- Canada

- /

- Oil and Gas

- /

- TSX:ARX

How Investors May Respond To ARC Resources (TSX:ARX) Approving a Major Share Buyback Program

Reviewed by Simply Wall St

- ARC Resources Ltd. has announced the launch of a substantial share repurchase program, with approval to buy back up to 57,967,896 shares, representing nearly 10% of its issued and outstanding capital, by September 2026, with all repurchased shares to be cancelled.

- This move signals the company’s intent to return capital to shareholders and could meaningfully impact ARC's earnings per share through a reduced share count.

- We'll examine how ARC's decision to execute a sizeable share buyback shapes its investment narrative and approach to shareholder returns.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ARC Resources Investment Narrative Recap

To be an ARC Resources shareholder, you need to believe in the long-term relevance of natural gas and liquids production in Western Canada, as well as management’s ability to sustain free cash flow and returns amid commodity cycles. While the new buyback program sharpens ARC’s capital return profile, it does not fundamentally alter the primary near-term catalyst: successful integration of recent Kakwa acquisitions and associated production ramp, nor does it materially change the prevailing risk of margin pressure from rising operating costs.

Among ARC’s recent announcements, its production guidance update on July 31, 2025, is particularly relevant. With oil and gas output projected to exceed 410,000 BOE per day by late 2025, completion of the share repurchase program could amplify per-share results if operational targets are met, reinforcing capital returns as a key draw for holders.

Yet, with production growth and shareholder returns in focus, investors should not overlook the potential for structural cost increases at Kakwa and Sunrise to strain ARC’s margins if commodity prices weaken…

Read the full narrative on ARC Resources (it's free!)

ARC Resources' outlook anticipates CA$6.9 billion in revenue and CA$2.0 billion in earnings by 2028. This scenario assumes a 6.8% annual revenue growth rate and a CA$0.5 billion earnings increase from the current CA$1.5 billion.

Uncover how ARC Resources' forecasts yield a CA$33.94 fair value, a 33% upside to its current price.

Exploring Other Perspectives

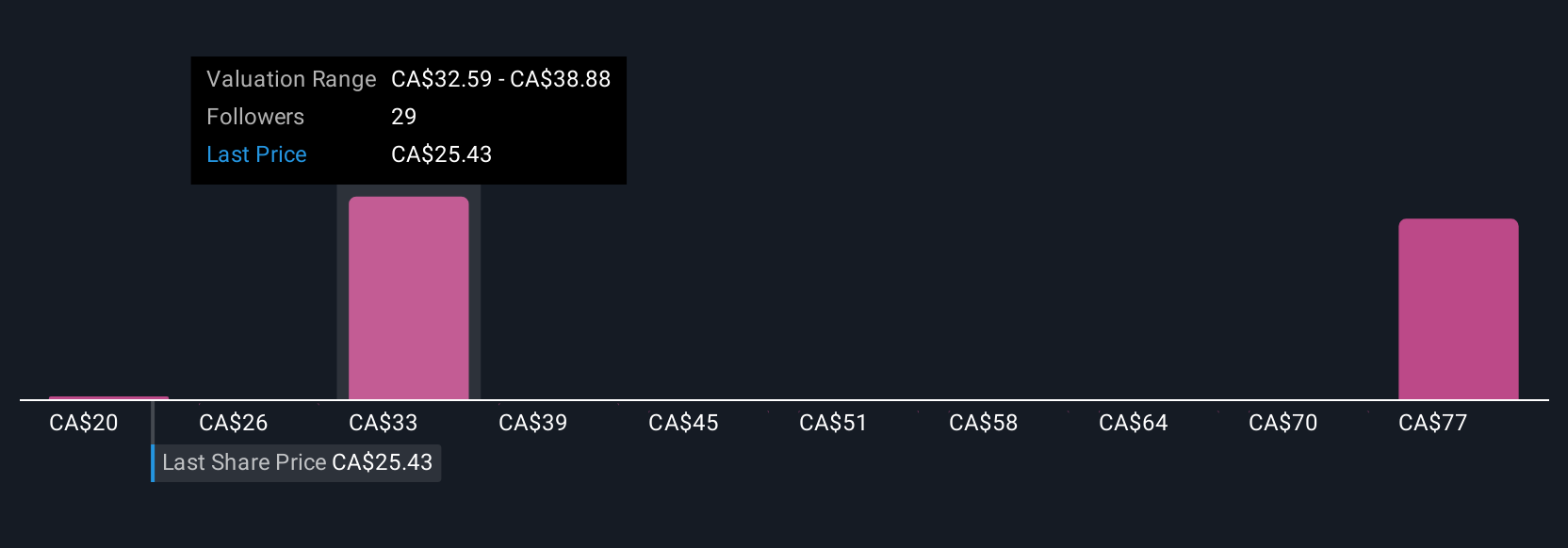

Six Simply Wall St Community members place ARC’s fair value between CA$20 and CA$83, showing estimates with more than threefold difference. While some see clear upside, views differ sharply given exposure to rising cost pressure and volatile energy demand.

Explore 6 other fair value estimates on ARC Resources - why the stock might be worth over 3x more than the current price!

Build Your Own ARC Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ARC Resources research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ARC Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ARC Resources' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARX

ARC Resources

Engages in the acquiring and developing crude oil, natural gas, condensate, and natural gas liquids in Canada.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives