- China

- /

- Medical Equipment

- /

- SHSE:688351

Three Stocks Investors May Be Undervaluing Based On Current Market Estimates

Reviewed by Simply Wall St

In the midst of global market fluctuations, with U.S. stocks ending lower due to tariff uncertainties and mixed economic signals from major regions like Europe and Japan, investors are keenly observing potential opportunities in undervalued stocks. As the market grapples with these challenges, identifying stocks that may be trading below their intrinsic value can provide a strategic edge for those looking to capitalize on current conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gilead Sciences (NasdaqGS:GILD) | US$96.14 | US$191.74 | 49.9% |

| National World (LSE:NWOR) | £0.227 | £0.45 | 49.5% |

| On the Beach Group (LSE:OTB) | £2.495 | £4.94 | 49.5% |

| TCI (TPEX:8436) | NT$119.00 | NT$237.00 | 49.8% |

| Hanjaya Mandala Sampoerna (IDX:HMSP) | IDR575.00 | IDR1141.10 | 49.6% |

| APAC Realty (SGX:CLN) | SGD0.455 | SGD0.91 | 49.9% |

| Smurfit Westrock (NYSE:SW) | US$53.64 | US$107.04 | 49.9% |

| Array Technologies (NasdaqGM:ARRY) | US$6.87 | US$13.66 | 49.7% |

| SK D&D (KOSE:A210980) | ₩7110.00 | ₩14097.07 | 49.6% |

| Pantoro (ASX:PNR) | A$0.135 | A$0.27 | 49.5% |

Here's a peek at a few of the choices from the screener.

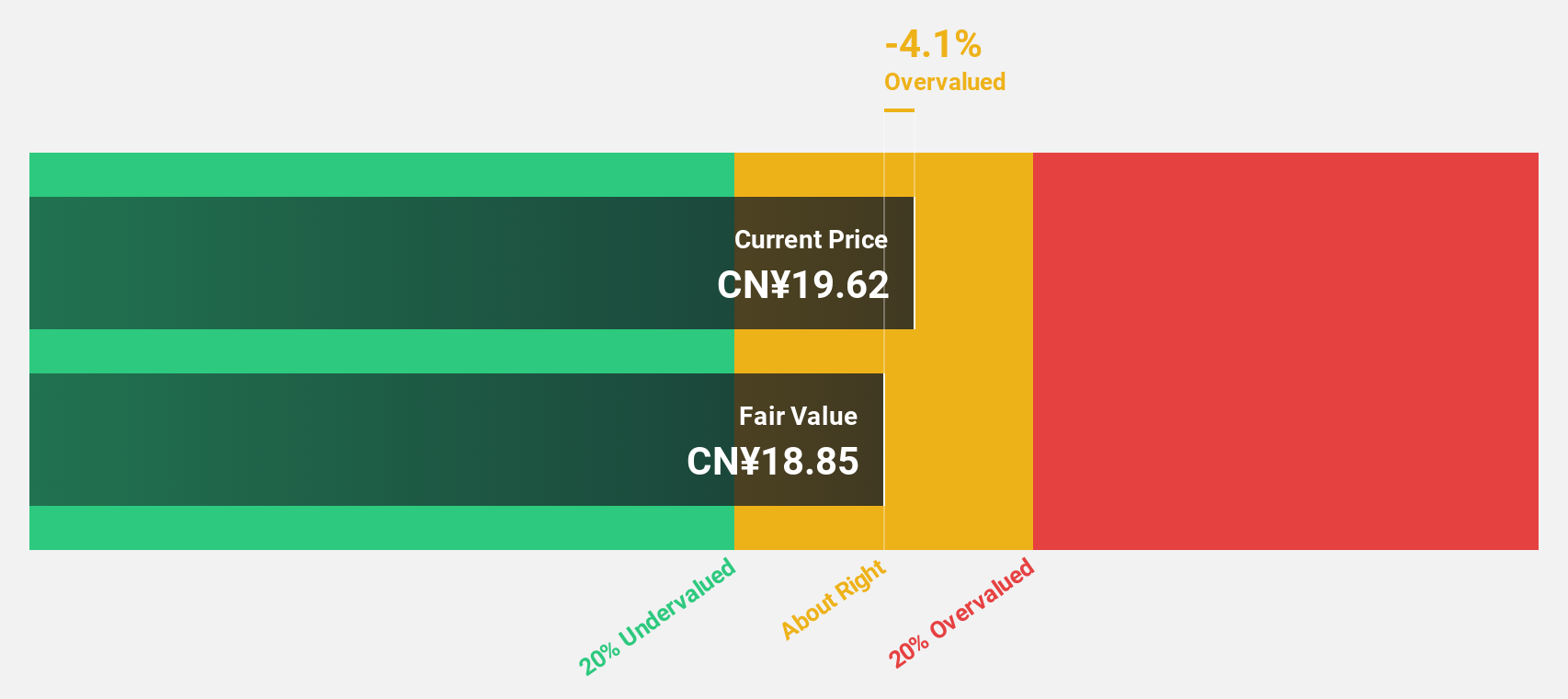

Shanghai MicroPort EP MedTech (SHSE:688351)

Overview: Shanghai MicroPort EP MedTech Co., Ltd. focuses on the research, development, production, and sale of medical devices for electrophysiological interventional diagnosis and ablation therapy both in China and internationally, with a market cap of CN¥9.02 billion.

