Loblaw Companies (TSX:L) Expands Maxi and No Frills Stores Amid Q2 Earnings Decline and Legal Settlement

Reviewed by Simply Wall St

Loblaw Companies(TSX:L) is navigating a dynamic period marked by both opportunities and challenges. Recent highlights include a 10.8% rise in adjusted diluted net earnings per share and the financial impact of a class-action settlement. In the discussion that follows, we will explore Loblaw's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Explore the specifics of Loblaw Companies here with our thorough analysis report.

Strengths: Core Advantages Driving Sustained Success For Loblaw Companies

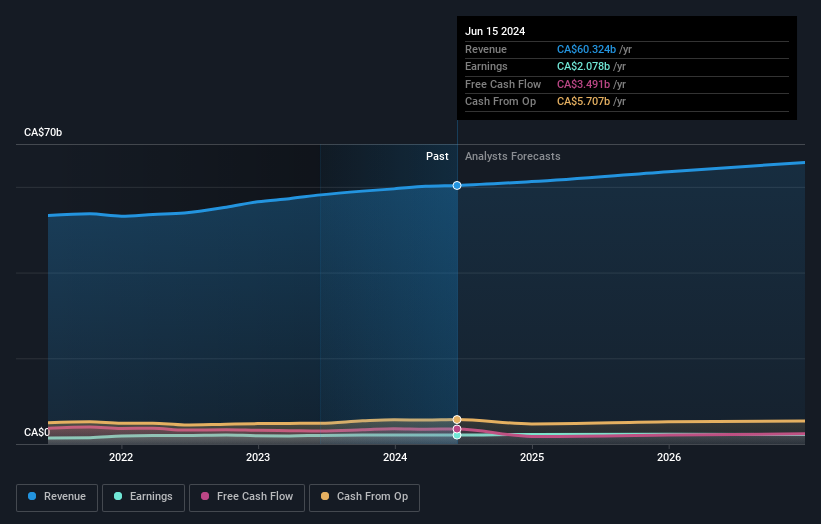

Loblaw Companies has demonstrated solid financial performance, with revenue growing by 1.5% to CAD 13.9 billion and adjusted EBITDA increasing by 4.5% in the latest quarter, as stated by CFO Richard Dufresne. The company also reported a 10.8% rise in adjusted diluted net earnings per share to CAD 2.15. Customer engagement remains strong, with increasing customer visits and recognition for quality and service, as highlighted by CEO Per Bank. Additionally, Loblaw's market share performance has been solid, particularly in food retail, where actual food tonnage increased. The drug retail segment also showed growth, with absolute sales up by 2.4% and same-store sales rising by 1.5%. The company's balance sheet is strong, with an improved credit rating to BBB+ by S&P, reflecting its operating performance's diversity and resilience. It is important to note that Loblaw is considered expensive based on its Price-To-Earnings Ratio (25.9x), which is higher than both the peer average (19.6x) and the North American Consumer Retailing industry average (20.2x), while also trading above the estimated fair value of CA$153.89.

To explore how Loblaw Companies's valuation metrics are shaping its market position, check out our detailed analysis of Loblaw Companies's Valuation.

Weaknesses: Critical Issues Affecting Loblaw Companies's Performance and Areas For Growth

One of the critical weaknesses for Loblaw Companies is the financial impact of a class-action settlement, which resulted in a 10% decline in GAAP net earnings, amounting to CAD 51 million, as noted by CFO Richard Dufresne. Additionally, front store same-store sales declined by 2.4%, following a 5% growth last year. High costs have also been a concern, with the spend rate as a percentage of sales increasing by 60 basis points due to lower operating leverage, real estate activities, and labor costs. Furthermore, the company's earnings growth over the past year (3.5%) is below its 5-year average (18.8% per year). The Return on Equity (ROE) of 19.3% is considered low, and the company's Price-To-Earnings Ratio of 25.9x suggests it is trading above the fair value estimate of CA$153.89.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Loblaw Companies has several growth opportunities, including the planned addition of 20 new Maxi and No Frills stores, which CFO Richard Dufresne mentioned as a strategy to bring more value to communities across the country. The company is also bullish on expanding its pharmacy services, with CEO Per Bank expressing confidence in the new clinics. Online sales present another growth avenue, with a 14.2% increase in the latest quarter, and delivery channels outperforming. Cost management initiatives continue to be a focus, with teams effectively managing expenses. These strategies could enhance Loblaw's market position and capitalize on emerging opportunities, despite the company's earnings forecast to decline by an average of 0.2% per year over the next three years.

To gain deeper insights into Loblaw Companies's historical performance, explore our detailed analysis of past performance.

Threats: Key Risks and Challenges That Could Impact Loblaw Companies's Success

Loblaw Companies faces several threats, including a highly competitive market environment in Canada, as highlighted by CEO Per Bank. The economic shift towards discount shopping continues, with hard discount banners outperforming conventional stores. Regulatory changes also pose a risk, as seen in Nova Scotia, where pharmacy clinics have contributed to a nearly 10% decline in emergency room visits for nonurgent cases. Additionally, the company has a high level of debt, which could impact its financial flexibility. Earnings are forecast to decline by an average of 0.2% per year for the next three years, further adding to the challenges Loblaw faces in maintaining its market position.

Conclusion

Loblaw Companies' solid financial performance, marked by revenue growth and increased customer engagement, underscores its strong market position. However, the company's high Price-To-Earnings Ratio of 25.9x, compared to the peer average of 19.6x and the North American Consumer Retailing industry average of 20.2x, indicates that it is trading above its estimated fair value of CA$153.89. This premium valuation, coupled with challenges such as high costs, declining same-store sales, and a forecasted earnings decline, suggests that while Loblaw has growth opportunities, it must navigate these hurdles to sustain its competitive edge and justify its current market valuation.

- Got skin in the game with Loblaw Companies? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Ready For A Different Approach?

If you're looking to trade Loblaw Companies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:L

Loblaw Companies

A food and pharmacy company, provides grocery, pharmacy and healthcare services, health and beauty products, apparel, general merchandise, financial services, and wireless mobile products and services in Canada and the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives