- Canada

- /

- Oil and Gas

- /

- TSX:BIR

Promising TSX Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

The Canadian market has recently experienced a pullback, with the TSX index losing about 6.5% since its peak on December 6, amid political uncertainties and year-end profit-taking. Despite this volatility, the underlying economic conditions remain robust, offering opportunities for investors to consider diversifying their portfolios. Penny stocks, while often considered relics of past market eras, continue to present potential value by offering affordability and growth prospects when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$115M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.33 | CA$942.04M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.15 | CA$389.72M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.49 | CA$14.04M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.55 | CA$501.61M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$221.48M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$179.46M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.82 | CA$112.03M | ★★★★☆☆ |

Click here to see the full list of 961 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

NetraMark Holdings (CNSX:AIAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NetraMark Holdings Inc. develops artificial intelligence and machine learning solutions for the pharmaceutical industry in Canada, with a market cap of CA$70.94 million.

Operations: The company's revenue is derived entirely from its healthcare software segment, amounting to CA$0.35 million.

Market Cap: CA$70.94M

NetraMark Holdings, with a market cap of CA$70.94 million, is pre-revenue, generating less than US$1 million annually. The company recently secured a pilot collaboration with a top 5 pharmaceutical firm to explore AI-driven insights for autoimmune disorders, potentially enhancing clinical trial success. Despite its innovative approach, NetraMark faces challenges such as increased losses over the past five years and limited cash runway under one year if current cash flow trends persist. Strategic leadership changes include the appointment of Dr. Angelico Carta as Chief Strategy Officer to guide long-term growth and commercialization strategies.

- Click to explore a detailed breakdown of our findings in NetraMark Holdings' financial health report.

- Review our historical performance report to gain insights into NetraMark Holdings' track record.

Birchcliff Energy (TSX:BIR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Birchcliff Energy Ltd. is an intermediate oil and natural gas company that explores, develops, and produces natural gas, light oil, condensate, and other natural gas liquids in Western Canada with a market cap of CA$1.27 billion.

Operations: The company's revenue is primarily derived from its oil and gas exploration and production segment, which generated CA$615.10 million.

Market Cap: CA$1.27B

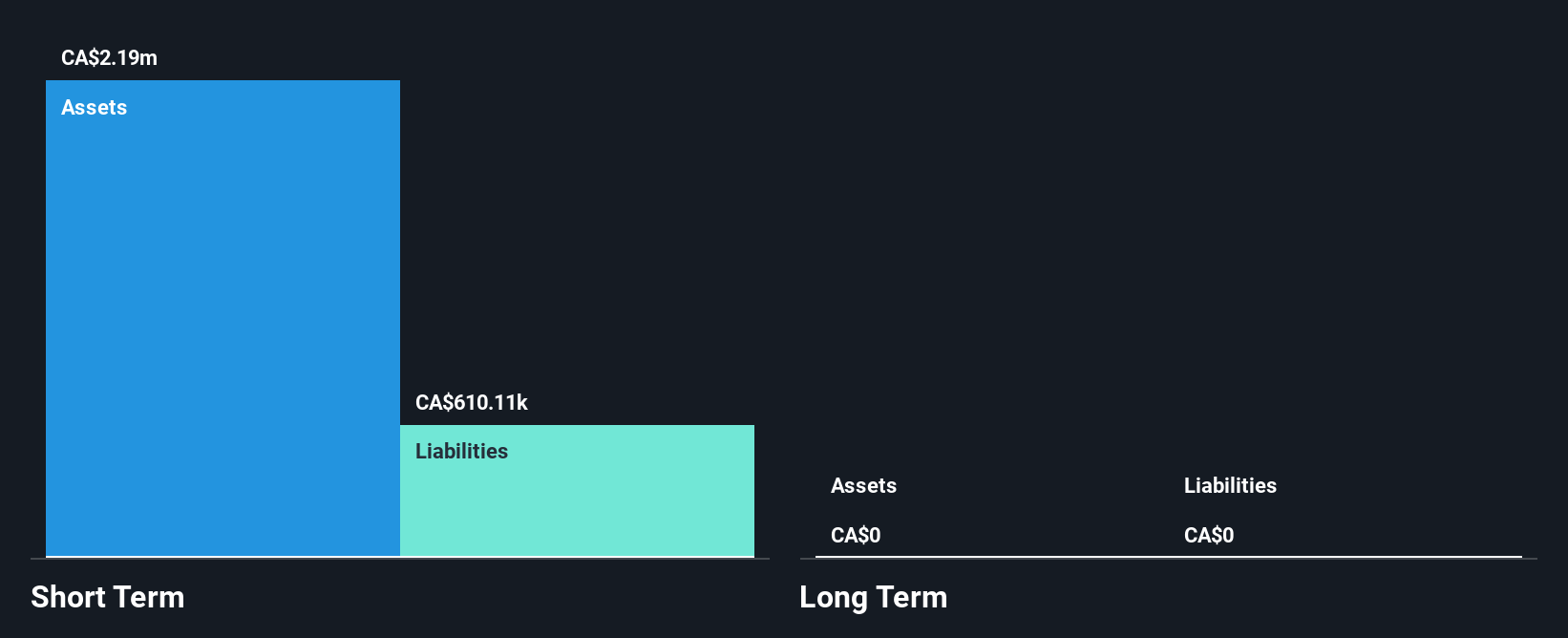

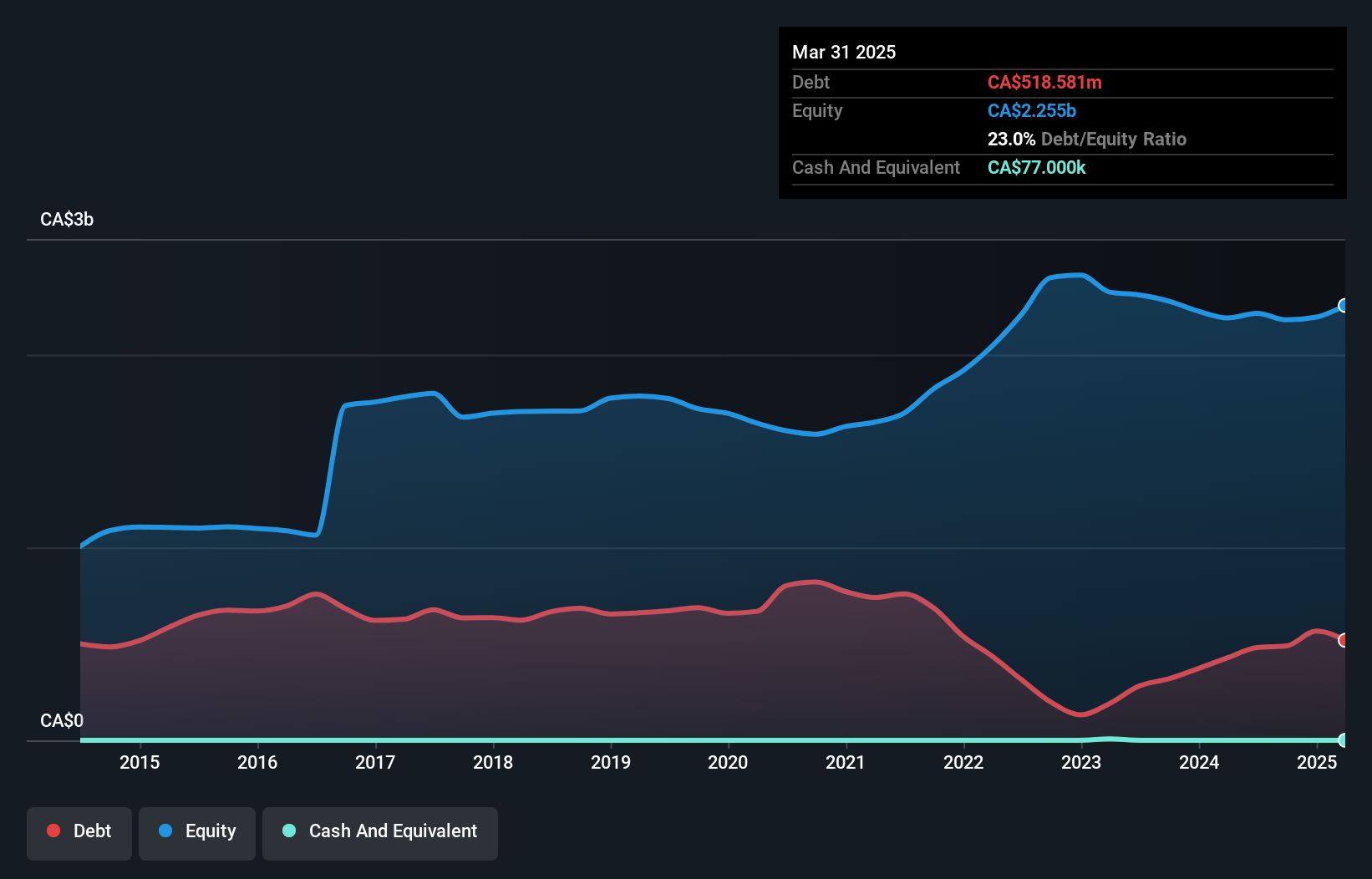

Birchcliff Energy, with a market cap of CA$1.27 billion, has recently announced a share repurchase program to buy back up to 5% of its outstanding shares, reflecting confidence in its valuation. Despite negative earnings growth over the past year and declining profit margins from 10.3% to 2.5%, the company maintains stable production levels and forecasts revenue growth of 30.02%. Its debt-to-equity ratio has improved significantly over five years, now at a satisfactory level of 22.4%, though interest coverage remains weak at 1.7 times EBIT, raising concerns about financial flexibility amidst industry volatility.

- Click here to discover the nuances of Birchcliff Energy with our detailed analytical financial health report.

- Understand Birchcliff Energy's earnings outlook by examining our growth report.

Aldebaran Resources (TSXV:ALDE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aldebaran Resources Inc. is involved in acquiring, exploring, and evaluating mineral properties in Canada and Argentina, with a market cap of CA$360.22 million.

Operations: There are no revenue segments reported for the company.

Market Cap: CA$360.22M

Aldebaran Resources, with a market cap of CA$360.22 million, remains pre-revenue and recently reported a net loss reduction for Q1 2024. The company's updated resource estimate for its Altar copper-gold project in Argentina shows significant increases in both measured and inferred resources, highlighting potential future value. Despite the absence of revenue streams, Aldebaran is debt-free with short-term assets exceeding liabilities. However, concerns persist due to an auditor's going concern doubts and the recent drop from the S&P/TSX Venture Composite Index. The management team is seasoned, supporting strategic development efforts amidst ongoing challenges.

- Navigate through the intricacies of Aldebaran Resources with our comprehensive balance sheet health report here.

- Explore historical data to track Aldebaran Resources' performance over time in our past results report.

Turning Ideas Into Actions

- Jump into our full catalog of 961 TSX Penny Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Birchcliff Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BIR

Birchcliff Energy

An intermediate oil and natural gas company, engages in the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)