- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Cameco (TSX:CCO) Secures Major Slovak Uranium Deal and Indigenous Partnership Is Its Growth Story Evolving?

Reviewed by Sasha Jovanovic

- Cameco recently secured a long-term supply agreement to provide uranium hexafluoride to Slovakia’s Slovenske elektrarne through 2036, and announced a 15-year, C$500 million workforce transportation partnership with Indigenous-owned Rise Air in northern Saskatchewan.

- These collaborations highlight Cameco's strengthened presence in international nuclear supply and its ongoing commitment to supporting local communities and Indigenous partners.

- We'll examine how Cameco's new Slovak supply agreement could influence its investment narrative and long-term growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cameco Investment Narrative Recap

To be a Cameco shareholder, you need to believe in the global nuclear build-out, rising uranium demand, and the company's ability to capitalize on new reactor construction and utility contracting. The recent Slovakia supply agreement further cements Cameco’s international reach but does not materially shift the most pressing short-term catalyst, an acceleration in long-term uranium contracting, or address the ongoing production risks at key mines, which remain the biggest operational challenge for the business.

Of Cameco's recent announcements, the 15-year, C$500 million workforce transportation deal with Rise Air stands out for its relevance to operational stability. By ensuring reliable workforce access to its northern Saskatchewan operations, Cameco is addressing one of the major sources of operational risk, workforce disruptions or shortages, that could otherwise impact its ability to meet production guidance as contracting activity builds.

However, investors should also be aware that while these new agreements add long-term visibility, the ongoing threat of production setbacks at critical assets could still pose...

Read the full narrative on Cameco (it's free!)

Cameco's narrative projects CA$3.9 billion revenue and CA$1.2 billion earnings by 2028. This requires 2.6% yearly revenue growth and a CA$666 million earnings increase from CA$533.6 million today.

Uncover how Cameco's forecasts yield a CA$119.88 fair value, a 8% downside to its current price.

Exploring Other Perspectives

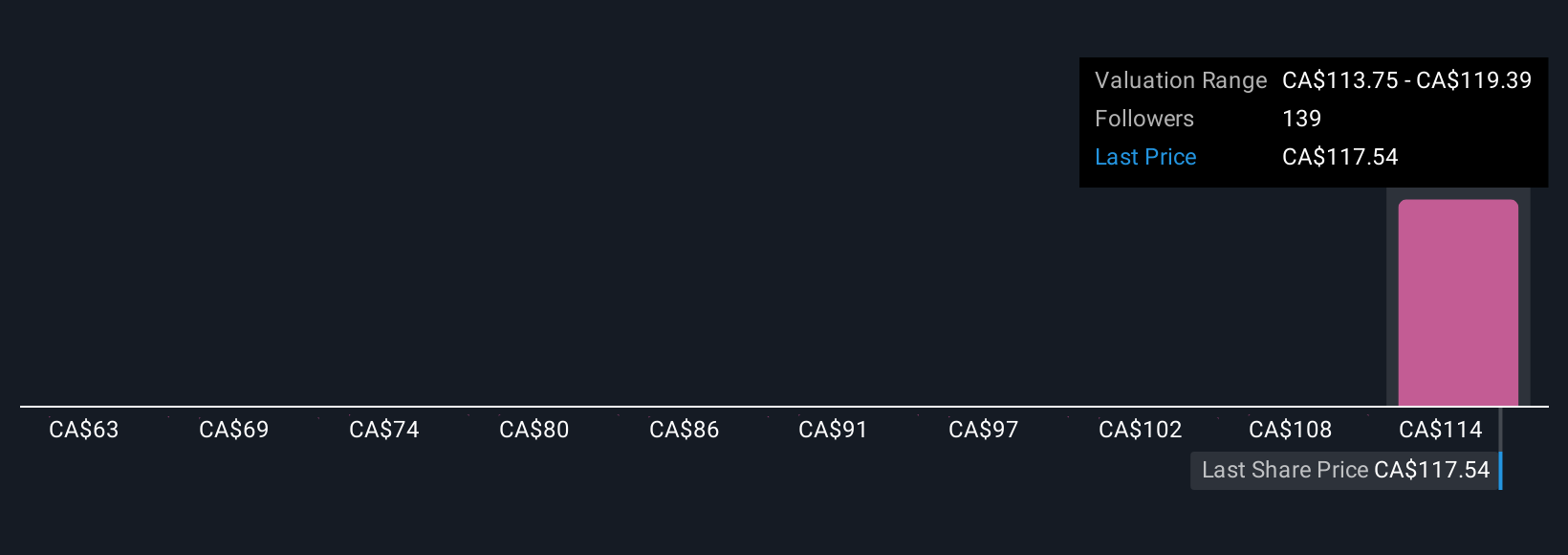

Thirteen Simply Wall St Community members estimate Cameco’s fair value spans from C$63.04 to C$119.88 per share. While opinions vary widely, operational risks at flagship mines remain in focus for assessing Cameco’s future performance.

Explore 13 other fair value estimates on Cameco - why the stock might be worth as much as CA$119.88!

Build Your Own Cameco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cameco research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cameco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cameco's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives