- Canada

- /

- Consumer Finance

- /

- TSX:GSY

Is goeasy Stock Set for a Rebound After 19% Drop Amid Sector Volatility?

Reviewed by Bailey Pemberton

Are you eyeing goeasy stock, trying to decide whether to buy, hold, or sell? If so, you are not alone. Many investors are weighing their options right now, especially after seeing some dramatic price movements lately. The stock has pulled back by nearly 19% in the past month and is down almost 5% over the past year. But take a step back, and the story looks a lot brighter, with a 68% gain over three years and a massive 170% return over the past five years. This volatility can feel like a roller coaster, but it also sparks an important question: is goeasy stock actually undervalued?

Recent market movements may reflect shifting investor sentiment as the financial sector faces changing interest rates and evolving regulatory expectations. While no single news event explains the recent dip, it is clear the market’s outlook on risk has changed for non-bank lenders like goeasy. But digging beneath the surface, has the price gone too far?

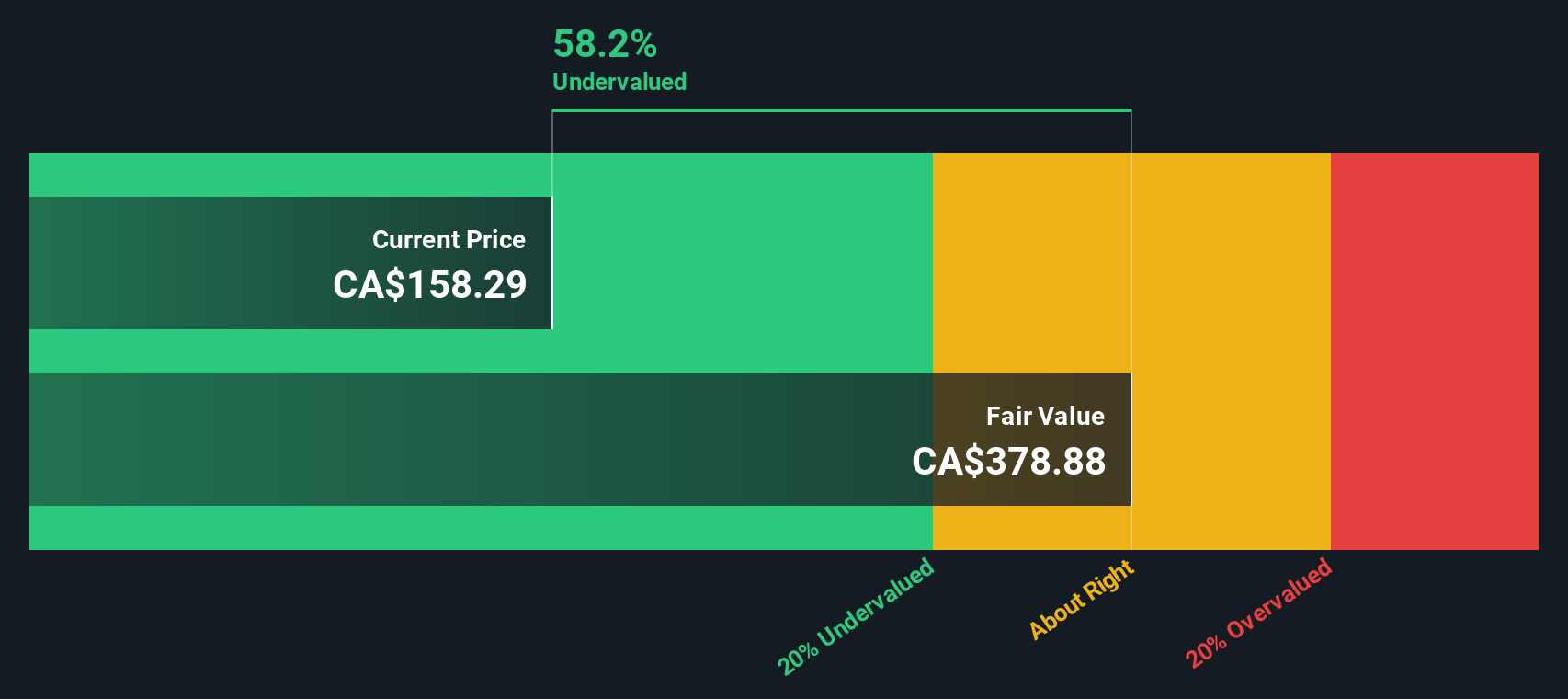

One quick way to gauge value is to look at how many standard valuation tests goeasy passes. Out of 6 widely used checks, it is currently undervalued on all 6, giving it a perfect value score of 6. This is not a score you see every day and it suggests there is more to the story than recent price swings might imply.

Let’s break down exactly how these different valuation approaches stack up for goeasy. And if you want the simplest perspective on value, keep reading as there is an even better shortcut coming up at the end.

