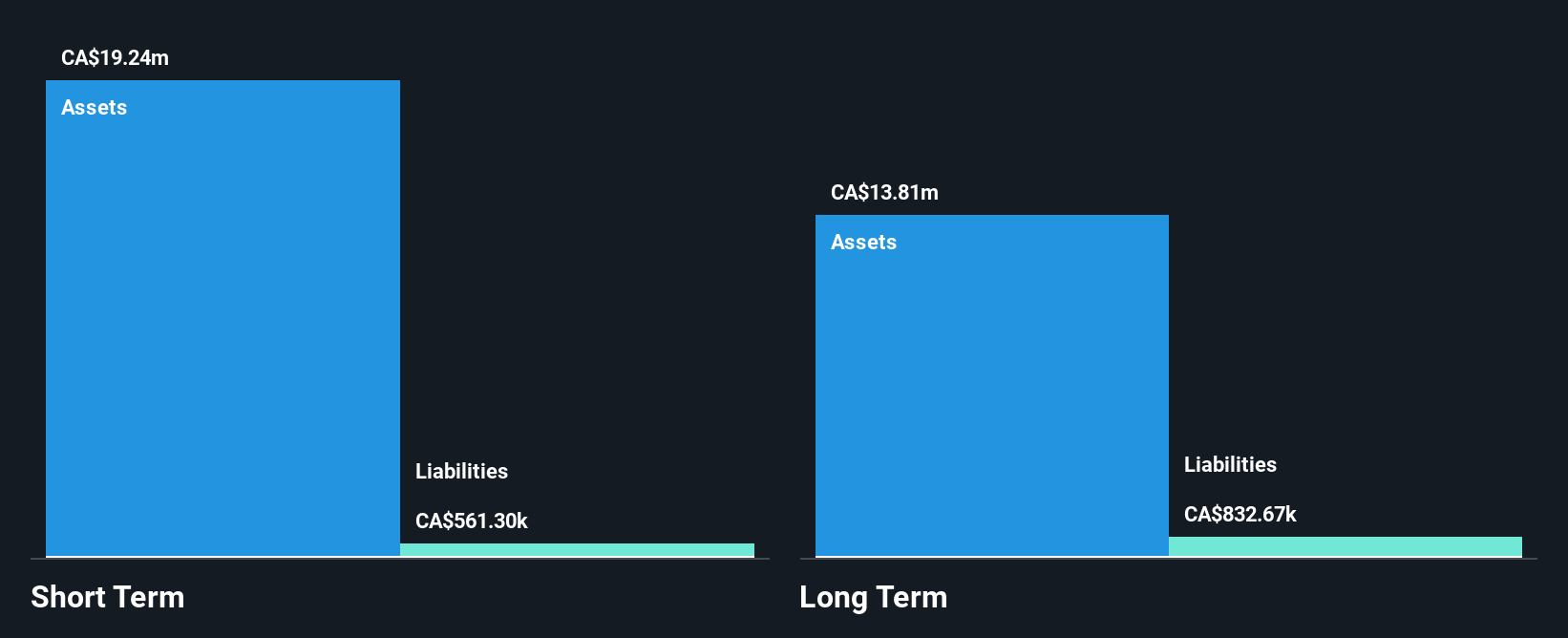

Prime Mining Corp., with a market cap of CA$221.87 million, is pre-revenue and focused on exploration in Mexico. The company has no debt and its short-term assets cover both short- and long-term liabilities, but it faces challenges with less than a year of cash runway at current free cash flow rates. Recent developments include an expanded drilling program at Los Reyes, aimed at extending high-grade mineralization zones. Despite increasing losses over the past five years, the management team remains experienced, though shareholder dilution has occurred recently. Analysts anticipate significant stock price growth potential based on resource expansion efforts.

- Navigate through the intricacies of Prime Mining with our comprehensive balance sheet health report here.

- Explore Prime Mining's analyst forecasts in our growth report.

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Santacruz Silver Mining Ltd. is involved in the acquisition, exploration, development, and operation of mineral properties in Latin America and has a market cap of CA$101.42 million.

Operations: The company's revenue is derived from its operations at Porco ($37.38 million), Bolivar ($79.43 million), Zimapan ($70.61 million), SAN Lucas ($73.13 million), and the Caballo Blanco Group ($67.09 million).

