- Canada

- /

- Commercial Services

- /

- TSX:EFN

Do These 3 Checks Before Buying Element Fleet Management Corp. (TSE:EFN) For Its Upcoming Dividend

Readers hoping to buy Element Fleet Management Corp. (TSE:EFN) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. You can purchase shares before the 30th of December in order to receive the dividend, which the company will pay on the 15th of January.

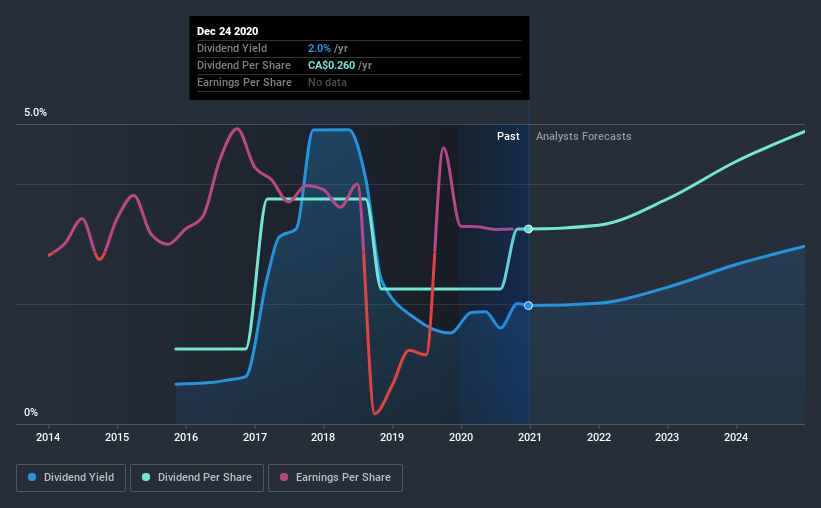

Element Fleet Management's next dividend payment will be CA$0.065 per share. Last year, in total, the company distributed CA$0.26 to shareholders. Calculating the last year's worth of payments shows that Element Fleet Management has a trailing yield of 2.0% on the current share price of CA$13.17. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Element Fleet Management

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Element Fleet Management paid out 164% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance.

When the dividend payout ratio is high, as it is in this case, the dividend is usually at greater risk of being cut in the future.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. Element Fleet Management's earnings per share have fallen at approximately 6.8% a year over the previous five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Element Fleet Management has delivered 21% dividend growth per year on average over the past five years. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. Element Fleet Management is already paying out 164% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

Final Takeaway

Has Element Fleet Management got what it takes to maintain its dividend payments? Not only are earnings per share shrinking, but Element Fleet Management is paying out a disconcertingly high percentage of its profit as dividends. It's not that we hate the business, but we feel that these characeristics are not desirable for investors seeking a reliable dividend stock to own for the long term. Element Fleet Management doesn't appear to have a lot going for it, and we're not inclined to take a risk on owning it for the dividend.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Element Fleet Management. For example, we've found 4 warning signs for Element Fleet Management that we recommend you consider before investing in the business.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Element Fleet Management, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Element Fleet Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:EFN

Element Fleet Management

Operates as a fleet management company primarily in Canada, the United States, Mexico, Australia, and New Zealand.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)