Global's Top Undervalued Small Caps With Insider Activity In April 2025

Reviewed by Simply Wall St

In April 2025, global markets are navigating a complex landscape marked by trade uncertainties and mixed performances across major indices. Notably, smaller-cap indexes like the S&P MidCap 400 and the Russell 2000 have shown resilience, outperforming their larger counterparts amid economic headwinds such as tariff impacts and policy uncertainties. In this environment, identifying promising small-cap stocks often involves looking for those with strong fundamentals and insider activity, which can signal confidence in their potential despite broader market challenges.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.6x | 1.1x | 40.92% | ★★★★★★ |

| Atturra | 26.0x | 1.1x | 42.80% | ★★★★★☆ |

| Dicker Data | 18.6x | 0.6x | -32.90% | ★★★★☆☆ |

| Hansen Technologies | 291.8x | 2.8x | 23.74% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 41.44% | ★★★★☆☆ |

| PWR Holdings | 35.6x | 4.9x | 22.93% | ★★★☆☆☆ |

| Arendals Fossekompani | 20.7x | 1.6x | 48.67% | ★★★☆☆☆ |

| Integral Diagnostics | 147.7x | 1.7x | 44.37% | ★★★☆☆☆ |

| Manawa Energy | NA | 2.7x | 40.62% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 11.1x | 25.43% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

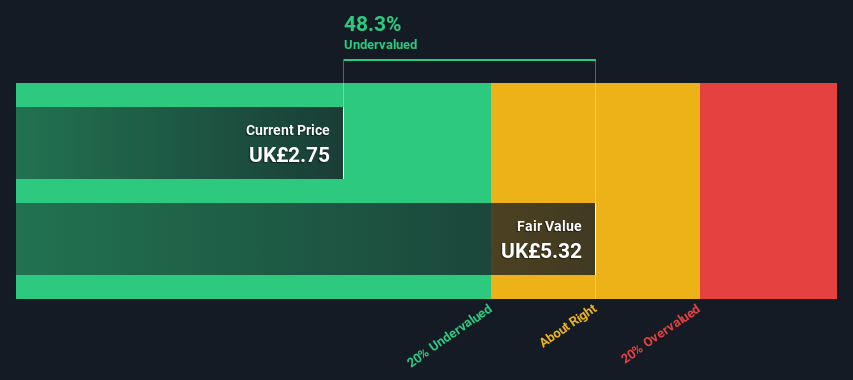

Kitwave Group (AIM:KITW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kitwave Group is a wholesale distributor specializing in ambient, foodservice, and frozen & chilled products with a market cap of £0.24 billion.

Operations: Revenue primarily comes from three segments: Ambient (£223.03 million), Foodservice (£224.82 million), and Frozen & Chilled (£239.87 million). Over recent periods, the gross profit margin has shown an upward trend, reaching 22.27% by October 2024. Operating expenses are a significant cost factor, with general and administrative expenses consistently contributing to this category.

PE: 13.5x

Kitwave Group, a smaller company with potential for growth, recently reported sales of £663.65 million for the year ending October 2024, up from £602.22 million the previous year. Despite a dip in net income to £16.72 million from £18.96 million, insider confidence is evident as an insider purchased 20,000 shares valued at approximately £51,600 in April 2025. The company's proposal to pay a total dividend of 11.30 pence per share underscores its commitment to returning value to shareholders amidst its high debt levels and reliance on external borrowing for funding.

- Dive into the specifics of Kitwave Group here with our thorough valuation report.

Understand Kitwave Group's track record by examining our Past report.

