- Canada

- /

- Oil and Gas

- /

- TSX:CCO

How Does Cameco Stack Up in 2025 After Another 15% Surge?

Reviewed by Bailey Pemberton

If you have been following Cameco lately, you have probably wondered if now is the time to jump in, hold steady, or quietly take some profits. The stock has been on an incredible run, returning almost 59% year to date and over 84% in the past year alone. Extend that lens out five years and you are looking at total gains of more than 835%. That is a rocket ride by any measure. But new highs come with new questions, especially for investors trying to pin down what actually makes Cameco tick, and more importantly, what the stock is really worth in today’s market.

Looking at recent moves, Cameco’s jump of 14.9% in the last month has caught even more attention. Much of this rally has been fueled by growing global interest in uranium, as nuclear power gains fresh momentum in energy-constrained markets worldwide. As governments seek both secure and lower-emission energy sources, uranium producers like Cameco have found themselves in the spotlight. Changes in supply expectations and heightened geopolitical tensions have further shifted the risk perceptions, amplifying price action in recent weeks.

Now, when we try to evaluate how fairly valued Cameco is, traditional valuation metrics only get us so far. Interestingly, Cameco currently does not appear undervalued in any of the six main checks analysts typically use, racking up a value score of 0. That is a red flag for bargain hunters, but it does not tell the whole story either. Let’s take a closer look at how Cameco’s valuation stacks up by different methods and why the way we measure value might need a rethink before you make your next move.

Cameco scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Cameco Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its future cash flows and then discounting those estimates back to today’s value. For Cameco, this approach starts with its latest reported Free Cash Flow, which stands at CA$910.6 Million. Analysts expect this figure to grow steadily over the next five years, with cash flows projected to reach CA$1.60 Billion by 2029. After that, Simply Wall St extrapolates further and forecasts gradual increases each year for a full decade ahead, reflecting a combination of analyst input and model-based growth assumptions.

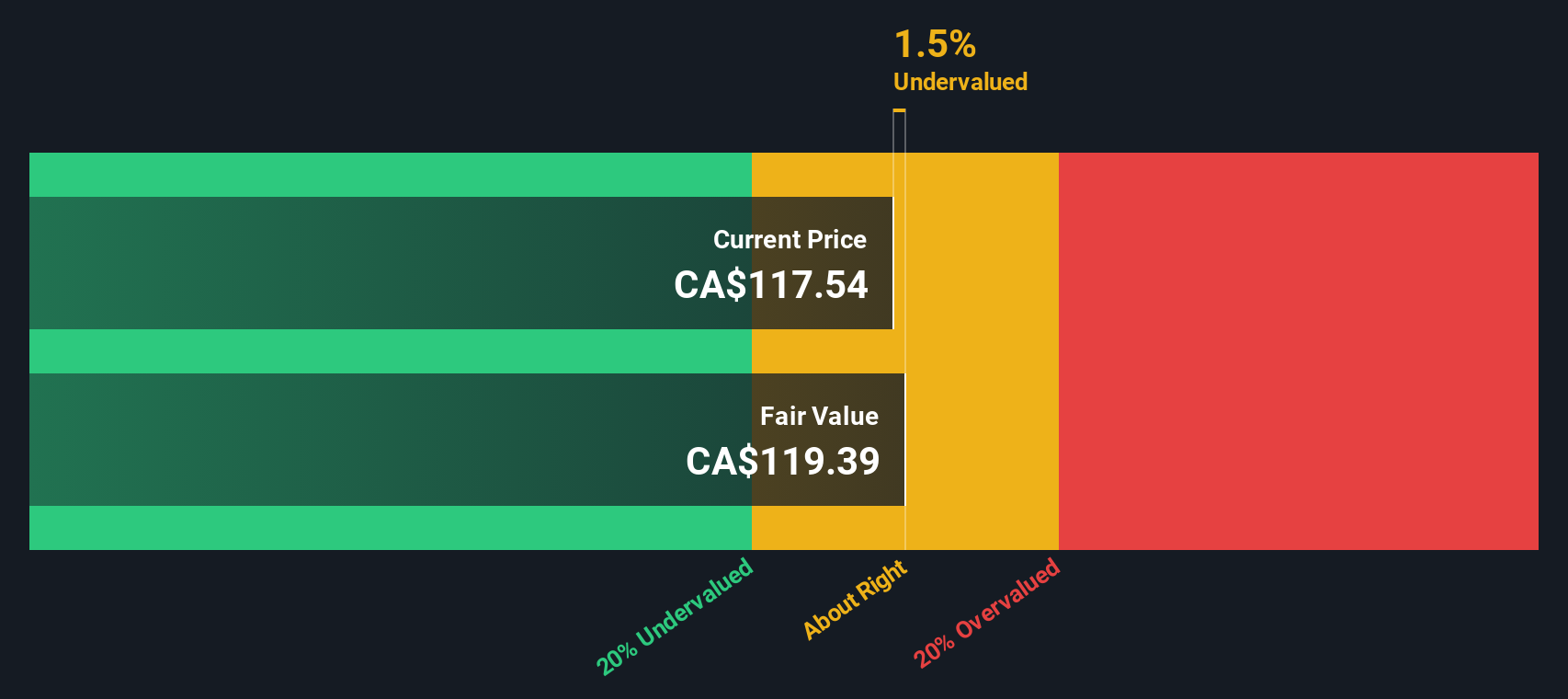

According to the DCF model, Cameco’s fair value lands at CA$117.43 per share. However, the intrinsic discount suggests the stock is trading about 1.5% above this estimated value, meaning it is slightly overvalued by this measure.

While not a glaring mismatch, this suggests that Cameco's current share price is closely aligned with expectations based on long-term cash flow potential.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Cameco.

Approach 2: Cameco Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is the go-to valuation metric for profitable companies, as it relates a firm’s share price to its actual earnings power. This makes it a useful yardstick for investors who want to quickly compare how much they are paying for each dollar of profit, especially when the business is generating steady income.

However, what qualifies as a “normal” or “fair” PE ratio is a moving target, shaped by expectations for future earnings growth and the overall riskiness of the company. Fast-growing or lower-risk firms usually command higher multiples, while those with dimmer prospects or greater risks can trade at a discount.

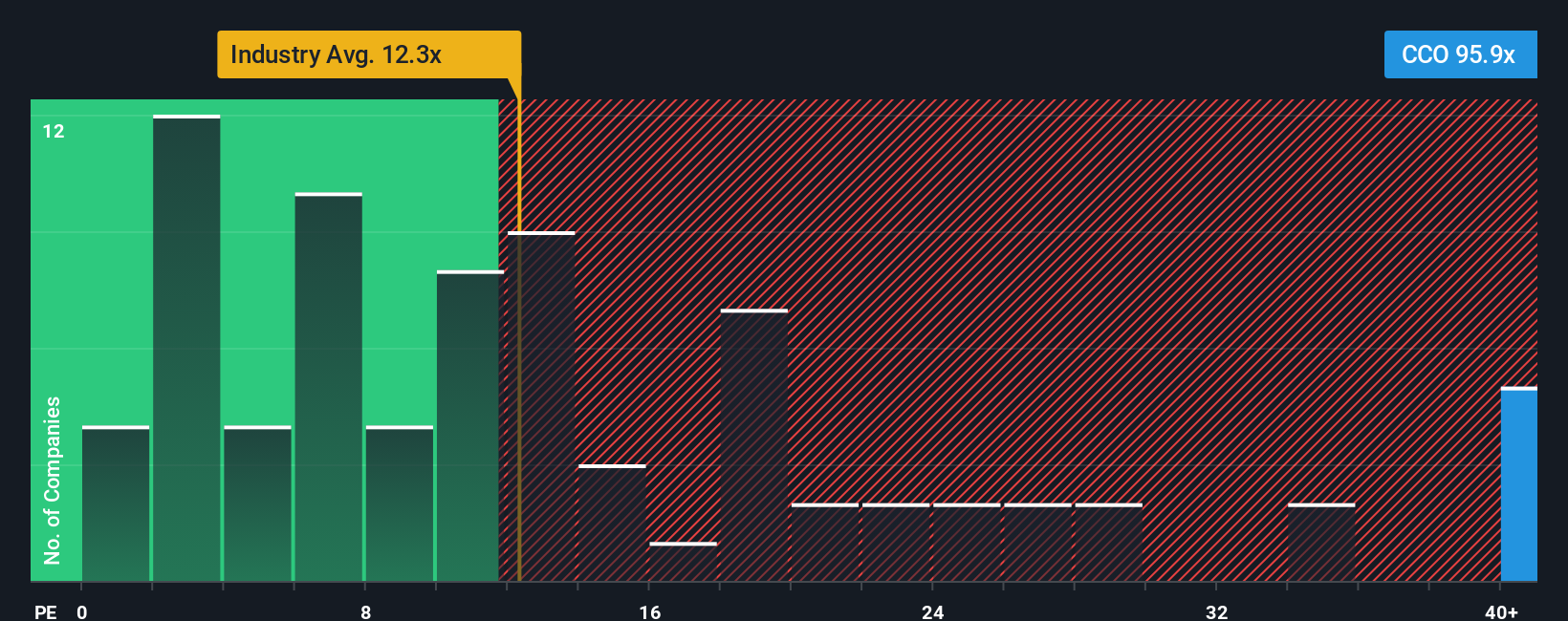

Right now, Cameco trades at a PE of 97.3x, which is well above both the peer average of 15.5x and the broader Oil and Gas industry average of 12.6x. This high multiple reflects not just current performance but also investor confidence in Cameco’s future growth and strategic positioning in the uranium market.

To provide more nuance, Simply Wall St calculates a proprietary “Fair Ratio” for Cameco, which is 16.6x. Unlike simple peer or industry averages, this measure adjusts for earnings growth forecasts, profit margins, company size, and unique risks, offering a more tailored benchmark for fair value.

With Cameco trading at 97.3x against a Fair Ratio of 16.6x, the shares appear richly valued on this basis, suggesting significant optimism is already priced in.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Cameco Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a method that lets you connect your own view of a company's story directly to a numbers-driven forecast and estimated fair value. A Narrative is simply your personal perspective or “story” about where a company is headed, supported by your assumptions about its future revenue growth, profit margins, and earnings potential. Instead of just following historic metrics, Narratives allow you to link Cameco’s business developments or industry shifts to a financial outlook, and ultimately, to the price you think the stock should trade at.

On Simply Wall St’s Community page, Narratives are an accessible and dynamic tool trusted by millions, empowering you to set your own fair value and check how it compares to the current market price. This means investors can decide when the gap between price and value justifies buying or selling. Plus, whenever new data or news hits the market, Narratives update automatically, so your reasoning can adapt as conditions change.

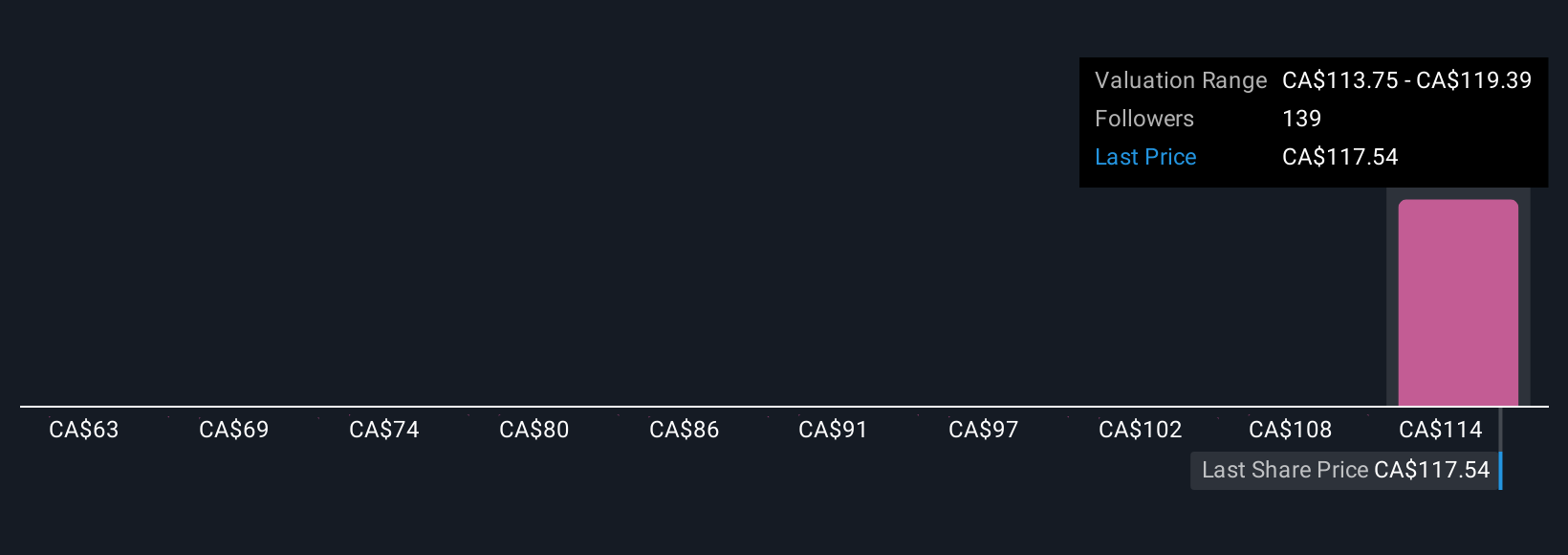

For example, recent Cameco Narratives ranged from highly optimistic, valuing the stock at CA$131.0 using bullish assumptions of accelerating nuclear demand and margin expansion, to far more conservative at CA$100.0, with a cautious stance on project delays and margin risks. So whichever story best matches your outlook, Narratives help ensure your decisions reflect both your view and the latest facts.

Do you think there's more to the story for Cameco? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives