- Canada

- /

- Oil and Gas

- /

- TSX:BTE

Is There an Opportunity in Baytex After Recent Share Price Slide?

Reviewed by Bailey Pemberton

Trying to figure out what to do with your Baytex Energy shares, or maybe considering a fresh buy? You are not alone. Baytex has been a bit of a roller coaster lately, and even the savviest investors are pausing to weigh their options. While the stock closed at $3.26, it has seen a 7.9% slip in just the last week. However, zoom out and that volatility becomes even more striking: Baytex is down 1.2% over the past month, 14.4% year-to-date, and 19.3% over the last 12 months. The three-year chart shows a steeper drop of 45.6%, but here is the twist: the five-year return is a remarkable 656%. With numbers like that, timing clearly matters, and so does your perspective on value and risk.

Recent movements in crude oil prices and shifts in market sentiment toward energy producers have definitely played their part in these swings. As global energy markets stay in the headlines, it is natural to question what a fair price for Baytex really looks like, especially now that investor attitudes toward commodity cycles and Canadian energy firms are shifting yet again.

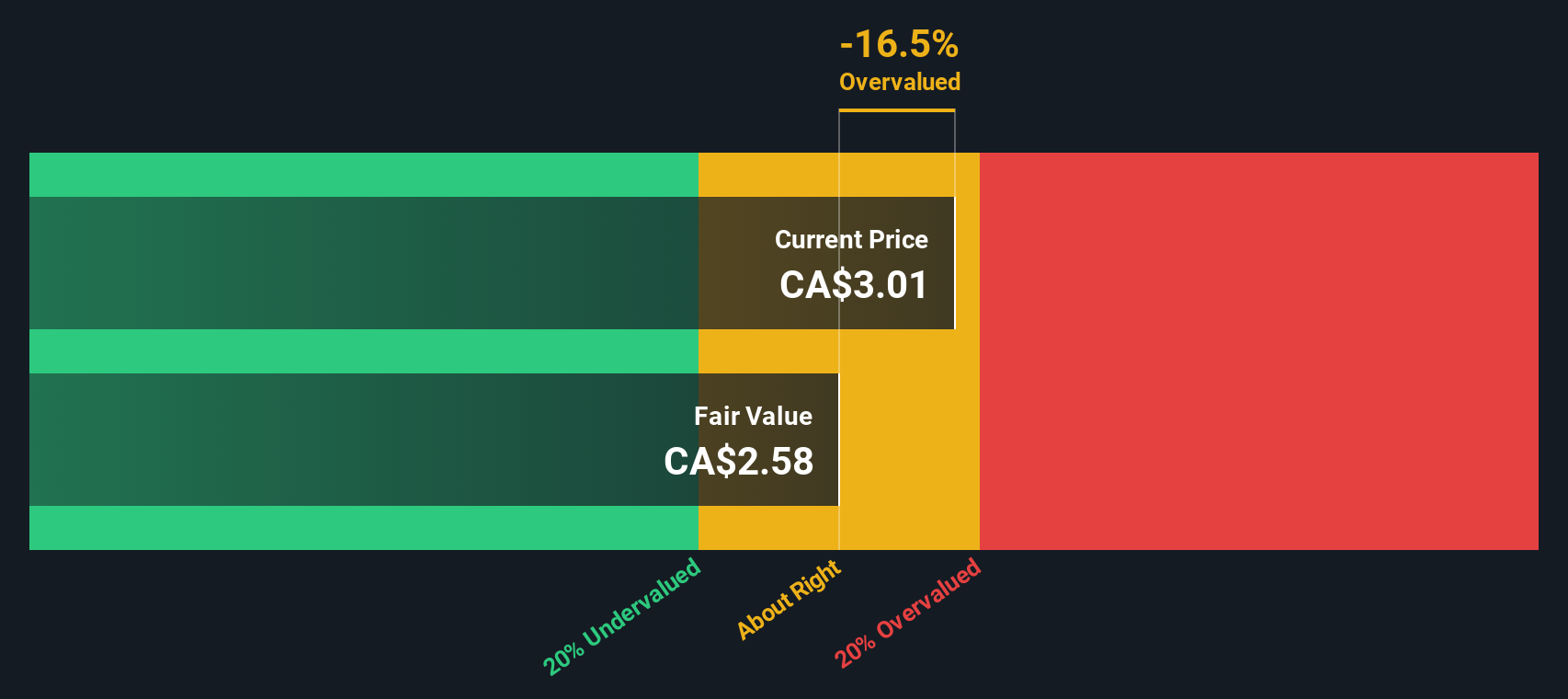

If you are looking for a data-driven place to start, Baytex currently scores a 3 out of 6 on our valuation check, showing it is undervalued in half of the metrics we track. But numbers only tell part of the story. Next, we will explore the different methods analysts use to judge if a stock is undervalued, fairly priced, or risky, and why some valuation tools are more meaningful than others. By the end, you will know how the experts do it, along with a smarter way to think about what Baytex is truly worth.

Why Baytex Energy is lagging behind its peers

Approach 1: Baytex Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting them back to today's value. This approach helps investors understand the intrinsic value of a stock based on the business's ability to generate cash over time. It is a widely used tool for assessing companies like Baytex Energy.

For Baytex Energy, the current Free Cash Flow stands at CA$556.6 million. Analyst forecasts extend out a few years, with projections becoming more speculative as time goes further out. By 2027, Free Cash Flow is estimated at CA$121 million. Looking further, ten-year projections extrapolated by Simply Wall St suggest a declining trend, with cash flow estimates dropping to just over CA$28 million by 2035. This DCF analysis uses a two-stage Free Cash Flow to Equity model, making it suitable for companies with shifting growth rates over time.

The resulting DCF calculation places Baytex's intrinsic value per share at CA$0.95. With shares recently closing at CA$3.26, the stock appears to be trading roughly 243.9% above its estimated fair value. This significant disconnect implies the market is pricing in more optimistic future growth or that other factors are at play beyond core cash generation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Baytex Energy may be overvalued by 243.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Baytex Energy Price vs Earnings (PE)

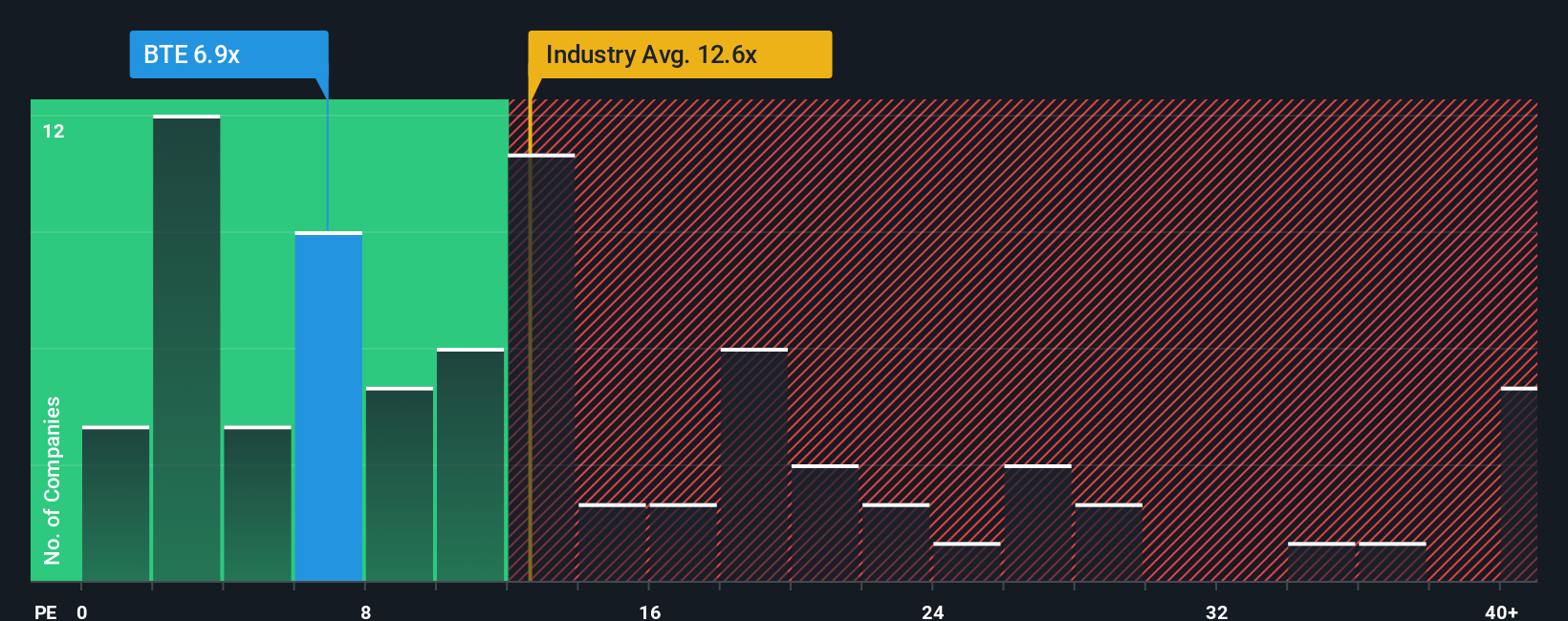

The Price-to-Earnings (PE) ratio is a favored valuation method for profitable companies like Baytex Energy. It compares a company's share price to its per-share earnings, helping investors judge whether the stock is expensive or cheap relative to the profits the business generates. Generally, companies with strong growth prospects or lower risk deserve higher PE ratios, while riskier or slower-growing firms tend to trade on lower multiples.

Baytex Energy currently trades at a PE of 6.81x. For context, the average PE across the Oil and Gas industry is around 12.24x, while Baytex's peer group sits at 11.67x. On face value, Baytex appears cheaper than both its industry and peers. However, these simple comparisons do not tell the full story. Factors such as a company's growth outlook, profit margins, risk, and market cap matter significantly when deciding what is a "normal" multiple.

This is where Simply Wall St's proprietary "Fair Ratio" comes in. The Fair Ratio distills all these variables, such as earnings growth, industry landscape, profitability, size, and inherent risks, to estimate what a reasonable PE should be for Baytex today. For Baytex, the Fair Ratio stands at 4.53x, which is notably lower than both its actual PE and sector averages. Because the current PE of 6.81x is above the Fair Ratio, it suggests the stock may be slightly overvalued on this measure, even if it looks cheap compared to industry benchmarks. Using the Fair Ratio provides a more tailored, nuanced view of value beyond peer or sector comparisons alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Baytex Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple yet dynamic tool that allows you to combine your view of a company’s story, the real-world events and trends you think matter, with clear financial forecasts and a fair value based on your assumptions. Narratives help you link Baytex Energy’s business catalysts, risks, and future outlook directly to projected numbers like revenue, earnings, and profit margins. This approach takes investing beyond just ratios or historical charts.

This approach is not just for advanced analysts. Anyone can use Narratives easily on Simply Wall St’s Community page, where millions of investors share their perspectives and fair value estimates. Narratives update automatically as new news or earnings come in so your view adapts with fresh market information. By comparing Fair Value, based on your chosen Narrative, to the current share price, you can make clearer, more confident decisions about when to buy or sell.

For example, some investors believe Baytex could be worth as much as CA$5.00 if operational gains outpace the impact of tariffs and oil price swings. Others think it is only worth CA$2.50 if challenges persist. This is a perfect illustration of how Narratives shape each investor's fair value and action plan.

Do you think there's more to the story for Baytex Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baytex Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BTE

Baytex Energy

An energy company, engages in the acquisition, development, and production of crude oil and natural gas in the Western Canadian Sedimentary Basin and in the Eagle Ford, the United States.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives