- Canada

- /

- Oil and Gas

- /

- CNSX:API

How Much Are Appia Energy Corp. (CSE:API) Insiders Spending On Buying Shares?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So shareholders might well want to know whether insiders have been buying or selling shares in Appia Energy Corp. (CSE:API).

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise'.

See our latest analysis for Appia Energy

Appia Energy Insider Transactions Over The Last Year

In fact, the recent purchase by President Anastasios Drivas was not their only acquisition of Appia Energy shares this year. They previously made an even bigger purchase of CA$140k worth of shares at a price of CA$0.25 per share. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of CA$0.38. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

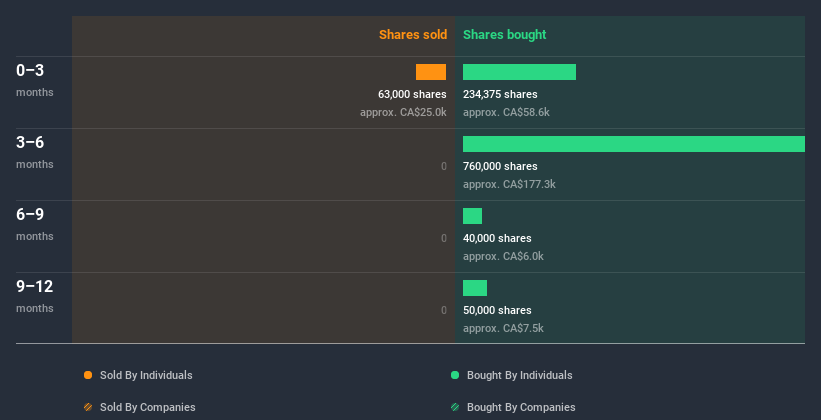

In the last twelve months insiders purchased 1.08m shares for CA$257k. On the other hand they divested 63.00k shares, for CA$26k. In total, Appia Energy insiders bought more than they sold over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Appia Energy is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Appia Energy Insiders Bought Stock Recently

There was some insider buying at Appia Energy over the last quarter. In that period President Anastasios Drivas spent CA$59k on shares. But CFO, Secretary & Director Frank van de Water sold CA$26k worth. It is good to see that insiders have been buying, but they did not buy very many shares, in the scheme of things.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. We usually like to see fairly high levels of insider ownership. Our data suggests Appia Energy insiders own 2.4% of the company, worth about CA$838k. But they may have an indirect interest through a corporate structure that we haven't picked up on. I generally like to see higher levels of ownership.

So What Does This Data Suggest About Appia Energy Insiders?

Insider purchases may have been minimal, in the last three months, but there was no selling at all. The net investment is not enough to encourage us much. On a brighter note, the transactions over the last year are encouraging. While we have no worries about the insider transactions, we'd be more comfortable if they owned more Appia Energy stock. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Be aware that Appia Energy is showing 3 warning signs in our investment analysis, and 1 of those is a bit concerning...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Appia Energy, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:API

Appia Rare Earths & Uranium

Engages in the acquisition, exploration, and development of mineral properties in Canada and Brazil.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)