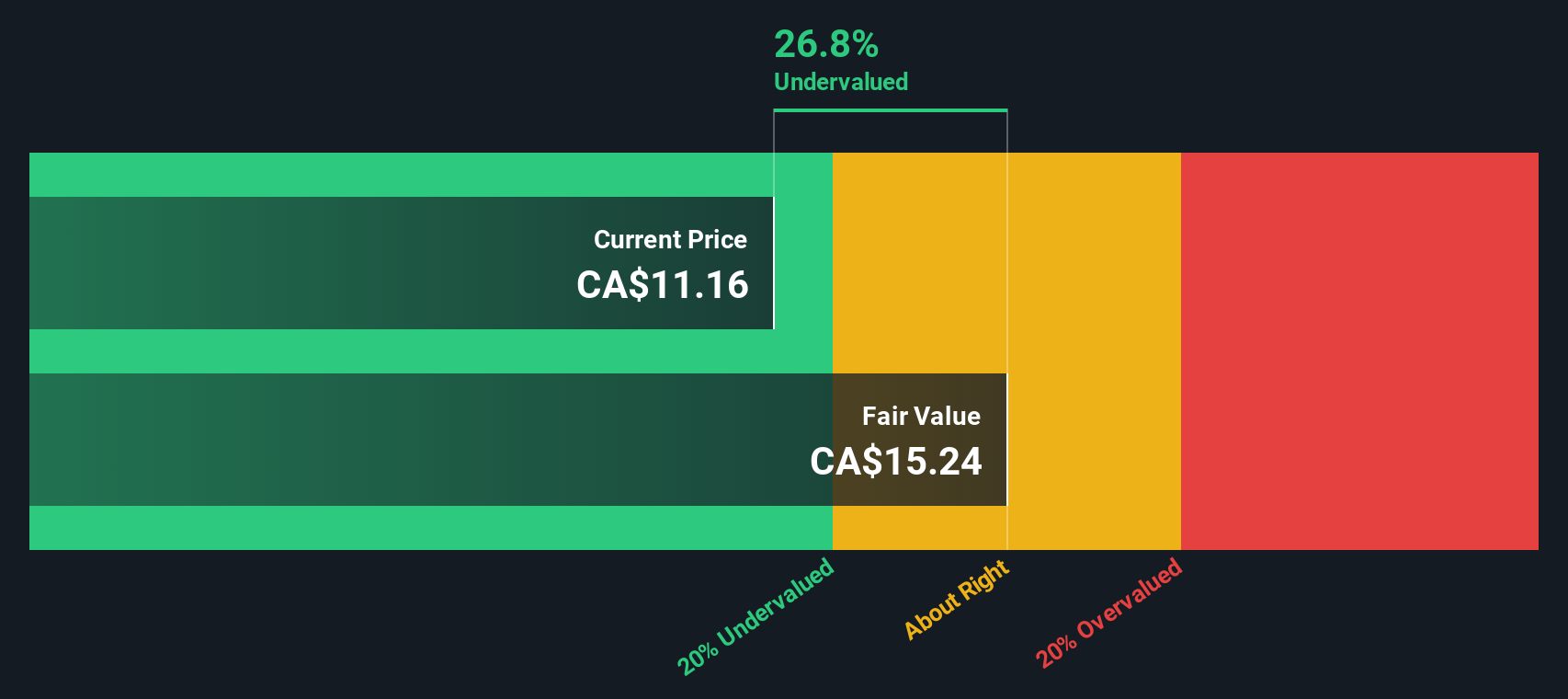

Atrium Mortgage Investment (TSX:AI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Atrium Mortgage Investment is a Canadian company focused on providing residential and commercial mortgage financing, with a market capitalization of approximately CA$0.48 billion.

Operations: The company generates revenue primarily through its mortgage financial services, with recent figures showing CA$58.21 million in revenue. It has a gross profit margin of 85.30%, indicating the effectiveness of its cost management relative to revenue generation. Operating expenses have been consistently low, contributing to a strong net income margin of 82.20%.

PE: 10.6x

Atrium Mortgage Investment, a smaller player in the financial sector, is showing signs of being undervalued despite some challenges. The company has forecasted revenue growth of 20.23% annually but faces high debt levels and relies solely on external borrowing for funding. Insider confidence is evident as Robert Goodall purchased 21,850 shares worth approximately C$250K in early April 2025. Recent dividend affirmations and executive changes add layers to its evolving narrative, with Razvan Vulcu stepping in as interim CFO after John Ahmad's departure.

Savaria (TSX:SIS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Savaria is a company that specializes in manufacturing and distributing products for patient care and accessibility, including adapted vehicles, with a market cap of CA$1.16 billion.

Operations: Savaria generates revenue primarily from its Accessibility segment, which includes adapted vehicles, contributing CA$673.88 million, and its Patient Care segment at CA$193.88 million. The company's gross profit margin has shown an upward trend, reaching 37.07% by the end of 2024.

PE: 24.3x

Savaria, a company in the accessibility and patient care sectors, reported sales of C$867.76 million for 2024, up from C$836.95 million the previous year, with net income rising to C$48.51 million from C$37.84 million. Despite relying on external borrowing for funding, their earnings are expected to grow by 22% annually. Insider confidence is evident through recent share purchases within the last six months, suggesting potential growth aligned with projected revenue of approximately $925 million for 2025.

- Unlock comprehensive insights into our analysis of Savaria stock in this valuation report.

Review our historical performance report to gain insights into Savaria's's past performance.

Key Takeaways

- Click here to access our complete index of 157 Undervalued Global Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Savaria, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SIS

Savaria

Provides accessibility solutions for the elderly and physically challenged people in Canada, the United States, Europe, and internationally.

Established dividend payer and good value.

Market Insights

Community Narratives