- Canada

- /

- Food and Staples Retail

- /

- TSX:ATD

Assessing Couche Tard’s Valuation After Recent Expansion of Its Global Store Network

Reviewed by Bailey Pemberton

- If you have been wondering whether Alimentation Couche-Tard is quietly becoming a bargain or just fairly priced after its long run, you are not alone. That is exactly what we are going to unpack.

- The stock has slipped 2.0% over the last week and is still down 9.3% year to date and 11.1% over the last year, but those pullbacks sit against a much stronger 18.4% 3 year and 67.6% 5 year return history.

- Recent headlines have focused on Couche-Tard expanding its global convenience store footprint and deepening partnerships around fuel and alternative energy, moves that shape how investors think about its long term growth runway. Strategic acquisitions and network upgrades tend to support the case for durable cash flows, even if markets temporarily focus on integration risks.

- On our checklist of 6 valuation tests, Couche-Tard scores a solid 5 out of 6, which strongly suggests it screens as undervalued on most metrics. Next we will walk through the usual valuation approaches and then finish with a more complete way of thinking about what the market might really be missing.

Approach 1: Alimentation Couche-Tard Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model projects the cash Alimentation Couche-Tard can generate in the future and then discounts those cash flows back to what they are worth in today’s dollars. It starts from the latest 12 month Free Cash Flow of about $3.1 billion and uses analyst estimates for the next few years, then extends those trends further out using the 2 Stage Free Cash Flow to Equity approach.

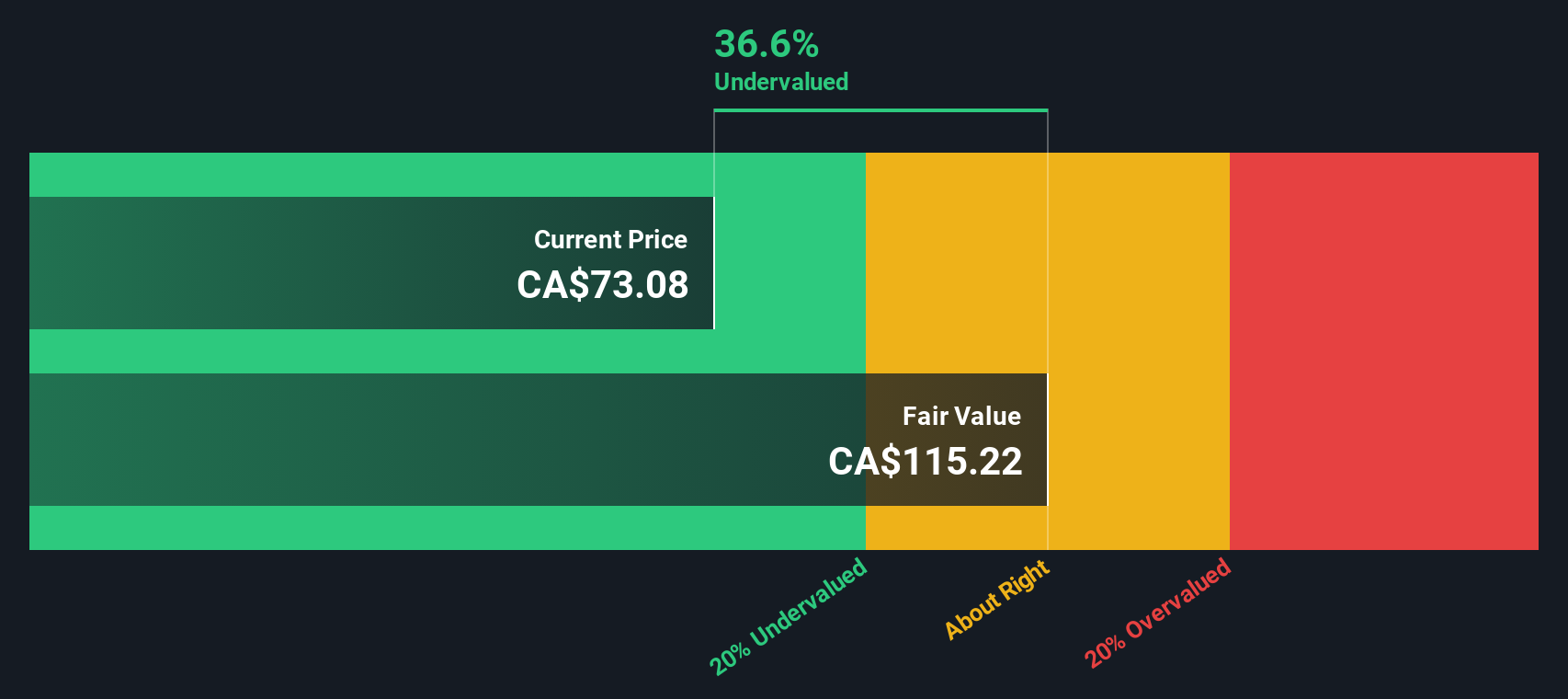

Under this framework, Simply Wall St projects Free Cash Flow rising to roughly $3.7 billion by 2035, with the nearer term analyst forecasts stepping up gradually before slower, more mature growth assumptions are applied. All of these future cash flows are discounted back to the present and summed to arrive at an estimated intrinsic value of about $115.13 per share.