Operations: The company's revenue is primarily derived from its Surgical & Medical Equipment segment, amounting to CN¥383.99 million.

Estimated Discount To Fair Value: 16.3%

Shanghai MicroPort EP MedTech is trading at CN¥19.16, below its estimated fair value of CN¥22.89, suggesting undervaluation based on cash flows. Despite a low forecasted ROE of 5.6%, the company's earnings are expected to grow significantly at 54.5% annually over the next three years, outpacing the Chinese market's growth rate. Recent regulatory approvals for innovative products like the Magbot Catheter and Genesis RMN System bolster its potential revenue growth and market position in China’s medical device sector.

- Upon reviewing our latest growth report, Shanghai MicroPort EP MedTech's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Shanghai MicroPort EP MedTech.

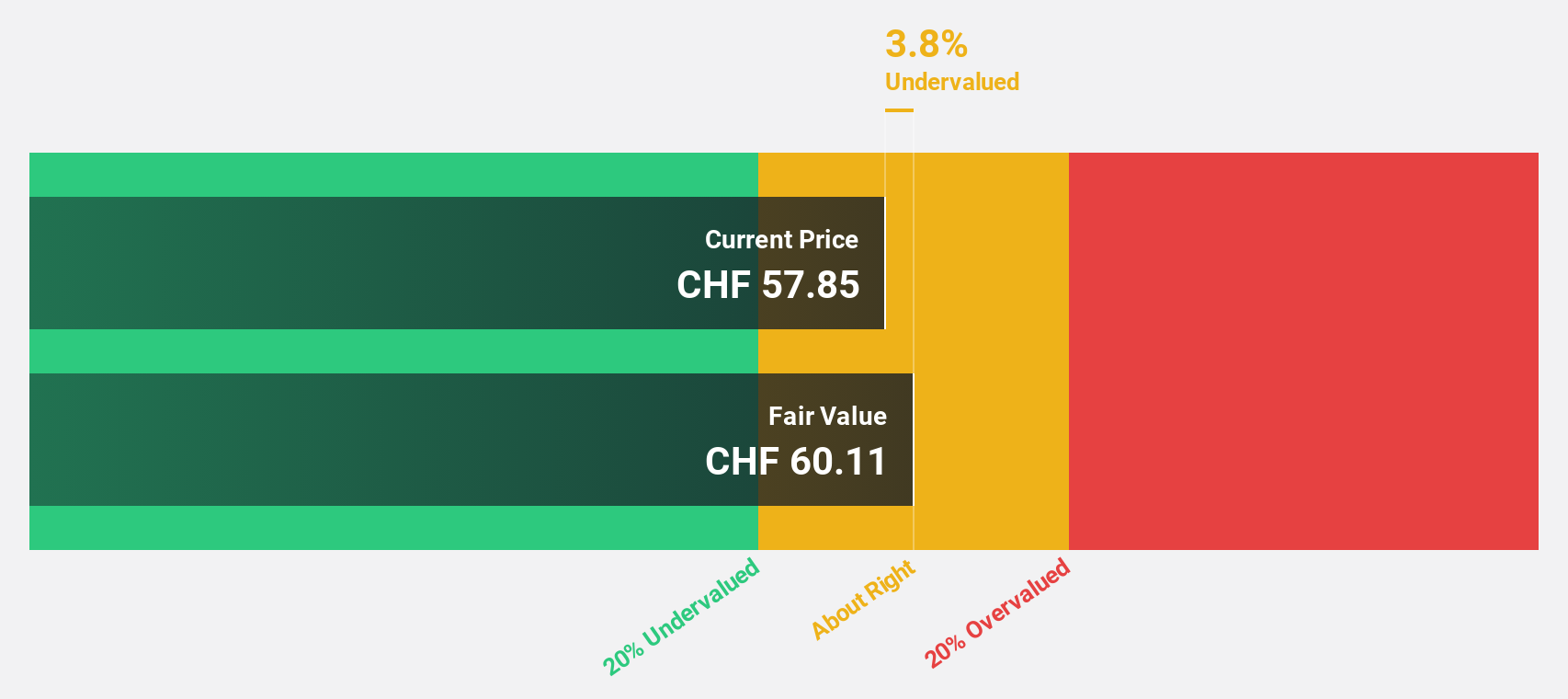

Temenos (SWX:TEMN)

Overview: Temenos AG develops, markets, and sells integrated banking software systems to banking and other financial institutions worldwide, with a market cap of CHF5.78 billion.

Operations: The company's revenue segments include software licensing, which generated $347.5 million, software-as-a-service with $164.3 million, maintenance at $444.8 million, and services contributing $125.6 million.

Estimated Discount To Fair Value: 19.6%

Temenos, trading at CHF79.25, is undervalued compared to its estimated fair value of CHF98.61. The company's revenue is projected to grow at 7.3% annually, surpassing the Swiss market's 4.3%. Recent client wins with Aldermore Bank and CEC Bank highlight its strong SaaS offerings and cloud-based solutions, enhancing operational efficiency and customer experience. Despite a high debt level, Temenos' earnings are expected to grow faster than the Swiss average at 12% per year.

- Insights from our recent growth report point to a promising forecast for Temenos' business outlook.

- Take a closer look at Temenos' balance sheet health here in our report.

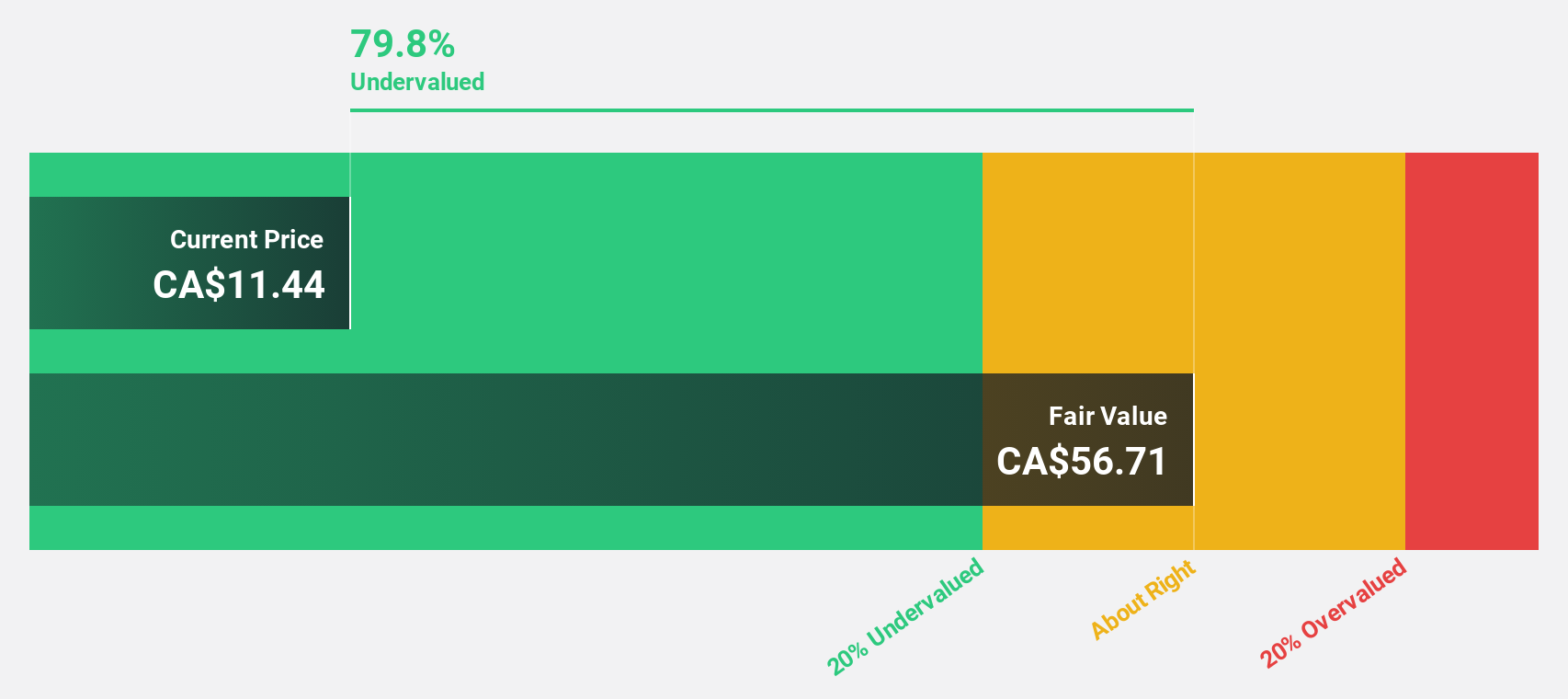

Advantage Energy (TSX:AAV)

Overview: Advantage Energy Ltd. operates in the acquisition, exploitation, development, and production of natural gas, crude oil, and natural gas liquids in Alberta, Canada with a market cap of CA$1.58 billion.

Operations: The company's revenue segment includes CA$488.84 million from Advantage Oil & Gas Ltd.

Estimated Discount To Fair Value: 48.3%

Advantage Energy, priced at CA$9.68, trades significantly below its fair value of CA$18.72. Despite a high debt level, its earnings are forecast to grow substantially at 45% annually over the next three years, outpacing the Canadian market's growth rate of 17.1%. Revenue is also set to increase by 21.1% per year, exceeding the market average of 5.8%, although profit margins have decreased from last year’s levels.

- Our growth report here indicates Advantage Energy may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Advantage Energy stock in this financial health report.

Make It Happen

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 896 more companies for you to explore.Click here to unveil our expertly curated list of 899 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688351

Shanghai MicroPort EP MedTech

Engages in the research, development, production, and sale of medical devices in the field of electrophysiological interventional diagnosis and ablation therapy in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives