- Canada

- /

- Commercial Services

- /

- TSX:EFN

Here's Why We Think Element Fleet Management (TSE:EFN) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Element Fleet Management (TSE:EFN). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Element Fleet Management's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Element Fleet Management managed to grow EPS by 16% per year, over three years. That's a pretty good rate, if the company can sustain it.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Element Fleet Management's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Element Fleet Management maintained stable EBIT margins over the last year, all while growing revenue 7.1% to US$1.7b. That's encouraging news for the company!

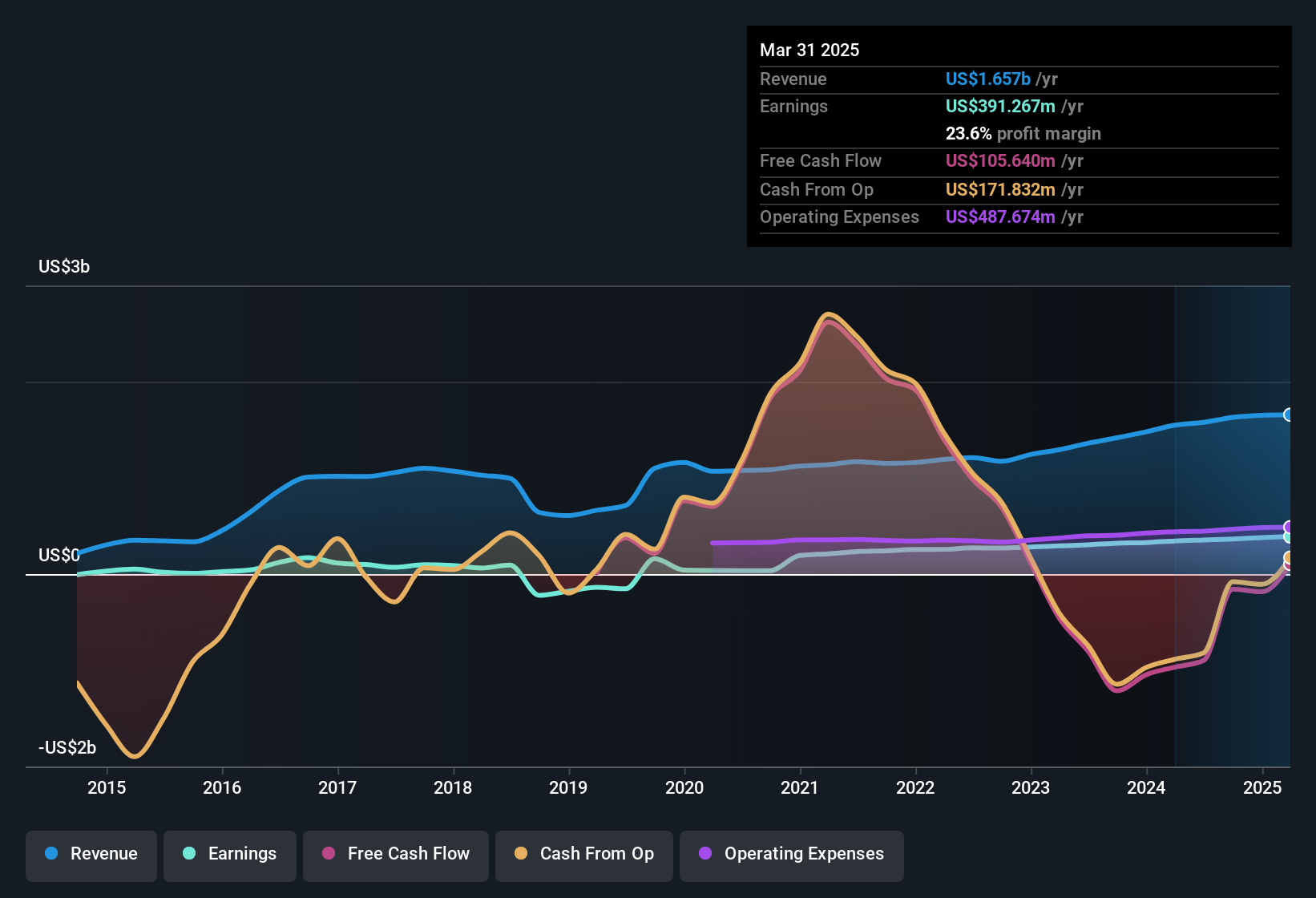

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

View our latest analysis for Element Fleet Management

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Element Fleet Management's future profits.

Are Element Fleet Management Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold US$1.1m worth of shares. But that's far less than the US$2.7m insiders spent purchasing stock. We find this encouraging because it suggests they are optimistic about Element Fleet Management'sfuture. Zooming in, we can see that the biggest insider purchase was by CEO, President & Director Laura Dottori-Attanasio for CA$500k worth of shares, at about CA$27.78 per share.

Along with the insider buying, another encouraging sign for Element Fleet Management is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$25m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.2%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because Element Fleet Management's CEO, Laura Dottori-Attanasio, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations over US$8.0b, like Element Fleet Management, the median CEO pay is around US$7.5m.

Element Fleet Management's CEO took home a total compensation package worth US$5.2m in the year leading up to December 2024. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Element Fleet Management To Your Watchlist?

One important encouraging feature of Element Fleet Management is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Element Fleet Management (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

Keen growth investors love to see insider activity. Thankfully, Element Fleet Management isn't the only one. You can see a a curated list of Canadian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Element Fleet Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:EFN

Element Fleet Management

Operates as a fleet management company primarily in Canada, the United States, Mexico, Australia, and New Zealand.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives