- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

How Investors Are Reacting To Canadian Natural Resources (TSX:CNQ) Expanding Debt Shelf After Strong Earnings

Reviewed by Simply Wall St

- In August 2025, Canadian Natural Resources Limited filed shelf registrations for up to CA$3 billion and US$4.5 billion of unsubordinated unsecured debt securities, coinciding with the release of second-quarter earnings that surpassed analyst expectations and highlighted operational advancements.

- This combination of expanded financing capacity and enhanced oil sands production signals a focus on reinforcing both liquidity and long-term growth initiatives amid ongoing capital discipline.

- We'll examine how this substantial new shelf registration and quarterly outperformance could impact Canadian Natural Resources' investment outlook.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Canadian Natural Resources Investment Narrative Recap

To hold Canadian Natural Resources stock, you’d need confidence in the long-term value of Canadian oil sands assets and the company’s ability to manage costs, regulatory risk, and evolving energy markets. The August 2025 dual-currency shelf registrations increase financial flexibility, but do not materially shift the most important short-term catalyst, ongoing operational execution and cost efficiencies, or the biggest current risk, which remains commodity price volatility and changing regulatory pressures.

Among recent announcements, the strong Q2 2025 earnings beat, driven by a 13% jump in oil sands production, stands out as most relevant. This operational outperformance aligns closely with the catalyst of lower breakevens and higher margins, suggesting Canadian Natural’s production base may benefit from scale even as the sector faces pressure on realized prices over the short term.

In contrast, investors should also be aware of lingering risks tied to regulatory requirements on emissions and capital spending, especially if...

Read the full narrative on Canadian Natural Resources (it's free!)

Canadian Natural Resources is projected to generate CA$36.7 billion in revenue and CA$8.1 billion in earnings by 2028. This outlook assumes revenues will decline at a rate of 1.2% per year and earnings will decrease by CA$0.2 billion from the current CA$8.3 billion.

Uncover how Canadian Natural Resources' forecasts yield a CA$52.14 fair value, a 18% upside to its current price.

Exploring Other Perspectives

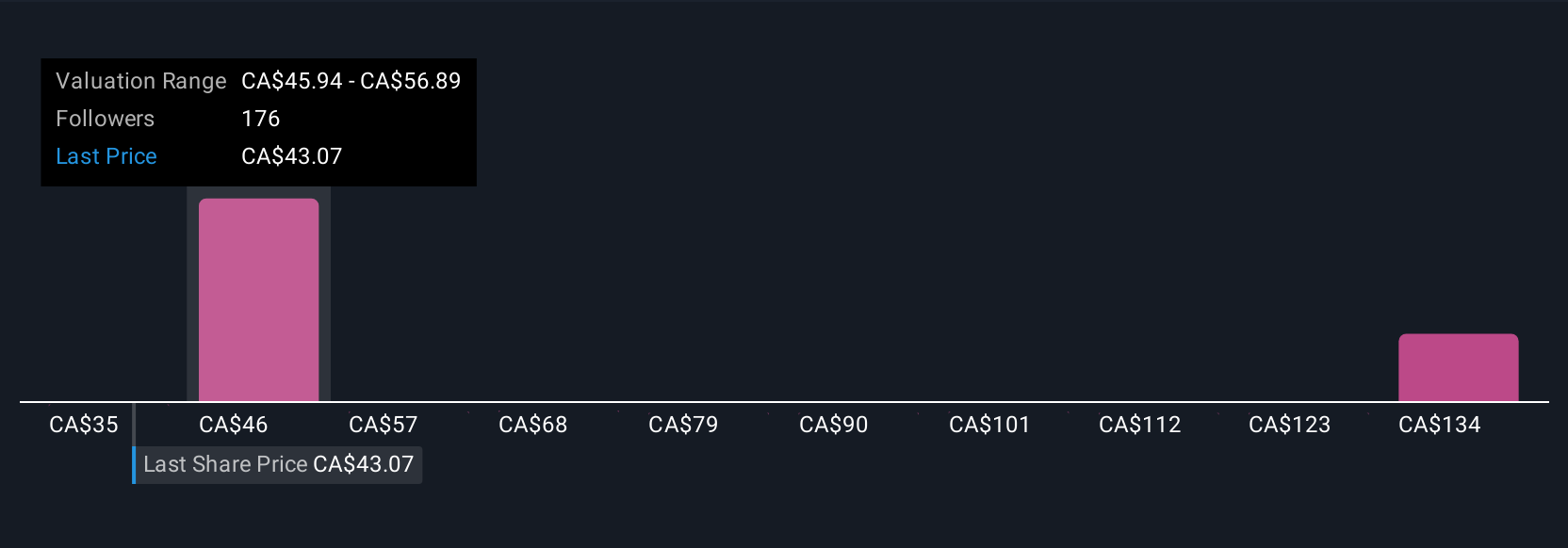

The Simply Wall St Community has 25 independent fair value estimates for CNQ ranging from CA$35 to CA$143.95 per share. While opinions vary widely, ongoing environmental policy and emissions pressures could affect both earnings and investor conviction going forward.

Explore 25 other fair value estimates on Canadian Natural Resources - why the stock might be worth over 3x more than the current price!

Build Your Own Canadian Natural Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Natural Resources research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Natural Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Natural Resources' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives