- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Cameco (TSX:CCO) Valuation Check After Powerful Multi‑Year Run And Recent Pullback

Reviewed by Simply Wall St

Cameco (TSX:CCO) has been on a strong long term run, even after a recent pullback this month, and that combination is exactly what has uranium investors rechecking their expectations.

See our latest analysis for Cameco.

With the share price still around CA$123.40 after a 1 month share price return of roughly negative 13 percent, but a powerful year to date share price return above 60 percent and a 5 year total shareholder return above 700 percent, momentum looks more like a healthy pause than a trend reversal as investors reassess growth expectations and uranium market risks.

If Cameco’s run has you thinking about where the next big winners might come from, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings rising, uranium demand improving and the stock still trading below analyst targets, investors now face a key question: Is Cameco still undervalued, or is the market already pricing in its next phase of growth?

Most Popular Narrative Narrative: 18.7% Undervalued

With Cameco last closing at CA$123.40 against a narrative fair value of CA$151.75, the current price implies meaningful upside if the thesis plays out.

Analysts expect earnings to reach CA$1.2 billion (and earnings per share of CA$2.8) by about September 2028, up from CA$533.6 million today. However, there is a considerable amount of disagreement amongst the analysts, with the most bullish expecting CA$1.3 billion in earnings and the most bearish expecting CA$873 million.

Want to see what kind of revenue expansion, margin lift, and future earnings multiple are included in that upside case? The narrative relies on bold growth assumptions, an aggressive profitability reset, and a premium valuation that would usually sit with market darlings. Curious how those moving parts combine into one target number? Read on to uncover the full playbook behind this fair value.

Result: Fair Value of $151.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent delays in new reactor approvals and ongoing operational challenges at key mines could easily derail Cameco’s high growth and margin expansion narrative.

Find out about the key risks to this Cameco narrative.

Another Way To Look At Value

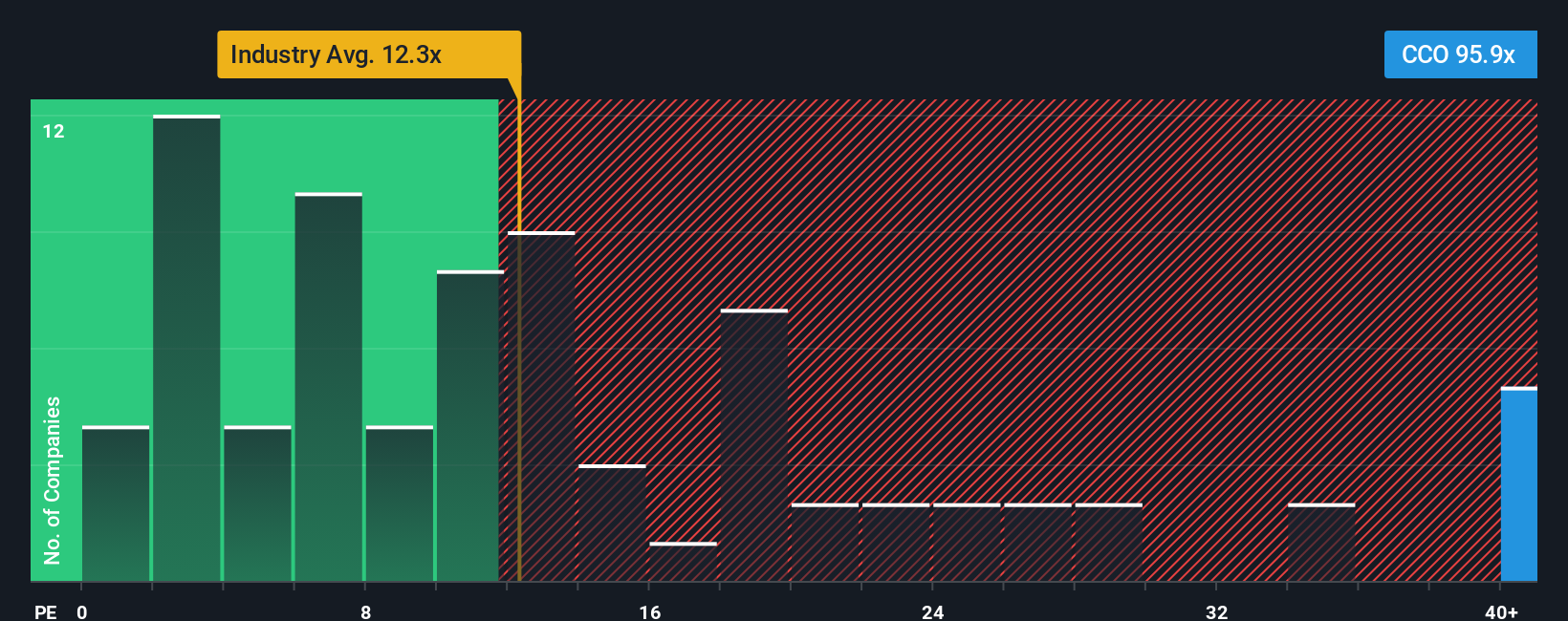

While the narrative fair value suggests Cameco is 18.7 percent undervalued, its current price to earnings ratio of about 102 times tells a very different story. This is far above peers at 16.4 times and above a fair ratio of 20.7 times, which points to real downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cameco Narrative

If you see the story differently or want to stress test the assumptions with your own research, you can craft a personalized thesis in minutes using Do it your way.

A great starting point for your Cameco research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winners by using the Simply Wall Street Screener to uncover opportunities most investors are still overlooking.

- Capture early stage growth by targeting these 3569 penny stocks with strong financials that already back their promise with solid financial foundations and improving business momentum.

- Capitalize on structural tech shifts by focusing on these 24 AI penny stocks positioned at the heart of automation, data intelligence, and productivity transformation.

- Strengthen your long term core holdings with these 933 undervalued stocks based on cash flows that current market prices do not yet fully reflect, based on underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026