Examining Canada Goose Shares After 42% Rally and CEO’s New Strategic Plan in 2025

Reviewed by Bailey Pemberton

If you have been eyeing Canada Goose Holdings, you are likely wondering if now is finally the moment to dive in or time to stay on the sidelines. There is no denying the renewed energy in the share price lately, with the stock climbing 8.5% over the past week and a hefty 12.5% over the last month. For anyone who has weathered the ups and downs, the year-to-date gain of 42.3% feels like vindication, even after a drop of more than 56% from five years ago and a still-negative three-year total return.

Much of this momentum can be traced to recent optimism in the luxury apparel market and shifting sentiment among growth investors. While global market conditions have thrown curveballs at premium brands, Canada Goose seems to be regaining investor confidence, at least in the short term. Still, with a current value score of 0 out of 6, traditional valuation metrics do not see the company as undervalued in any major way right now. This is a fact worth digesting as you weigh your next move.

This begs a closer look at how the market is pricing Canada Goose today and which pieces of the valuation puzzle matter most. Let’s walk through the key valuation methods and what they reveal. Then we will explore a better take on value that is often overlooked.

Canada Goose Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Canada Goose Holdings Discounted Cash Flow (DCF) Analysis

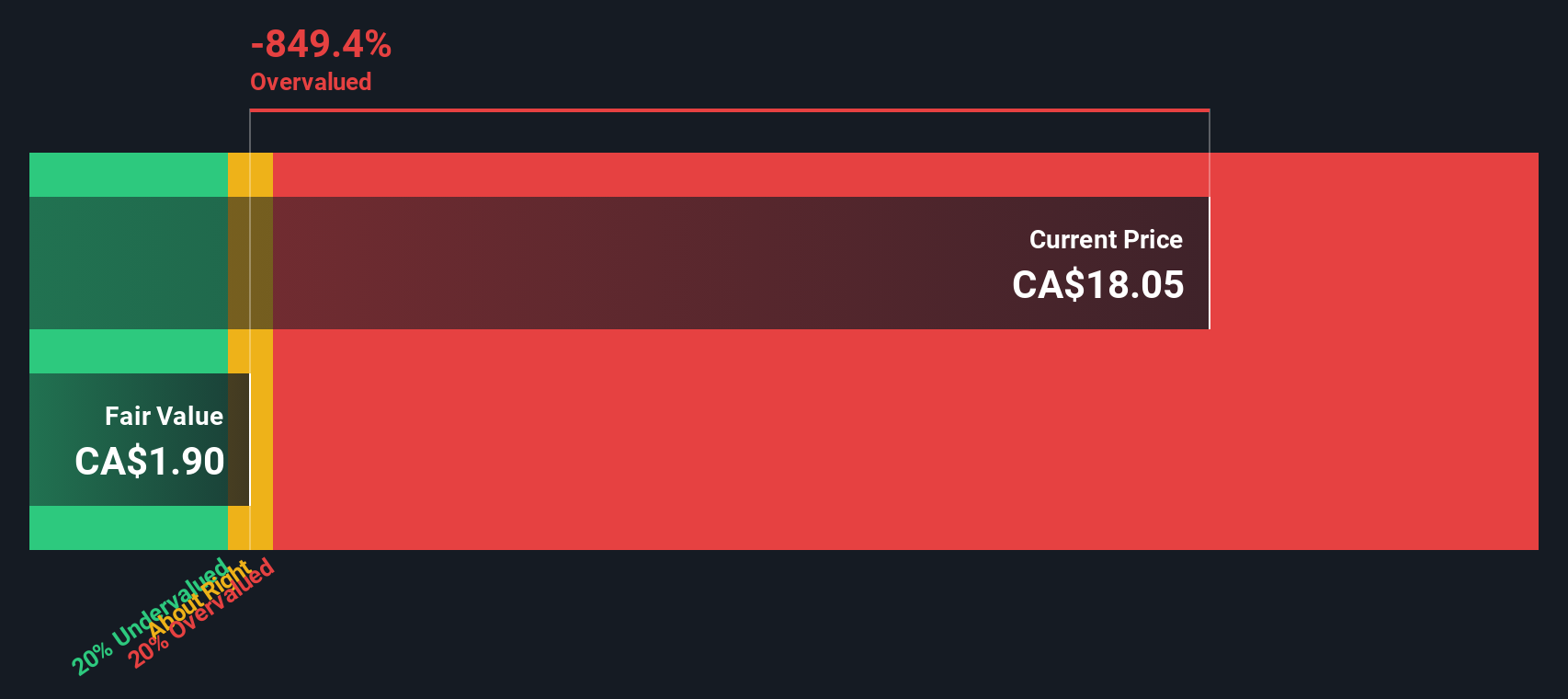

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to today’s value. For Canada Goose Holdings, this approach uses the 2 Stage Free Cash Flow to Equity model, which starts with analyst forecasts for the first five years and then applies longer-term assumptions beyond those estimates.

Currently, Canada Goose reports a trailing twelve months Free Cash Flow (FCF) of CA$251.2 Million. Analyst consensus projects FCF of CA$122.4 Million by 2026 and CA$84.4 Million by 2027, with projections dropping sharply to CA$0 from 2028 onward based on available data. These estimates suggest significant uncertainty around the company’s ability to generate consistent cash flows over the next decade.

Based on these future cash flow projections, the DCF model calculates an intrinsic value of CA$1.90 per share. Compared to the current market price, this indicates the stock trades at a hefty 971.3% premium to its calculated fair value. According to this metric, Canada Goose Holdings appears significantly overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Canada Goose Holdings may be overvalued by 971.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Canada Goose Holdings Price vs Earnings

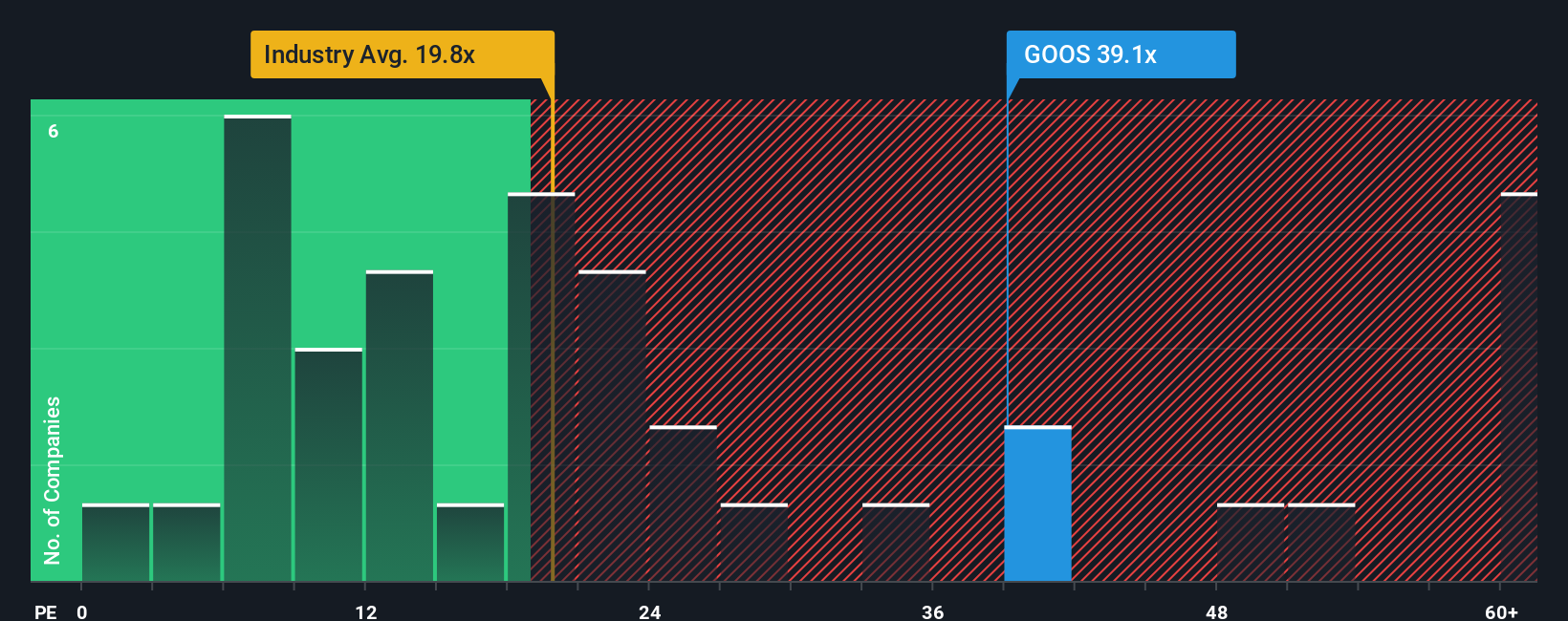

The Price-to-Earnings (PE) ratio is a go-to valuation tool for profitable companies because it links the stock price to actual earnings power. For established brands like Canada Goose Holdings, the PE ratio provides a clear picture of how much investors are willing to pay for each dollar of earnings. Naturally, companies with higher growth prospects or lower perceived risks often justify a higher PE ratio, while those with less certain futures or more volatile results may be valued at a discount.

At present, Canada Goose has a PE ratio of 42.1x, which is well above both the luxury industry average of 18.7x and the peer group average of 28.5x. This indicates investors are pricing in elevated expectations for growth and profitability, or perhaps are less concerned about near-term risks compared to the broader sector.

Simply Wall St calculates a proprietary Fair Ratio for Canada Goose at 17.7x, tailored specifically to factors impacting the company such as its earnings growth projections, industry position, profit margins, size, and risk profile. Unlike straightforward peer or industry comparisons, the Fair Ratio adapts to the nuances of each business, providing a more holistic benchmark for fair value. With Canada Goose’s actual PE at 42.1x compared to the Fair Ratio of 17.7x, the valuation appears meaningfully stretched by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Canada Goose Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is the story behind an investment, your perspective on where a company is heading, supported by your real-world assumptions about its future revenue, profits, margins, and the fair value you think is justified for the stock.

Rather than relying solely on static metrics, Narratives link a company's story to a forward-looking financial forecast, which is then translated into an estimated fair value. This approach is easy to access and use on Simply Wall St's platform, where millions of investors share, compare, and refine Narratives within the Community page.

Narratives empower investors to make smarter, more dynamic decisions. When you compare your Narrative's Fair Value to the actual market price, it is easier to see whether it is time to buy, sell, or simply hold. Plus, as new information emerges, such as earnings releases or breaking news, Narratives update automatically, ensuring your view of fair value keeps pace with reality.

For Canada Goose Holdings, for example, investor Narratives currently range widely, from bullish scenarios projecting expansion in North America and China and valuing shares as high as CA$28.00, to far more cautious views focusing on luxury market headwinds and valuing shares closer to CA$14.00.

Do you think there's more to the story for Canada Goose Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GOOS

Canada Goose Holdings

Designs, manufactures, and sells performance luxury outerwear, apparel, footwear, and accessories for men, women, youth, children, and babies.

Mediocre balance sheet with poor track record.

Similar Companies

Market Insights

Community Narratives