- Canada

- /

- Capital Markets

- /

- CNSX:VST

What Can We Learn About Victory Square Technologies' (CSE:VST) CEO Compensation?

This article will reflect on the compensation paid to Shafin Tejani who has served as CEO of Victory Square Technologies Inc. (CSE:VST) since 2015. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Victory Square Technologies

Comparing Victory Square Technologies Inc.'s CEO Compensation With the industry

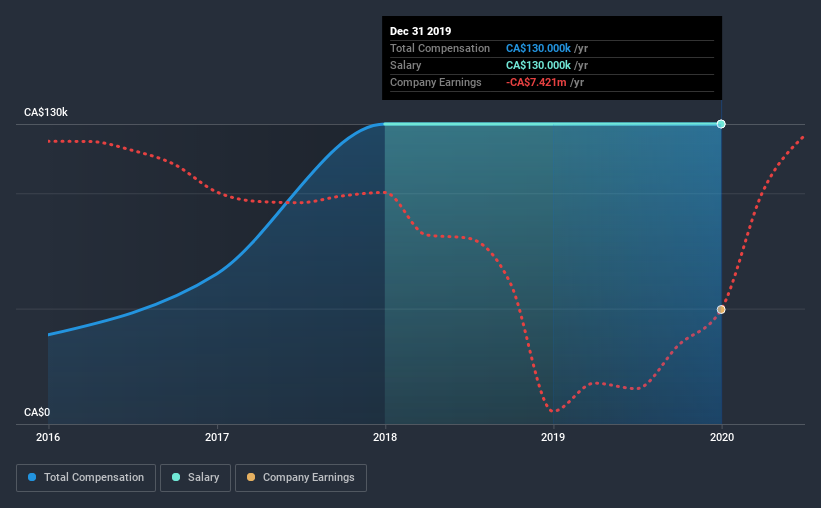

Our data indicates that Victory Square Technologies Inc. has a market capitalization of CA$34m, and total annual CEO compensation was reported as CA$130k for the year to December 2019. That is, the compensation was roughly the same as last year. It is worth noting that the CEO compensation consists entirely of the salary, worth CA$130k.

On comparing similar-sized companies in the industry with market capitalizations below CA$262m, we found that the median total CEO compensation was CA$187k. In other words, Victory Square Technologies pays its CEO lower than the industry median. Moreover, Shafin Tejani also holds CA$330k worth of Victory Square Technologies stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CA$130k | CA$130k | 100% |

| Other | - | - | - |

| Total Compensation | CA$130k | CA$130k | 100% |

On an industry level, roughly 54% of total compensation represents salary and 46% is other remuneration. At the company level, Victory Square Technologies pays Shafin Tejani solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Victory Square Technologies Inc.'s Growth Numbers

Victory Square Technologies Inc. has reduced its earnings per share by 1.4% a year over the last three years. Its revenue is down 25% over the previous year.

Its a bit disappointing to see that the company has failed to grow its EPS. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Victory Square Technologies Inc. Been A Good Investment?

Since shareholders would have lost about 59% over three years, some Victory Square Technologies Inc. investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Victory Square Technologies pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As we touched on above, Victory Square Technologies Inc. is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Over the last three years, shareholder returns have been downright disappointing, and EPSgrowth has been equally disappointing. We can't say the CEO compensation is high, but shareholders will be cold to a bump at this stage, considering negative investor returns.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 7 warning signs (and 2 which can't be ignored) in Victory Square Technologies we think you should know about.

Switching gears from Victory Square Technologies, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Victory Square Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About CNSX:VST

Victory Square Technologies

A private equity and venture capital firm specializing in incubation, acquisition and invests in startups, Early stage and provides the senior leadership and resources needed to growth.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)