Compared with the current market price, this implies the stock trades at roughly a 37.7% discount to the DCF based valuation. This suggests a potentially meaningful margin of safety for long term investors who are comfortable with the underlying cash flow trajectory.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alimentation Couche-Tard is undervalued by 37.7%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Alimentation Couche-Tard Price vs Earnings

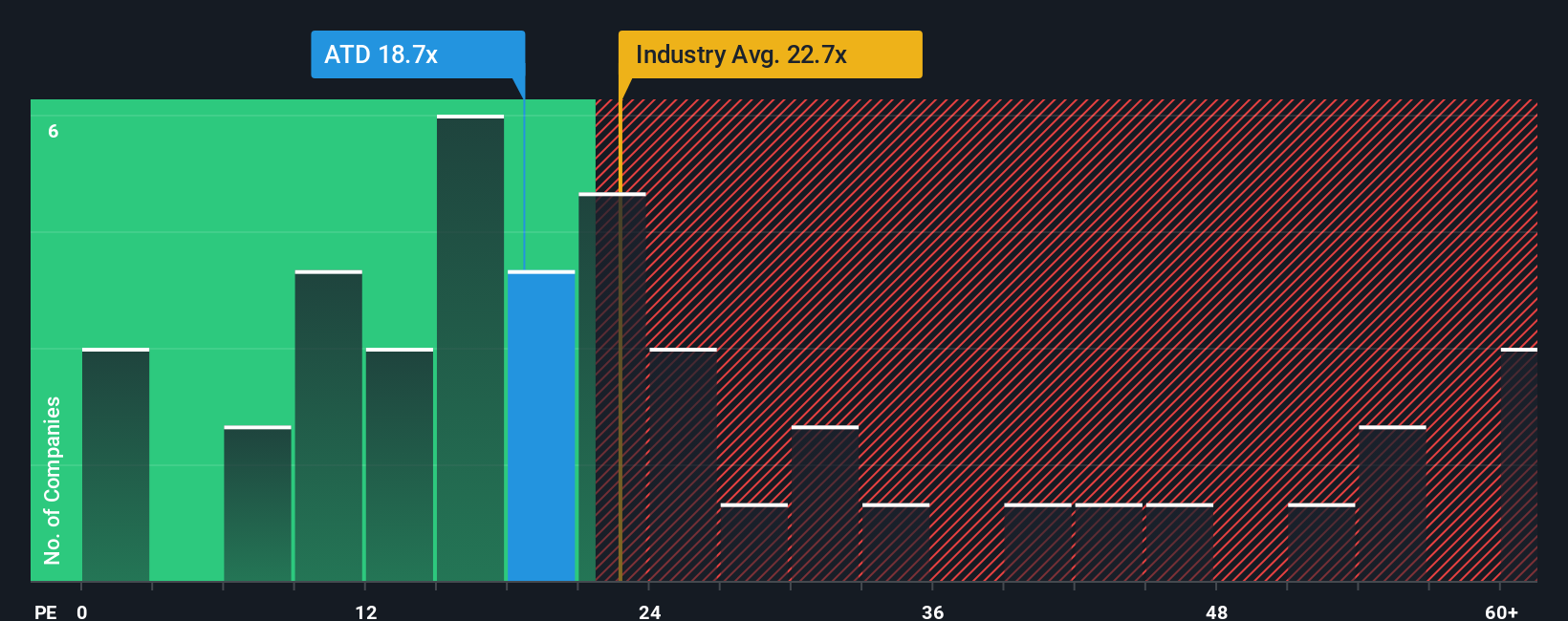

For a mature, consistently profitable business like Alimentation Couche-Tard, the Price to Earnings ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower, more volatile or uncertain earnings streams deserve a lower multiple.

Couche-Tard currently trades on a PE of about 18.5x, modestly above the Consumer Retailing industry average of roughly 17.3x but well below the peer group average near 26.8x. Simply Wall St’s Fair Ratio framework goes a step further, estimating what PE would be appropriate given the company’s specific earnings growth profile, margins, industry, market cap and risk factors. On this basis, Couche-Tard’s Fair Ratio is around 25.7x, implying that, accounting for its fundamentals, the stock deserves to trade closer to premium peers than to the broad sector average.

Since the current 18.5x multiple sits meaningfully below the 25.7x Fair Ratio, the PE lens points to the shares being undervalued rather than fully priced.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alimentation Couche-Tard Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply the stories investors tell about a company that connect their view of its future revenue, earnings and margins to a financial forecast and ultimately to a fair value. On Simply Wall St’s Community page, used by millions of investors, Narratives make this process easy and accessible by guiding you to spell out your assumptions and automatically translating them into forecasts and a Fair Value estimate that you can compare with today’s share price to decide whether ATD looks like a buy, hold or sell. Because Narratives update dynamically when new information arrives, such as news, earnings or changes in estimates, they stay aligned with the latest outlook rather than a one off calculation. For example, one Alimentation Couche-Tard Narrative might assume stronger foodservice growth, resilient margins and a Fair Value closer to about CA$91 per share, while a more cautious Narrative could focus on fuel and tobacco headwinds and land nearer CA$75, illustrating how different, clearly stated perspectives can coexist and help you decide which story you believe.

Do you think there's more to the story for Alimentation Couche-Tard? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATD

Alimentation Couche-Tard

Operates and licenses convenience stores in North America, Europe, and Asia.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)