- Canada

- /

- Capital Markets

- /

- TSXV:AIVC

TSX Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

As the Canadian market navigates the complexities of potential tariff impacts, investors are reminded of the importance of diversification and strategic portfolio management. Despite uncertainties, there remains a supportive economic backdrop with above-trend growth and rising corporate profits. In this context, penny stocks—often representing smaller or newer companies—continue to present intriguing opportunities for those seeking value and growth potential in under-the-radar investments.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.985 | CA$182.79M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.57 | CA$1.02B | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.73 | CA$441.37M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.45 | CA$124.55M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.41 | CA$235.26M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.51 | CA$14.61M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.6M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.86 | CA$397.63M | ★★★★★☆ |

Click here to see the full list of 943 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Caldwell Partners International (TSX:CWL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Caldwell Partners International Inc., along with its subsidiaries, offers candidate research and sourcing services across Canada, the United States, the United Kingdom, and other European countries, with a market cap of CA$28.97 million.

Operations: Caldwell Partners International generates revenue primarily from its Caldwell segment, contributing CA$78.89 million, and its IQTalent segment, which adds CA$11.28 million.

Market Cap: CA$28.97M

Caldwell Partners International, with a market cap of CA$28.97 million, has recently shown profitability after years of declining earnings. The company reported first-quarter revenue of CA$21.36 million, an increase from the previous year, although net income decreased to CA$0.465 million from CA$3.78 million due to various factors impacting margins. Despite low return on equity at 2.6%, Caldwell remains debt-free and has stable short-term financials with assets exceeding liabilities significantly. Recent strategic hires in its industrial recruiting segment may enhance growth prospects as it navigates the competitive professional services landscape in Canada and beyond.

- Jump into the full analysis health report here for a deeper understanding of Caldwell Partners International.

- Understand Caldwell Partners International's track record by examining our performance history report.

D-BOX Technologies (TSX:DBO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: D-BOX Technologies Inc. designs, manufactures, and commercializes motion systems for the entertainment and simulation, and training markets globally, with a market cap of CA$31.06 million.

Operations: The company's revenue is derived from three segments: Entertainment (CA$21.92 million), Simulation and Training (CA$8.05 million), and Rights for Use, Rental and Maintenance (CA$9.17 million).

Market Cap: CA$31.06M

D-BOX Technologies, with a market cap of CA$31.06 million, has demonstrated significant earnings growth of 196.9% over the past year, surpassing its five-year average growth rate. The company maintains a strong financial position with more cash than total debt and short-term assets exceeding both long-term and short-term liabilities. Recent expansion in Germany highlights strategic growth in the European market, doubling cinema screens to 200 over six years. Despite high volatility in share price, D-BOX's earnings are well-covered by operating cash flow and interest payments, supporting its ongoing innovation and market development initiatives globally.

- Take a closer look at D-BOX Technologies' potential here in our financial health report.

- Learn about D-BOX Technologies' historical performance here.

AI Artificial Intelligence Ventures (TSXV:AIVC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AI Artificial Intelligence Ventures Inc. is a venture capital and private equity firm focused on seed/startups, early stage, and growth capital investments, with a market cap of CA$14.25 million.

Operations: AI Artificial Intelligence Ventures Inc. reported no classified revenue segments in its financial disclosures.

Market Cap: CA$14.25M

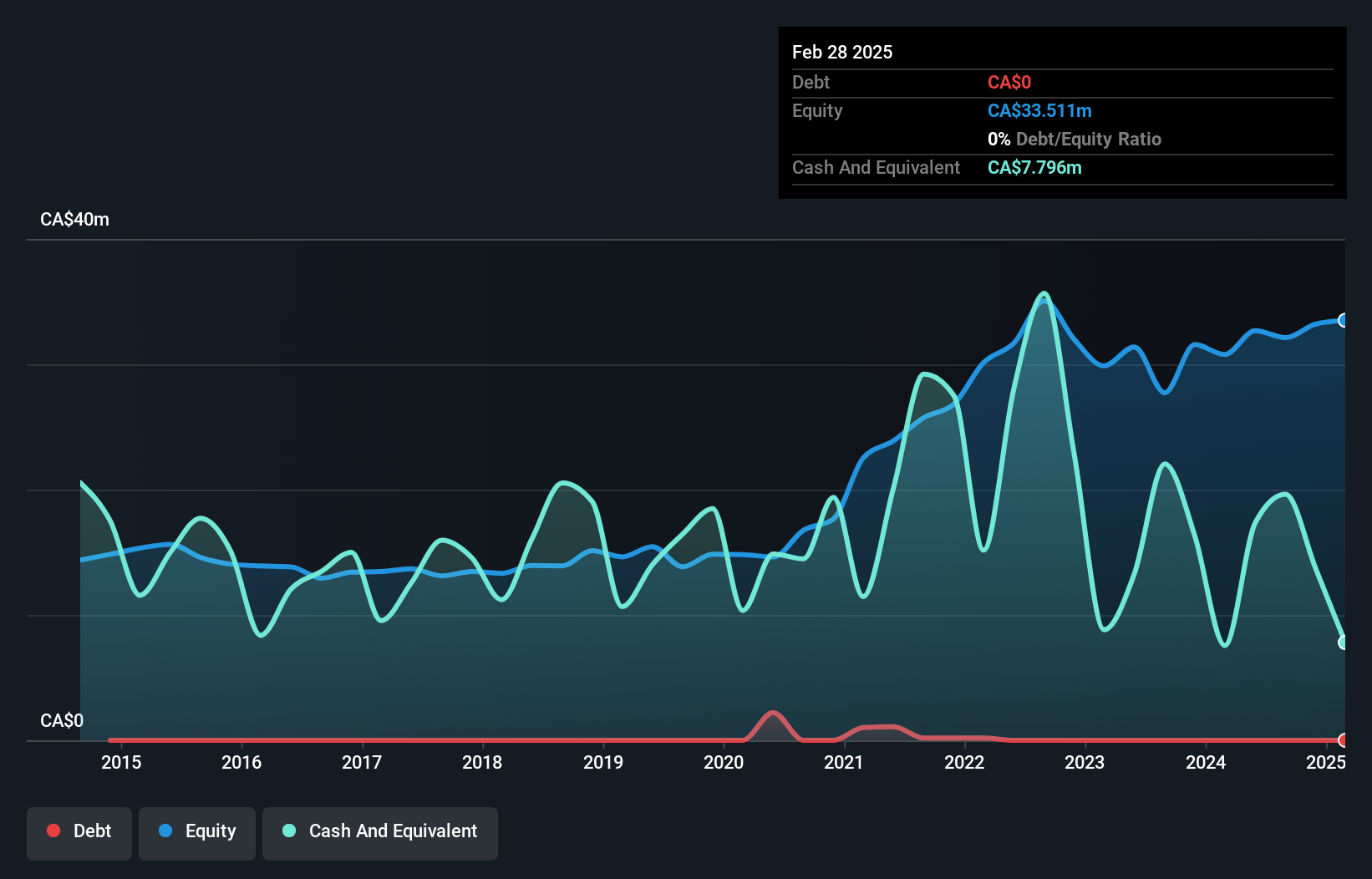

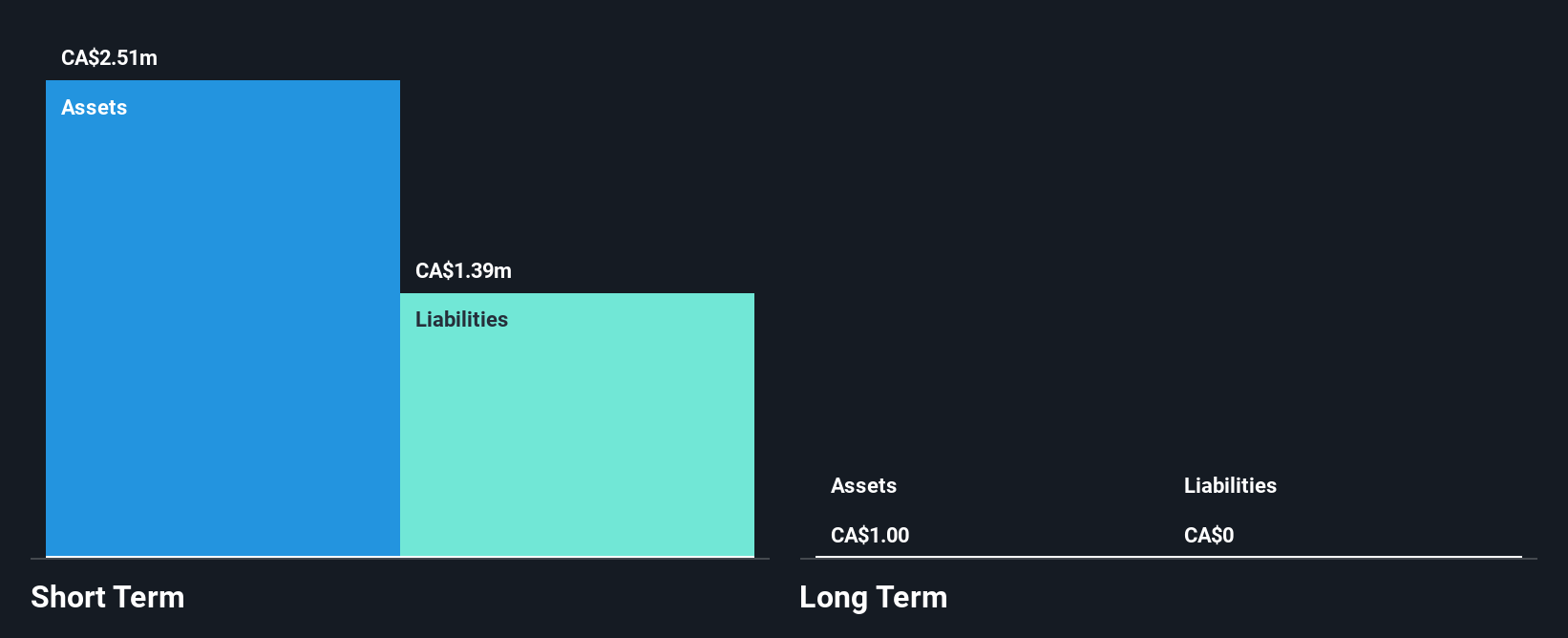

AI Artificial Intelligence Ventures Inc., with a market cap of CA$14.25 million, is currently pre-revenue, reporting negative revenues and net losses for the recent quarter and full year. Despite having more cash than total debt and covering short-term liabilities with assets, the company faces challenges including increased debt-to-equity ratio over five years and auditor concerns about its ability to continue as a going concern. The management team is experienced, averaging 5.3 years in tenure, while the board has an average tenure of four years. Weekly volatility has improved recently but remains a factor to consider for investors.

- Get an in-depth perspective on AI Artificial Intelligence Ventures' performance by reading our balance sheet health report here.

- Gain insights into AI Artificial Intelligence Ventures' historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Discover the full array of 943 TSX Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AIVC

AI Artificial Intelligence Ventures

AI Artificial Intelligence Ventures Inc. formerly known as ESG Global Impact Capital Inc., is a venture capital, private equity and venture debt firm specializing in seed/startups, early stage, growth capital, debt and equity investing.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)