Last Update03 Oct 25Fair value Decreased 2.35%

Analysts have lowered their price target for ARC Resources from C$35 to C$33. They cited modest shifts in revenue growth assumptions and an updated profit margin outlook as key factors for the revision.

Analyst Commentary

Recent analyst coverage for ARC Resources highlights both optimism surrounding the company’s fundamentals and ongoing caution about market and company-specific factors. The following summarizes key perspectives derived from recent research notes.

Bullish Takeaways- Bullish analysts continue to maintain positive ratings on ARC Resources, suggesting confidence in the company's operational execution and asset base, even amid price target adjustments.

- The inclusion of ARC Resources on Analyst Current Favorites lists signals that the stock is still seen as an attractive pick in the sector relative to peers.

- Gradual upward revisions in price targets by some analysts, despite modest increases, reflect confidence in ARC Resources’ capacity for stable cash flow generation and efficient cost management.

- Strong margin discipline and ongoing profitability improvements have also been highlighted as supportive of long-term valuation.

- Bearish analysts have adjusted their forecasts based on more conservative assumptions for revenue growth and profit margins. This has resulted in price target reductions.

- Concerns remain about the sustainability of current margin levels, as market volatility and input cost pressures may affect future earnings.

- The modest nature of revenue growth expectations reflects skepticism that ARC Resources will achieve outsized expansion in the near term, especially given macroeconomic uncertainties.

What's in the News

- ARC Resources Ltd. has been added to the FTSE All-World Index (USD) (Key Developments).

- The Board of Directors has authorized a new buyback plan, and the company announced a share repurchase program that could see up to 57,967,896 shares, or 9.97% of issued share capital, bought back and cancelled by September 7, 2026 (Key Developments).

- For the second quarter ended June 30, 2025, ARC Resources reported total production of 357,228 boe/day, up from 330,046 boe/day last year. Natural gas and crude oil production also saw year-over-year increases. NGLs production decreased slightly (Key Developments).

- ARC Resources revised 2025 consolidated production guidance upwards due to the Kakwa Acquisition. The company now expects total production between 385,000 and 395,000 boe/day and forecasts second-half output above 410,000 boe/day (Key Developments).

- From April 1, 2025 to June 30, 2025, ARC Resources repurchased 2,900,000 shares for CAD 81.81 million and completed the repurchase of 10,000,000 shares for CAD 266.7 million under a previously announced buyback plan (Key Developments).

Valuation Changes

- Fair Value Estimate: Decreased slightly from CA$33.82 to CA$33.03, reflecting a modest downward adjustment in overall valuation.

- Discount Rate: Narrowed from 6.28% to 6.11%, indicating a slightly lower perceived risk or cost of capital in analyst models.

- Revenue Growth Projection: Lowered marginally from 6.80% to 6.72% for upcoming periods.

- Net Profit Margin: Increased gently from 29.03% to 29.27%, suggesting expectations for improved profitability.

- Future Price-to-Earnings Ratio: Declined from 11.21x to 10.82x, which signals expectations for improved earnings or a lower valuation multiple.

Key Takeaways

- Strategic asset integration, infrastructure investments, and operational efficiencies enhance production, profitability, and revenue resilience across commodity cycles.

- Focused capital discipline and shifting production mix drive higher margins, improved cash flow, and increased shareholder returns.

- Heavy dependence on Western Canadian gas, rising costs, expansion risks, and high shareholder payouts may threaten long-term financial stability amid market and regulatory uncertainty.

Catalysts

About ARC Resources- Engages in the acquiring and developing crude oil, natural gas, condensate, and natural gas liquids in Canada.

- Integration of recently acquired Kakwa assets and new Attachie acreage extends ARC's inventory life and enhances production scalability, supporting long-term growth in operating cash flow, revenue visibility, and net margin expansion as operational synergies and capital efficiencies are realized.

- The ramp-up of LNG Canada and growing LNG export capacity out of Western Canada is expected to increase regional natural gas demand and support stronger local pricing, directly benefiting ARC's realized revenue and improving the profitability of its large Montney natural gas resource base.

- Continued shift toward a higher liquids (condensate and light oil) production mix, combined with success in well design optimization (higher-intensity completions, wider spacing), is driving higher-margin output and improved capital efficiency, leading to higher EBITDA margins and free cash flow generation.

- ARC's disciplined approach to capital allocation-returning nearly 100% of free cash flow via dividends and buybacks, while maintaining a strong balance sheet-positions the company to drive sustained growth in free cash flow per share and total shareholder return.

- Early investments in pipeline and transportation infrastructure, along with long-term marketing contracts accessing premium-priced North American and international markets, enable ARC to outperform local price benchmarks and support stronger, more resilient revenues through commodity cycles.

ARC Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ARC Resources's revenue will grow by 6.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 26.4% today to 29.0% in 3 years time.

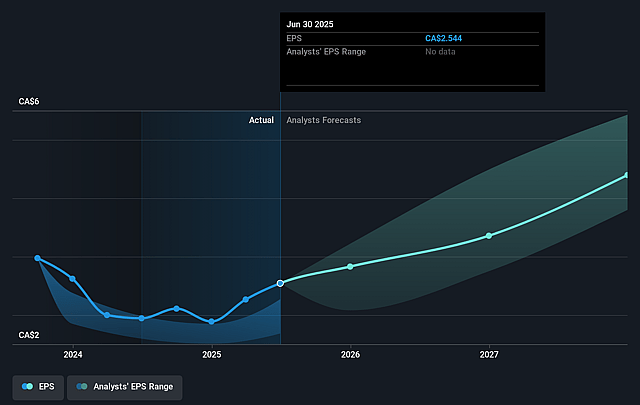

- Analysts expect earnings to reach CA$2.0 billion (and earnings per share of CA$3.93) by about September 2028, up from CA$1.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CA$1.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.2x on those 2028 earnings, up from 10.1x today. This future PE is lower than the current PE for the CA Oil and Gas industry at 12.2x.

- Analysts expect the number of shares outstanding to decline by 1.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.18%, as per the Simply Wall St company report.

ARC Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy long-term reliance on natural gas and liquids in Western Canada leaves ARC vulnerable to structural declines in fossil fuel demand driven by global decarbonization and electrification, which could negatively impact revenue and market valuation over time.

- Rising operating costs from water handling, higher expense per BOE due to Sunrise shut-ins, and potential ongoing structural cost increases at Kakwa may compress net margins and erode profitability as commodity prices fluctuate.

- Substantial CapEx commitments for expansion projects (especially Attachie Phase 2 and Kakwa integration) expose ARC to cost overruns or lower-than-expected production returns, straining free cash flow and increasing financial risk if commodity prices are weak.

- Shut-ins of low-cost dry gas assets (like Sunrise) due to unfavourable pricing highlight the company's sensitivity to local oversupply, pipeline bottlenecks, and the risk that anticipated LNG demand may materialize more slowly than expected-undermining revenue and earnings.

- Increased leverage from recent debt-funded acquisitions, alongside a corporate policy of returning essentially all free cash flow to shareholders, may limit balance sheet flexibility and the ability to address ESG-driven capital allocation pressures or future regulatory costs, which could impact long-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$33.941 for ARC Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$38.0, and the most bearish reporting a price target of just CA$31.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$6.9 billion, earnings will come to CA$2.0 billion, and it would be trading on a PE ratio of 11.2x, assuming you use a discount rate of 6.2%.

- Given the current share price of CA$26.13, the analyst price target of CA$33.94 is 23.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.