Why goeasy is lagging behind its peers

Approach 1: goeasy Excess Returns Analysis

The Excess Returns valuation model focuses on how much profit a company earns on its invested capital, beyond the required rate of return, to evaluate whether the stock is trading below its true worth. This approach measures sustainable profitability, not just headline growth.

For goeasy, the latest data paints a robust picture. The company’s Book Value stands at CA$75.44 per share, with a Stable EPS forecast of CA$23.50 per share, according to weighted future Return on Equity estimates from 8 analysts. The Cost of Equity is calculated at CA$7.82 per share, while the Excess Return is CA$15.68 per share. goeasy’s average Return on Equity is also strong at 24.39%. Analysts project a Stable Book Value of CA$96.37 per share, based on consensus from 7 analyst forecasts.

Based on this Excess Returns methodology, the model estimates that goeasy is currently trading at a 55.7% discount to its intrinsic value. This substantial margin of safety suggests that, even after recent volatility, the market price does not fully reflect goeasy’s ability to generate above-average returns for shareholders.

Result: UNDERVALUED

Our Excess Returns analysis suggests goeasy is undervalued by 55.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: goeasy Price vs Earnings

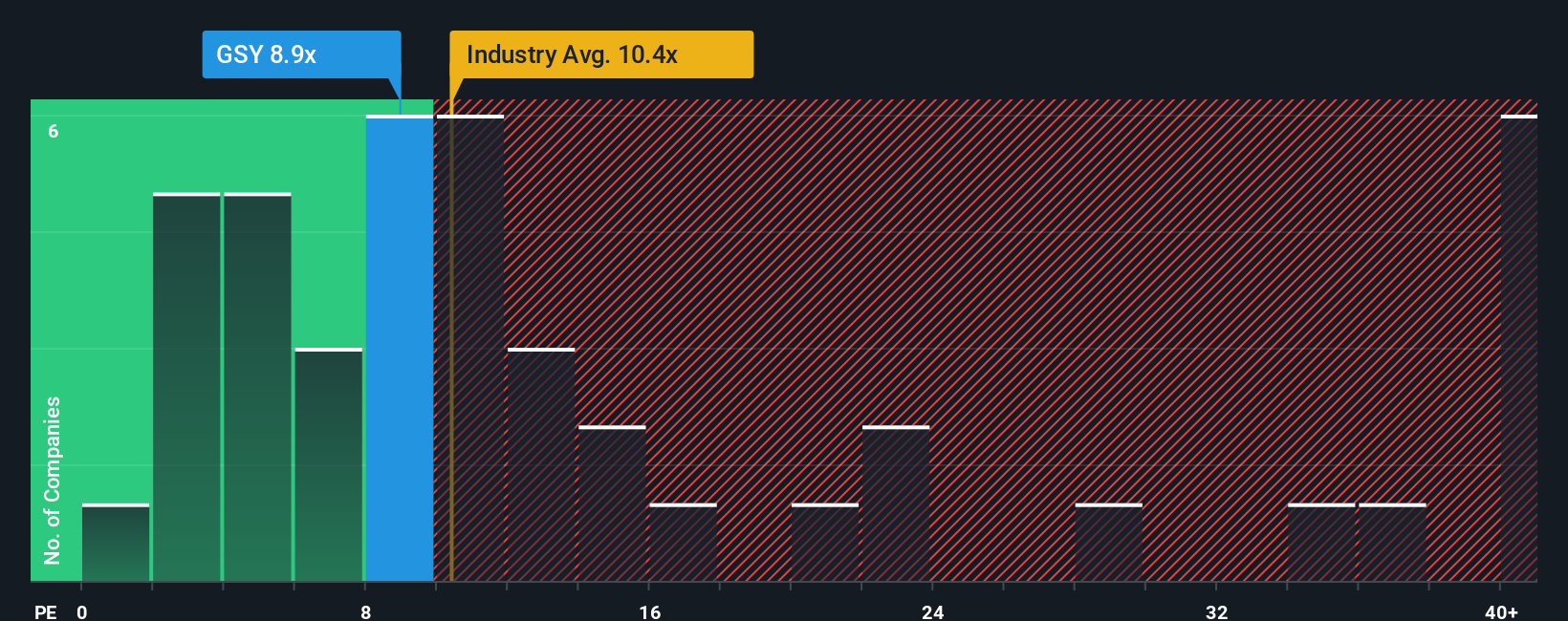

For profitable companies like goeasy, the Price-to-Earnings (PE) ratio is a time-tested way for investors to assess whether a stock is trading at a reasonable price compared to its earnings power. The PE ratio works well in this case because it reflects the market’s confidence in the company’s ability to generate and grow profits over time.

When using the PE ratio, growth expectations and risk profiles are key. Rapidly growing companies or those with more stable earnings understandably command higher PE ratios, while higher perceived risk or slowing growth usually means a lower “fair” PE multiple. So, looking at goeasy’s current PE of 9.5x, how does it stack up?

The wider Consumer Finance industry trades at an average of 13.6x. Similar publicly listed peers command an even higher average of 30.4x. At first glance, goeasy’s current valuation is well below these benchmarks, suggesting a potential bargain. However, industry and peer averages often fail to reflect a company’s specific risks, growth outlook, margins, and size.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair PE Ratio for goeasy is calculated at 21.9x, taking into account its robust earnings growth, risks unique to non-bank lenders, profitability, and market capitalization. Unlike the blunt comparisons to industry and peers, the Fair Ratio builds a more holistic and company-specific benchmark.

Since goeasy trades at 9.5x, significantly below its Fair Ratio of 21.9x, the data clearly suggests the stock is undervalued based on its earnings power.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your goeasy Narrative

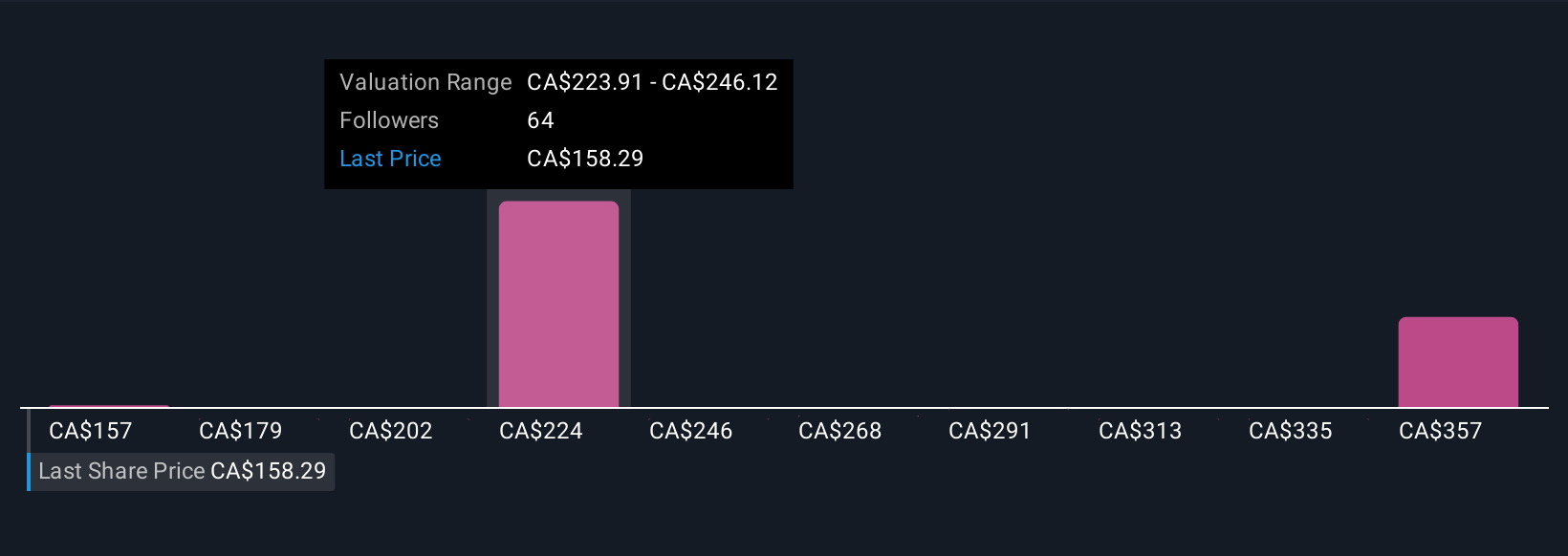

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique perspective on a company, combining the story you believe about its potential with financial forecasts like future revenue, earnings, and fair value estimates. Narratives connect the dots: you interpret goeasy’s journey, translate that into numbers, and instantly see how your view compares to the current share price.

Narratives are designed to make investing more personal and accessible. On Simply Wall St’s platform, millions of investors are already using Narratives in the Community page, sharing insights, exploring bullish or bearish cases, and adjusting their outlooks as new information emerges. Each Narrative is dynamic and updates automatically if goeasy announces earnings or news, so you always have a fresh perspective based on the most recent data.

For example, right now some investors forecast significant revenue growth and margin resilience, valuing goeasy at CA$300 per share. Cautious peers, however, worry about rising credit risk and regulatory pressure, setting their fair value as low as CA$210. Narratives let you compare these perspectives, test your own story, and decide whether the current price aligns with your convictions, helping you make smarter, more confident buy or sell decisions.

Do you think there's more to the story for goeasy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

Exceptional growth potential, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)