- Canada

- /

- Metals and Mining

- /

- TSXV:STRR

TSX Penny Stocks To Watch: AmeriTrust Financial Technologies And Two More Hidden Gems

Reviewed by Simply Wall St

The Canadian market has been navigating a complex landscape, with recent economic data showing resilience despite global uncertainties. Amidst these conditions, the concept of penny stocks remains relevant for investors seeking opportunities in smaller or newer companies that can offer significant value. By focusing on those with strong financial foundations and potential for growth, investors can uncover hidden gems that may provide both stability and upside potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.64 | CA$66.74M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.39 | CA$3.26M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.32 | CA$878.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.80 | CA$452.18M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.37 | CA$171.04M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.17 | CA$206M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.71 | CA$8.84M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 409 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

AmeriTrust Financial Technologies (TSXV:AMT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AmeriTrust Financial Technologies Inc. develops, markets, and sells access to cloud-based transaction platforms for financing and leasing new and used vehicles in Canada, with a market cap of CA$43.78 million.

Operations: The company's revenue primarily comes from its Rental & Leasing segment, which generated CA$1.84 million.

Market Cap: CA$43.78M

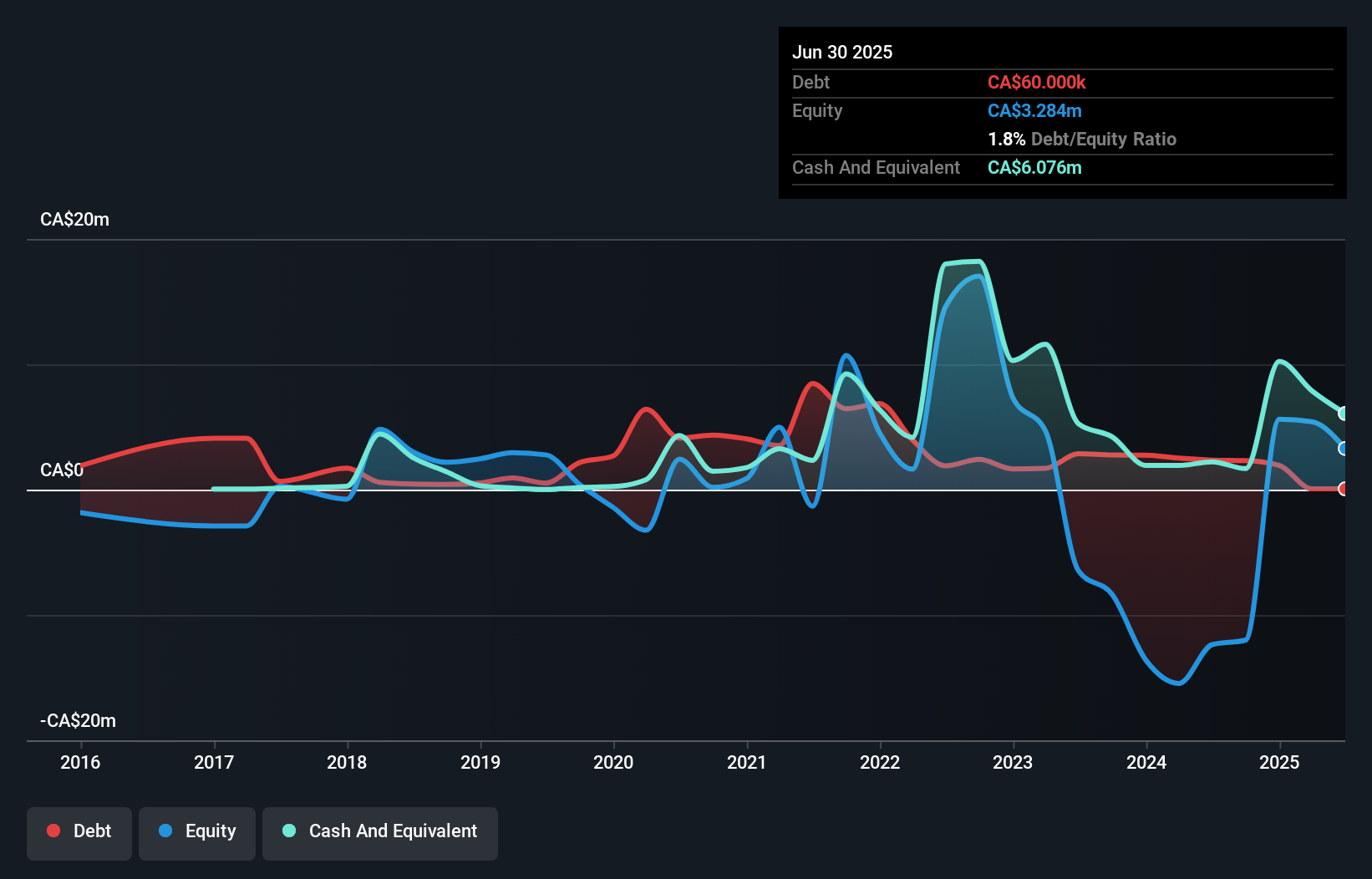

AmeriTrust Financial Technologies Inc., with a market cap of CA$43.78 million, has shown significant financial restructuring by reducing its debt to equity ratio from 169.2% to 1.8% over five years and maintaining more cash than total debt. Despite becoming profitable recently, the company reported a net loss of CA$3.05 million for Q2 2025 and has not generated meaningful revenue, indicating it is pre-revenue. The recent announcement of a debenture offering aims to raise up to CA$60 million, which could provide additional liquidity but also introduces potential dilution risks with new share issuance plans.

- Take a closer look at AmeriTrust Financial Technologies' potential here in our financial health report.

- Explore historical data to track AmeriTrust Financial Technologies' performance over time in our past results report.

Star Royalties (TSXV:STRR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Star Royalties Ltd. is a company engaged in precious metals and decarbonization solutions through royalty and streaming operations, with a market cap of CA$25.16 million.

Operations: The company generates revenue of $0.53 million from its acquisition of royalty interests segment.

Market Cap: CA$25.16M

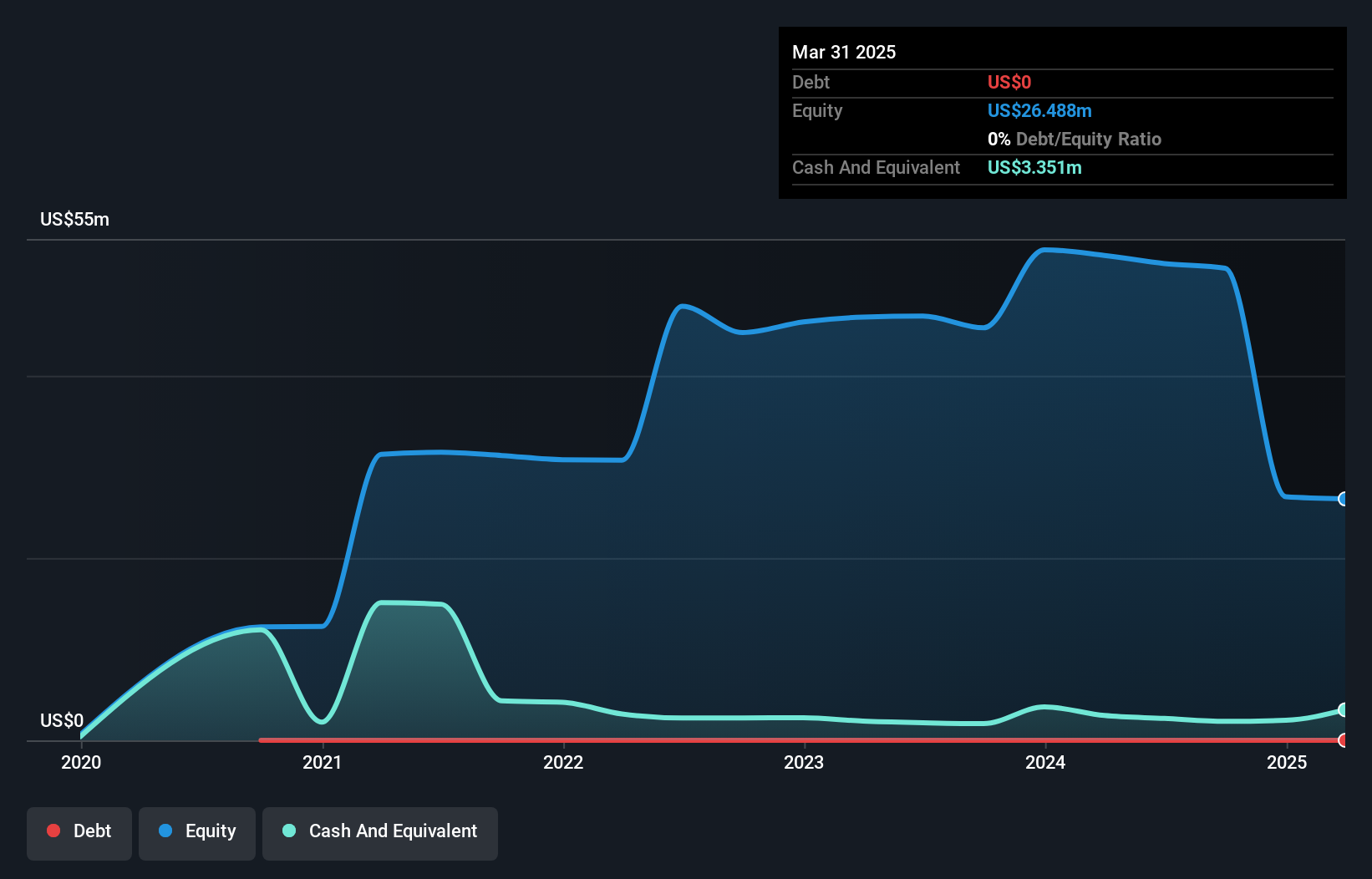

Star Royalties Ltd., with a market cap of CA$25.16 million, operates in the precious metals and decarbonization sectors but is currently pre-revenue, generating only $0.53 million from royalty interests. Despite being debt-free and having a seasoned management team with an average tenure of 5.2 years, the company remains unprofitable, reporting a net loss of US$0.825791 million for Q2 2025. The recent appointment of PricewaterhouseCoopers LLP as auditors could enhance financial oversight, yet the company's negative return on equity and increased losses over five years highlight ongoing challenges in achieving profitability amidst stable weekly volatility at 7%.

- Click to explore a detailed breakdown of our findings in Star Royalties' financial health report.

- Evaluate Star Royalties' historical performance by accessing our past performance report.

Theralase Technologies (TSXV:TLT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Theralase Technologies Inc. is a clinical stage pharmaceutical company focused on the research, development, and commercialization of light activated photodynamic compounds for treating cancers, bacteria, and viruses across Canada, the United States, and internationally, with a market cap of CA$52.70 million.

Operations: The company's revenue is primarily generated from its device segment, totaling CA$1.07 million.

Market Cap: CA$52.7M

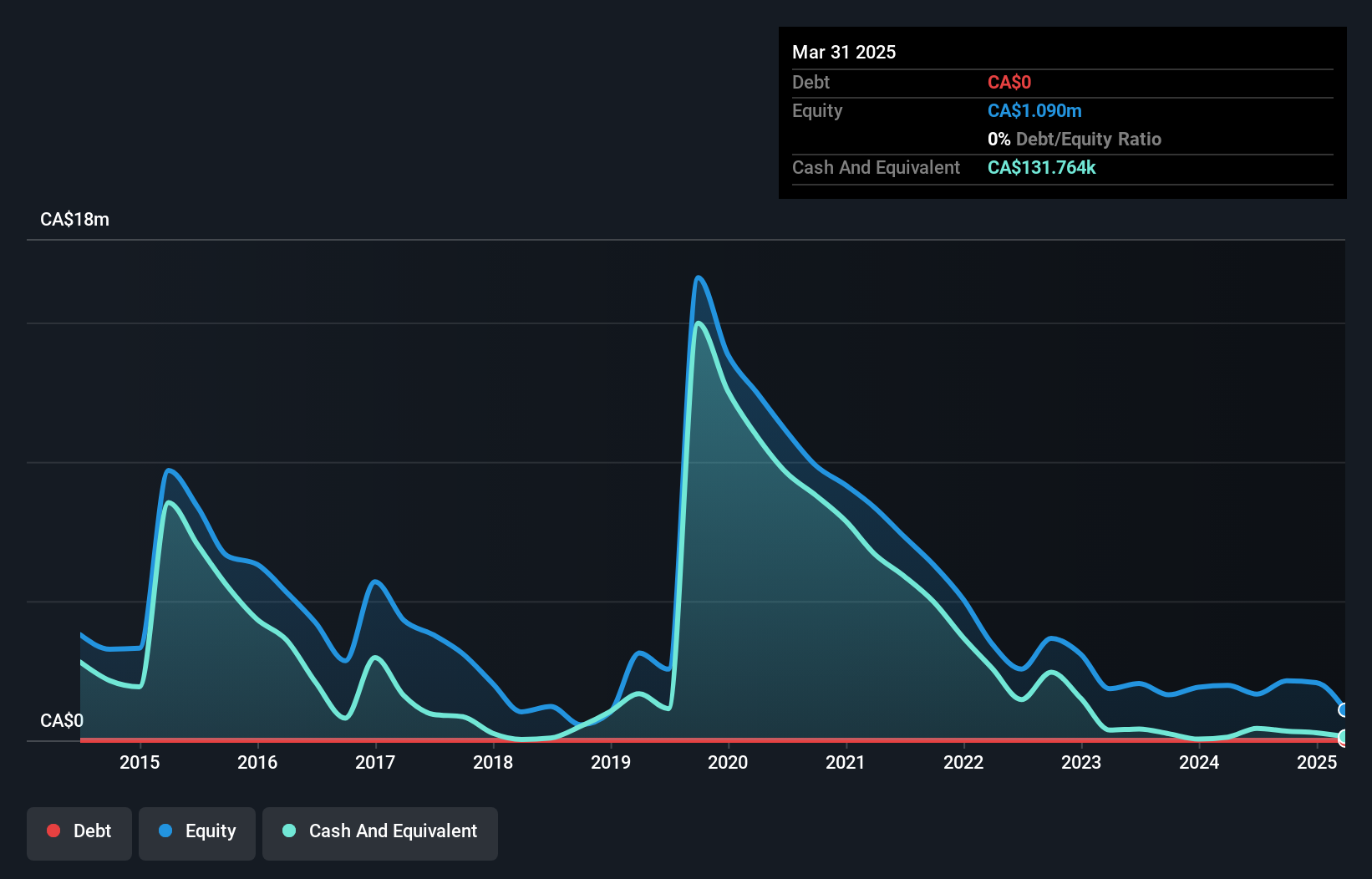

Theralase Technologies Inc., with a market cap of CA$52.70 million, remains pre-revenue, generating CA$1.07 million primarily from its device segment. The company is unprofitable but has reduced losses by 8.6% annually over the past five years and maintains a debt-free status with no shareholder dilution recently. Recent preclinical data highlights the potential of Ruvidar® in treating HSV-1 more effectively than current standards, prompting plans for further clinical studies in 2026. Despite short-term liabilities exceeding assets slightly, Theralase's seasoned management and board may provide stability as it pursues innovative treatments amidst financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Theralase Technologies.

- Understand Theralase Technologies' earnings outlook by examining our growth report.

Next Steps

- Get an in-depth perspective on all 409 TSX Penny Stocks by using our screener here.

- Searching for a Fresh Perspective? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:STRR

Star Royalties

Operates as a precious metals and decarbonization solutions royalty and streaming company.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)