Market Cap: CA$101.42M

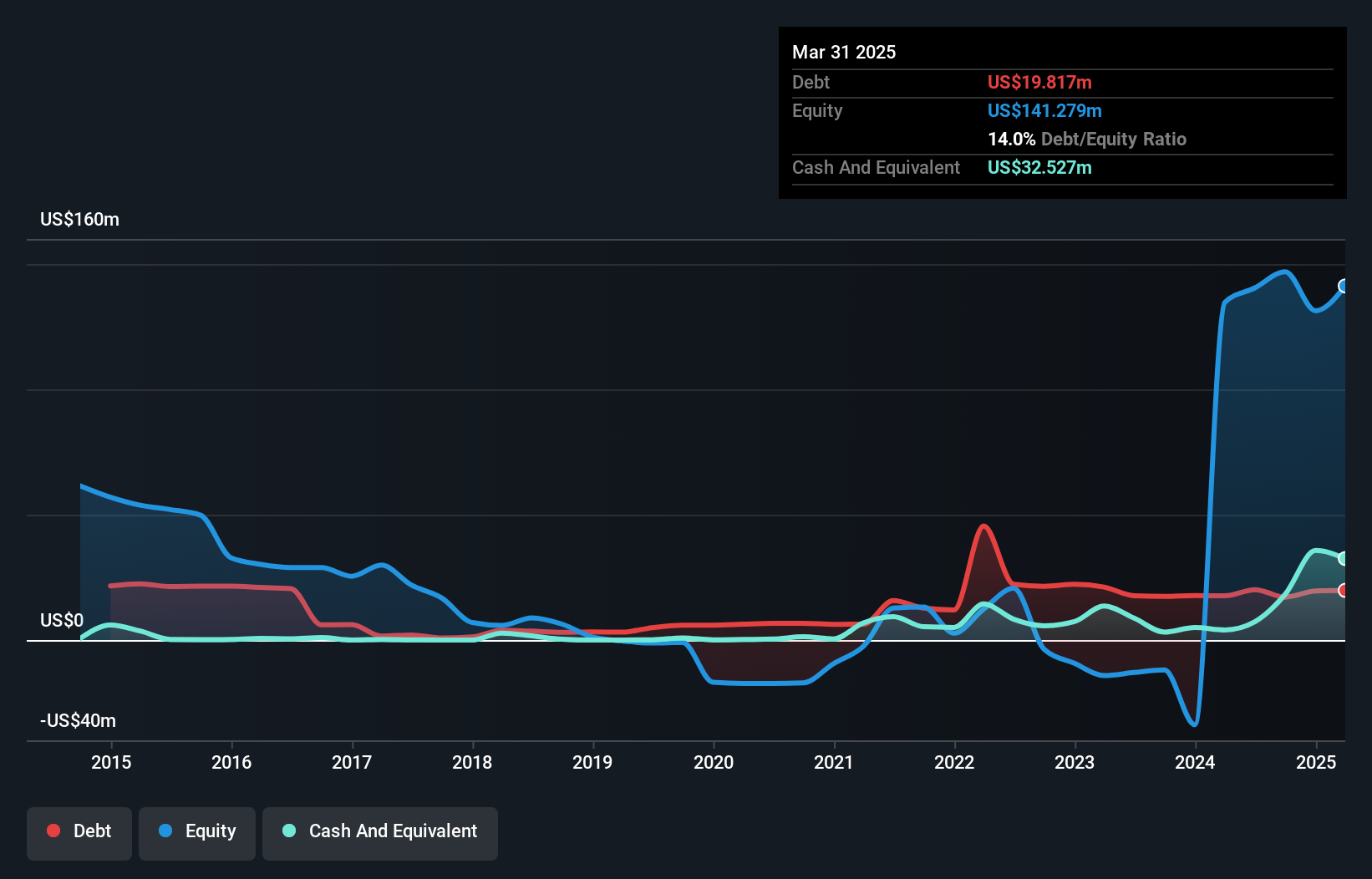

Santacruz Silver Mining Ltd., with a market cap of CA$101.42 million, has transitioned to profitability, reporting a net income of US$4.06 million for Q3 2024 and US$134.63 million for the first nine months. The company's revenue streams from operations at Porco, Bolivar, Zimapan, SAN Lucas, and Caballo Blanco Group are robust. Its debt is well covered by operating cash flow at 236.8%, and short-term assets exceed liabilities. Despite recent executive changes with the CFO's resignation and appointment of Andres Bedregal as interim CFO, Santacruz maintains strong financial health with an outstanding return on equity of 102.7%.

- Click here to discover the nuances of Santacruz Silver Mining with our detailed analytical financial health report.

- Learn about Santacruz Silver Mining's historical performance here.

Make It Happen

- Take a closer look at our TSX Penny Stocks list of 958 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRYM

Prime Mining

Engages in the acquisition, exploration, and development of mineral resource properties in Mexico.

Excellent balance sheet moderate.