- Canada

- /

- Commercial Services

- /

- TSXV:VTX

Further Upside For Vertex Resource Group Ltd. (CVE:VTX) Shares Could Introduce Price Risks After 33% Bounce

Vertex Resource Group Ltd. (CVE:VTX) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

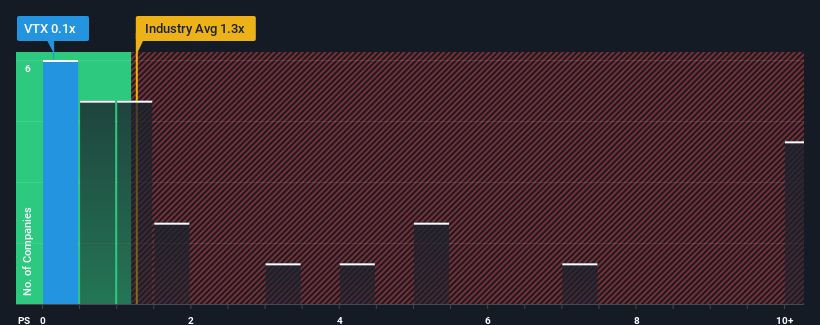

Even after such a large jump in price, given about half the companies operating in Canada's Commercial Services industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Vertex Resource Group as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 2 warning signs investors should be aware of before investing in Vertex Resource Group. Read for free now.View our latest analysis for Vertex Resource Group

What Does Vertex Resource Group's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Vertex Resource Group's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vertex Resource Group.Is There Any Revenue Growth Forecasted For Vertex Resource Group?

The only time you'd be truly comfortable seeing a P/S as low as Vertex Resource Group's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.0%. Even so, admirably revenue has lifted 44% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 5.1% as estimated by the one analyst watching the company. This is still shaping up to be materially better than the broader industry which is also set to decline 16%.

With this in mind, we find it curious but not unexplainable that Vertex Resource Group's P/S falls short of its industry peers. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares excessively.

What We Can Learn From Vertex Resource Group's P/S?

The latest share price surge wasn't enough to lift Vertex Resource Group's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Vertex Resource Group's analyst forecasts revealed that its P/S ratio is lower than expected, given it's set to outperform the broader industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the more attractive outlook. Perhaps there is some hesitation about the company's ability to keep resisting the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally constitute a higher P/S and thus share price.

Before you take the next step, you should know about the 2 warning signs for Vertex Resource Group that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:VTX

Vertex Resource Group

Provides environmental and industrial services in Canada and the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)