- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Cameco (TSX:CCO): Rethinking Valuation After a 22% Three‑Month Share Price Surge

Reviewed by Simply Wall St

Cameco (TSX:CCO) keeps grinding higher, with shares up about 22% over the past 3 months and roughly 66% over the past year, as investors lean into the nuclear power theme.

See our latest analysis for Cameco.

After a strong run that has pushed the share price to about CA$131.81, Cameco’s recent 90 day share price return of roughly 22% builds on a hefty multi year total shareholder return. This reflects renewed enthusiasm for nuclear energy and a higher tolerance for sector risk.

If Cameco’s surge has you rethinking the energy transition, it might be worth scanning other nuclear linked and electrification beneficiaries through fast growing stocks with high insider ownership.

With the stock already up sharply and trading above analysts’ average target, investors now face a key question: Is Cameco still undervalued given nuclear’s long runway, or has the market already priced in its future growth?

Most Popular Narrative Narrative: 12.6% Undervalued

With Cameco last closing at about CA$131.81 against a narrative fair value near CA$150.81, the story suggests further upside if assumptions hold.

Ongoing structural supply constraints in the uranium sector, combined with years of underinvestment and the need for Western aligned, geopolitically secure fuel suppliers, further enhance Cameco's long term volume and pricing opportunities, underpinning stronger forecast cash flows and sustained profitability.

Curious how modest revenue growth, aggressive margin expansion, and a lofty future earnings multiple add up to this price tag? The narrative’s math may surprise you. Want to see the full playbook behind that valuation?

Result: Fair Value of $150.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent project delays and operational hiccups at key mines could undermine the bullish margin and earnings assumptions built into today’s valuation.

Find out about the key risks to this Cameco narrative.

Another Angle on Valuation

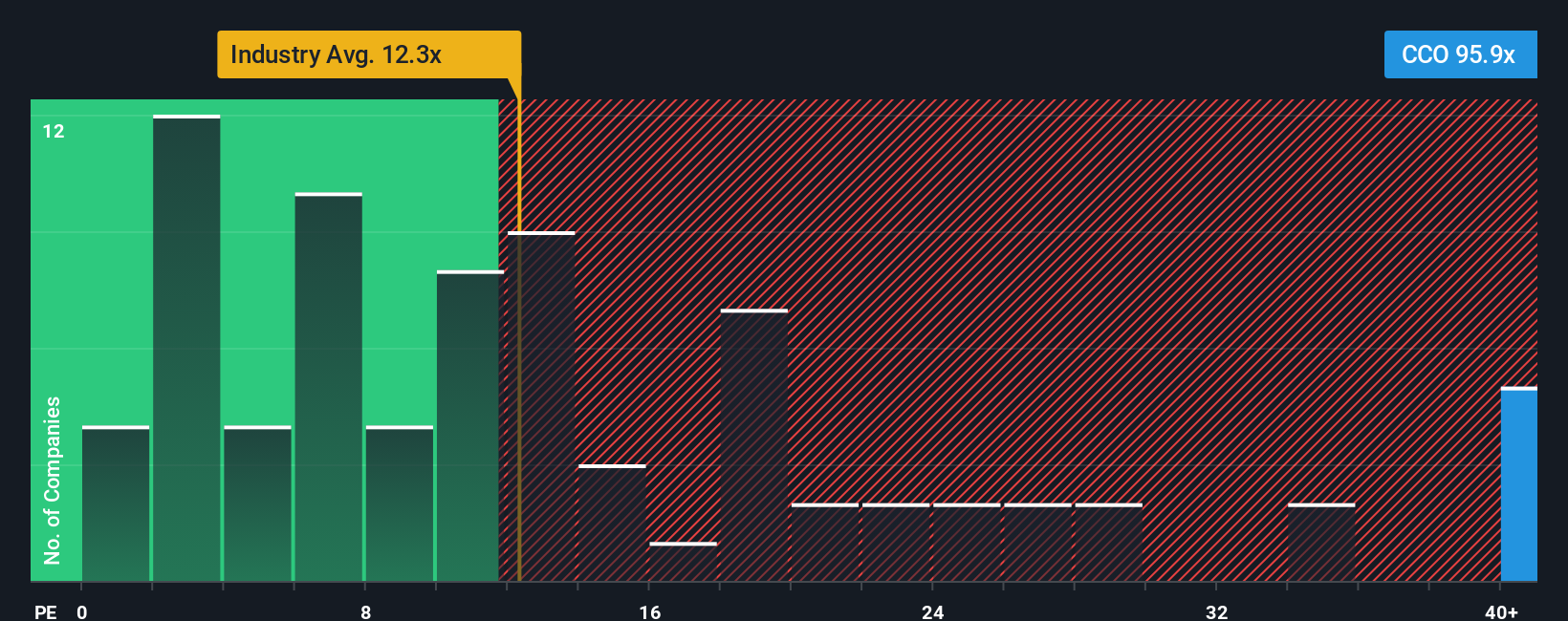

While the narrative fair value points to upside, the earnings multiple tells a harsher story. Cameco trades on a rich 109.1x P/E versus about 16.1x for peers and a 20.8x fair ratio, implying substantial valuation risk if sentiment or uranium prices cool. Is the market overpaying for growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cameco Narrative

If you are not aligned with this view, or would rather dig into the numbers yourself, you can build a personalized narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cameco.

Ready for more high conviction ideas?

Do not stop with one opportunity. Use the Simply Wall St screener to quickly uncover focused stock ideas that match your strategy before the crowd catches on.

- Capture mispriced quality by assessing these 903 undervalued stocks based on cash flows that may offer stronger upside than mature, fully valued blue chips.

- Position ahead of powerful technology shifts by reviewing these 25 AI penny stocks driving real world adoption of machine learning and automation.

- Strengthen your income stream by targeting these 12 dividend stocks with yields > 3% that can potentially balance growth ambitions with reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion