- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

Does Canadian Natural's New Debt Offer Reflect a Shift in Financial Strategy for TSX:CNQ?

Reviewed by Sasha Jovanovic

- Earlier this month, Canadian Natural Resources Limited announced a fixed-income exchange offer, featuring US$750 million in callable, unsubordinated, unsecured notes due in 2029 and another US$750 million due in 2034, both with fixed coupons.

- This development showcases the company's ongoing efforts to enhance its financial flexibility through disciplined debt management and access to long-term capital.

- We'll explore how Canadian Natural Resources' proactive capital structure management strengthens its investment narrative focused on stability and future growth potential.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Canadian Natural Resources Investment Narrative Recap

To own shares of Canadian Natural Resources, you typically need to accept the long-term outlook for Canadian oil and gas development, a reliance on efficient production, and comfort with commodity price cycles and evolving regulatory pressures. The recent US$1.5 billion fixed-income exchange offer does not materially impact the short-term catalyst, improved egress with the Trans Mountain pipeline expansion, but it helps reinforce financial stability. The largest risk remains exposure to higher operating costs or regulatory changes impacting oil sands margins.

Among recent developments, Canadian Natural Resources’ completion of its Chevron Canada acquisition is especially relevant, as it added significant oil sands and liquids-rich capacity with minimal upward pressure on the 2025 capital budget. This aligns directly with the company’s cash flow growth catalyst tied to new production, even as stronger balance sheet flexibility from the bonds supports further asset integration.

However, before getting comfortable, investors should be aware that rising environmental regulations or capital cost requirements could ...

Read the full narrative on Canadian Natural Resources (it's free!)

Canadian Natural Resources is projected to have CA$36.7 billion in revenue and CA$8.1 billion in earnings by 2028. This outlook assumes a 1.2% annual decline in revenue and a decrease in earnings of CA$0.2 billion from the current CA$8.3 billion.

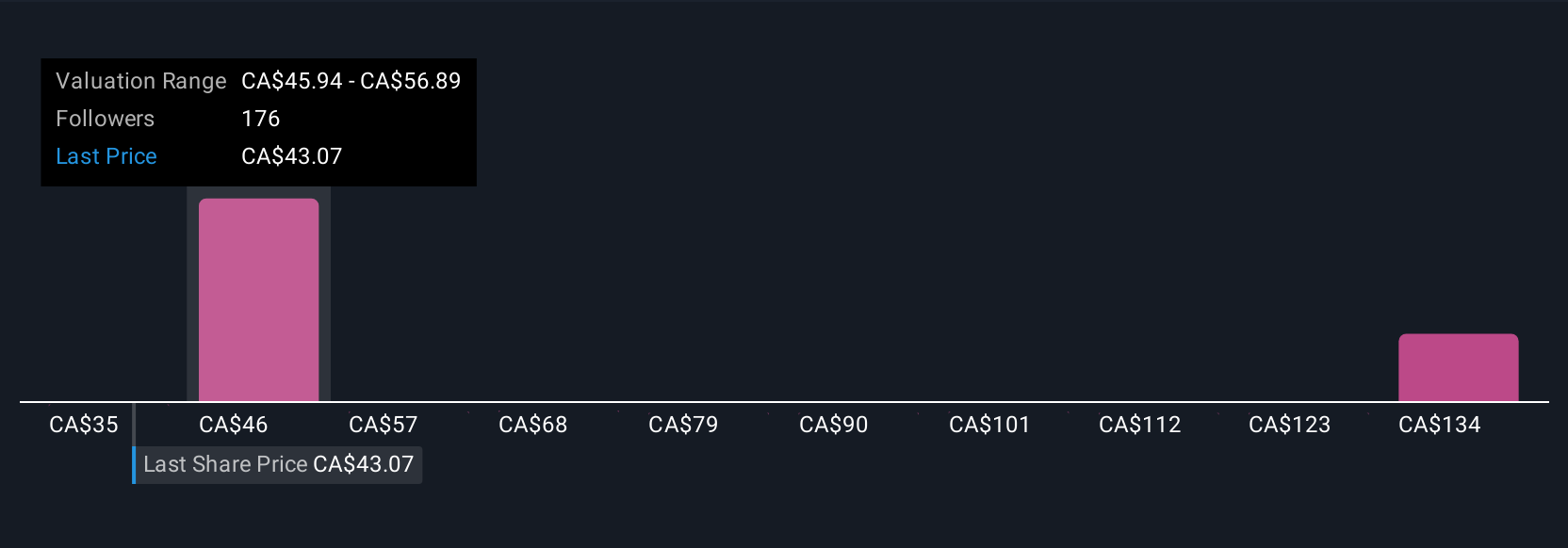

Uncover how Canadian Natural Resources' forecasts yield a CA$52.87 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Thirty Simply Wall St Community member estimates for fair value range from CA$32.25 to CA$151.84, revealing a broad spread of expectations. While many see upside tied to reserve growth and operational success, risks from tightening environmental policies could affect future earnings and market sentiment in diverse ways.

Explore 30 other fair value estimates on Canadian Natural Resources - why the stock might be worth over 3x more than the current price!

Build Your Own Canadian Natural Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Natural Resources research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Natural Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Natural Resources' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives