- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

Earnings Jump and Buyback Completion Could Be a Game Changer for Canadian Natural Resources (TSX:CNQ)

Reviewed by Simply Wall St

- Earlier this month, Canadian Natural Resources reported second quarter 2025 earnings showing net income rising to CA$2.46 billion and reaffirmed a quarterly dividend of CA$0.5875 per share, while also completing a share buyback program amounting to CA$478 million for 11,240,000 shares.

- This combination of higher earnings, continued dividend payouts, and the execution of a buyback highlights the company’s increased focus on shareholder returns through both operational performance and capital management.

- To assess the impact of this strong earnings report and buyback completion, we'll consider how it could shape Canadian Natural Resources' investment narrative going forward.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Canadian Natural Resources Investment Narrative Recap

To be a Canadian Natural Resources shareholder, you need to believe in the company’s ability to generate steady cash flow and shareholder returns from its oil and gas assets, while navigating the risks of volatile commodity prices and regulatory change. The latest earnings beat and completion of the buyback provided a short-term boost to sentiment, but did not materially alter the most pressing risk: cost pressure and regulatory uncertainty tied to oil sands operations.

Among the recent announcements, the company's reaffirmed quarterly dividend of CA$0.5875 per share stands out. This ongoing payout, supported by robust earnings, helps underpin investor confidence in the immediate cash-generating power of Canadian Natural Resources, even as operational and environmental cost risks remain a key watchpoint for future performance.

But on the other hand, investors cannot ignore the continued risk posed by future changes to emissions or carbon pricing policies that...

Read the full narrative on Canadian Natural Resources (it's free!)

Canadian Natural Resources' outlook anticipates CA$36.7 billion in revenue and CA$8.1 billion in earnings by 2028. This scenario assumes a 1.2% annual revenue decline and an earnings decrease of CA$0.2 billion from the current CA$8.3 billion.

Uncover how Canadian Natural Resources' forecasts yield a CA$52.17 fair value, a 27% upside to its current price.

Exploring Other Perspectives

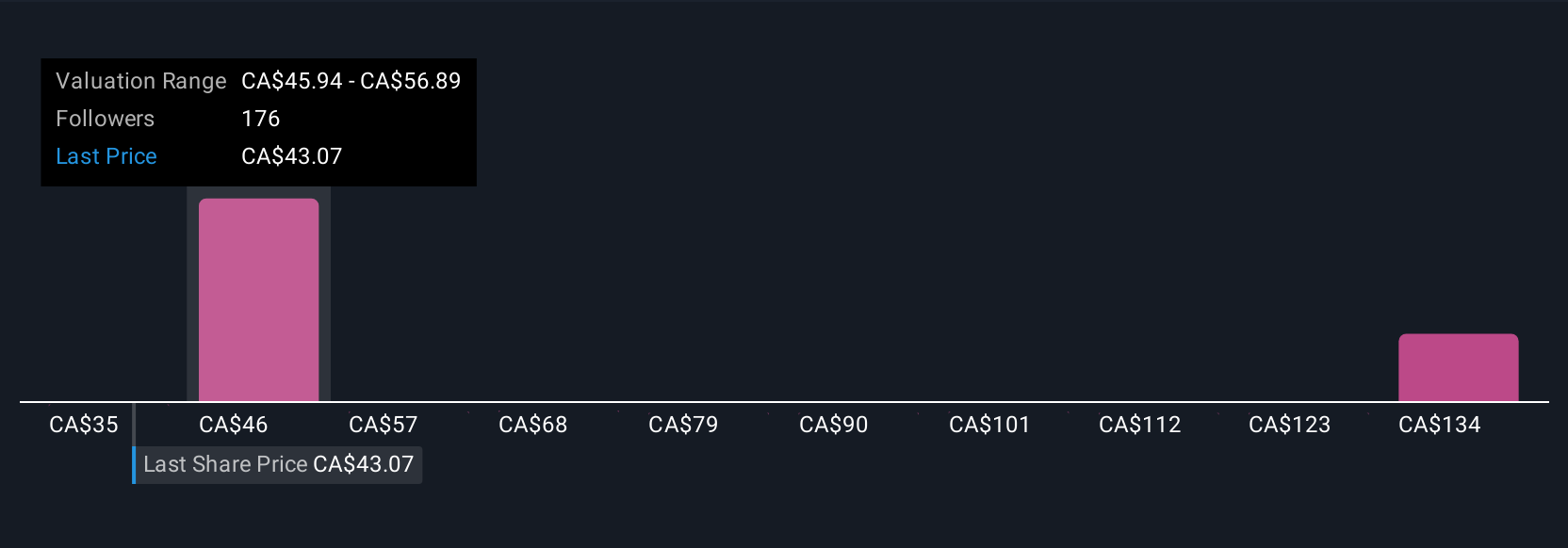

Twenty-two Simply Wall St Community members estimate Canadian Natural Resources’ fair value from CA$35 to CA$144.30. While these views differ widely, many point to regulatory cost risks as an ongoing wildcard for earnings stability.

Explore 22 other fair value estimates on Canadian Natural Resources - why the stock might be worth 15% less than the current price!

Build Your Own Canadian Natural Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Natural Resources research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Natural Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Natural Resources' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives