- Canada

- /

- Construction

- /

- TSX:BDGI

CSPC Innovation Pharmaceutical Among 3 Stocks That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

In the current landscape, global markets have been navigating a complex mix of economic signals, with U.S. stocks experiencing declines amid cautious Federal Reserve commentary and political uncertainties surrounding potential government shutdowns. Despite these challenges, some stocks may present opportunities for investors seeking value in an environment where interest rate forecasts and inflation expectations are shaping market movements. Identifying undervalued stocks often involves looking at companies whose intrinsic value appears higher than their current market price, particularly during times of broad-based market volatility when investor sentiment can overshadow fundamental strengths.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hainan Jinpan Smart Technology (SHSE:688676) | CN¥43.43 | CN¥86.42 | 49.7% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.95 | ₹2250.92 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK450.98 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$5.95 | CA$11.83 | 49.7% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.76 | 50% |

| Appier Group (TSE:4180) | ¥1479.00 | ¥2939.55 | 49.7% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.13 | 49.9% |

| Informa (LSE:INF) | £7.992 | £15.89 | 49.7% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.10 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.47 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

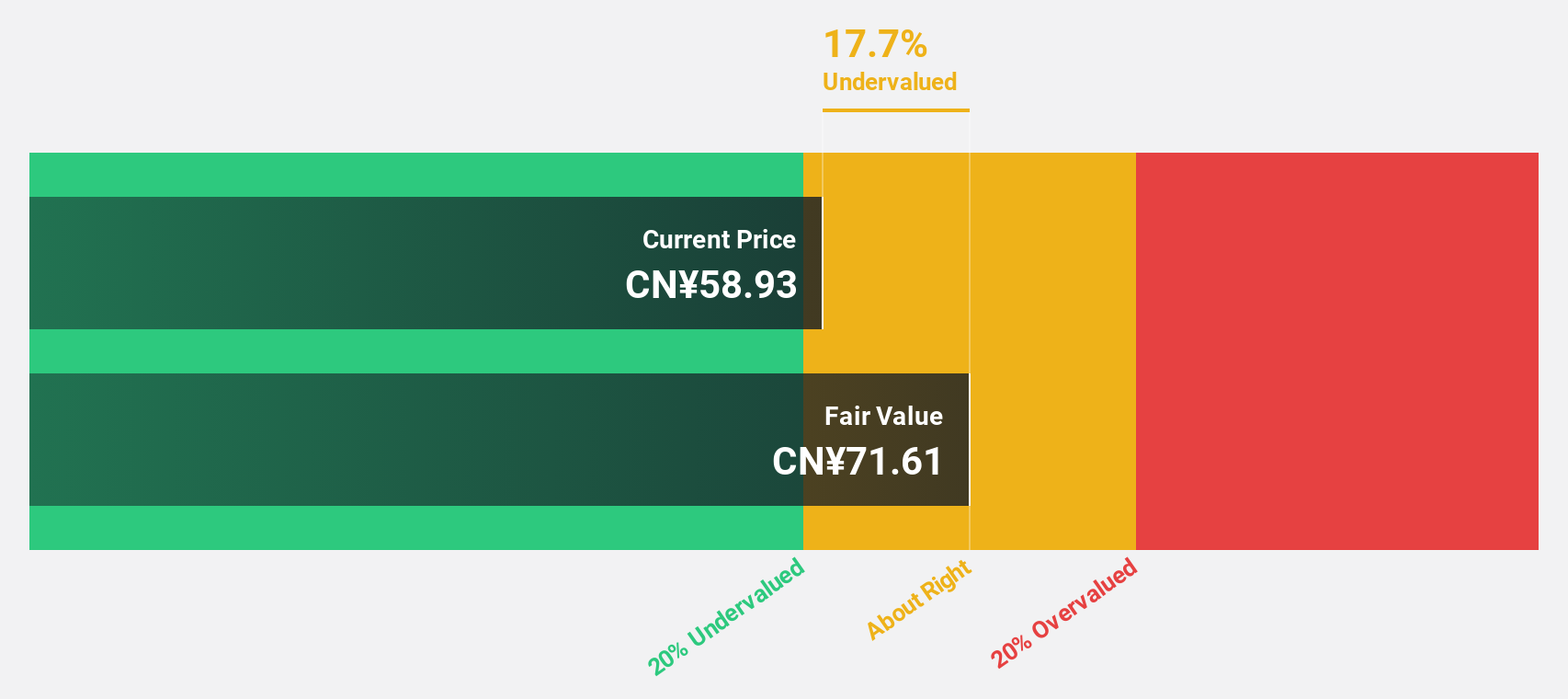

CSPC Innovation Pharmaceutical (SZSE:300765)

Overview: CSPC Innovation Pharmaceutical Co., Ltd. focuses on the research, development, production, and sales of biopharmaceuticals, APIs, and functional foods both in China and internationally with a market cap of approximately CN¥38.07 billion.

Operations: The company's revenue is primarily derived from its activities in biopharmaceuticals, APIs, and functional foods across domestic and international markets.

Estimated Discount To Fair Value: 12%

CSPC Innovation Pharmaceutical is trading at CN¥27.41, slightly below its estimated fair value of CN¥31.16, suggesting potential undervaluation. Despite a challenging year with decreased sales and net income, the company forecasts significant earnings growth of 47% annually over the next three years, outpacing the market average. However, its dividend yield remains poorly covered by free cash flows, and return on equity is expected to be modest at 13.5%.

- The analysis detailed in our CSPC Innovation Pharmaceutical growth report hints at robust future financial performance.

- Take a closer look at CSPC Innovation Pharmaceutical's balance sheet health here in our report.

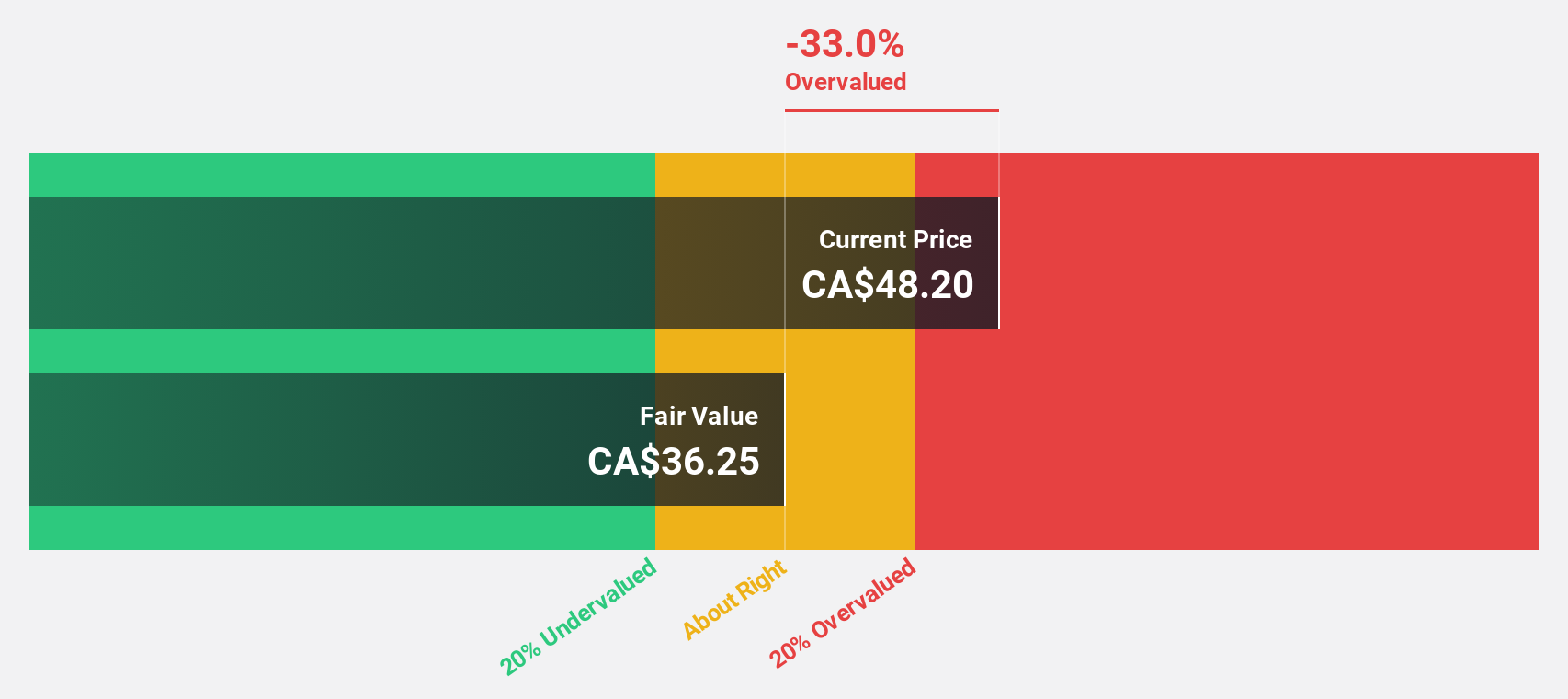

Badger Infrastructure Solutions (TSX:BDGI)

Overview: Badger Infrastructure Solutions Ltd. offers non-destructive excavating and related services across Canada and the United States, with a market cap of CA$1.25 billion.

Operations: The company generates revenue primarily through its non-destructive excavating services, amounting to $730.92 million.

Estimated Discount To Fair Value: 33.9%

Badger Infrastructure Solutions is trading at CA$36.38, well below its estimated fair value of CA$55.07, indicating potential undervaluation based on cash flows. Despite a high debt level and an unstable dividend track record, the company forecasts robust earnings growth of 37.8% annually over the next three years, surpassing Canadian market averages. Recent board changes with experienced leadership may positively influence strategic direction and governance stability moving forward.

- Our expertly prepared growth report on Badger Infrastructure Solutions implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Badger Infrastructure Solutions with our detailed financial health report.

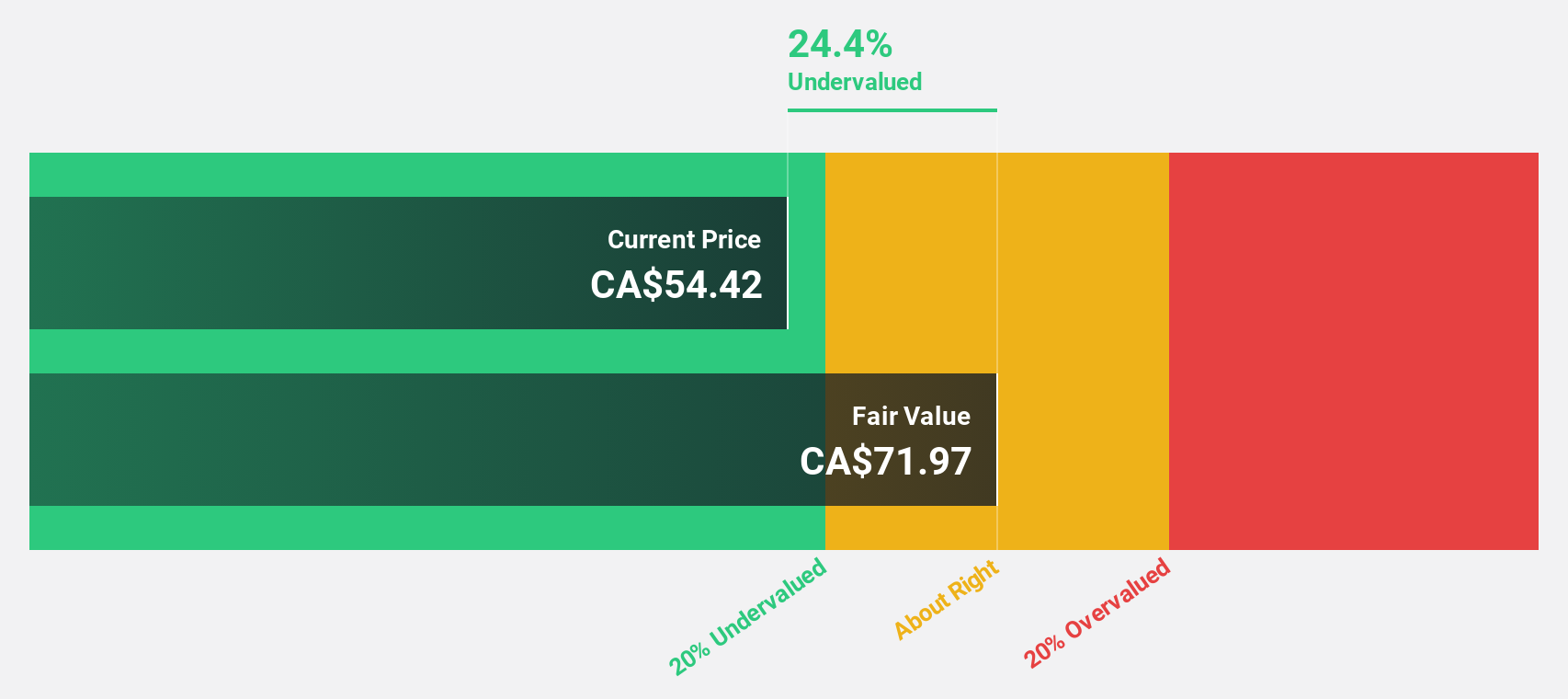

First National Financial (TSX:FN)

Overview: First National Financial Corporation, with a market cap of CA$2.42 billion, operates in Canada by originating, underwriting, and servicing commercial and residential mortgages through its subsidiaries.

Operations: The company generates revenue from two main segments: CA$215.53 million from commercial mortgages and CA$423.75 million from residential mortgages in Canada.

Estimated Discount To Fair Value: 43.5%

First National Financial is trading at CA$40.3, significantly below its estimated fair value of CA$71.32, highlighting potential undervaluation based on cash flows. Despite slower revenue growth forecasts and high debt levels not well-covered by operating cash flow, the company maintains a reliable dividend yield of 6.08%. Earnings are expected to grow at 15.9% annually, slightly outpacing the Canadian market's growth rate of 15.5%, suggesting moderate long-term growth potential.

- Our growth report here indicates First National Financial may be poised for an improving outlook.

- Navigate through the intricacies of First National Financial with our comprehensive financial health report here.

Where To Now?

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 865 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Badger Infrastructure Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDGI

Badger Infrastructure Solutions

Provides non-destructive excavating and related services in Canada and the United States.

Very undervalued with high growth potential and pays a dividend.

Market Insights

Community Narratives