- Canada

- /

- Industrial REITs

- /

- TSX:NXR.UN

Black Diamond Group And 2 Other Undervalued Small Caps With Insider Buying On TSX

Reviewed by Simply Wall St

As the Canadian market heads into 2025 with strong momentum, investors are keeping an eye on potential curveballs that could impact their portfolios. Amidst this backdrop, small-cap stocks on the TSX present intriguing opportunities, particularly those trading at valuations in line with or below their historical averages, offering a chance to capitalize on sectors that have been overlooked during the recent bull market.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Sagicor Financial | 1.2x | 0.3x | 33.86% | ★★★★★★ |

| Calfrac Well Services | 12.1x | 0.2x | 34.25% | ★★★★★☆ |

| Nexus Industrial REIT | 13.0x | 3.3x | 25.69% | ★★★★★☆ |

| Trican Well Service | 8.3x | 1.0x | 14.42% | ★★★★☆☆ |

| Parex Resources | 4.0x | 0.9x | 13.40% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 13.0x | 3.5x | 44.61% | ★★★★☆☆ |

| Hemisphere Energy | 6.1x | 2.3x | -127.78% | ★★★☆☆☆ |

| First National Financial | 14.8x | 4.2x | 37.78% | ★★★☆☆☆ |

| Coveo Solutions | NA | 3.9x | 34.44% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 2.4x | -206.87% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

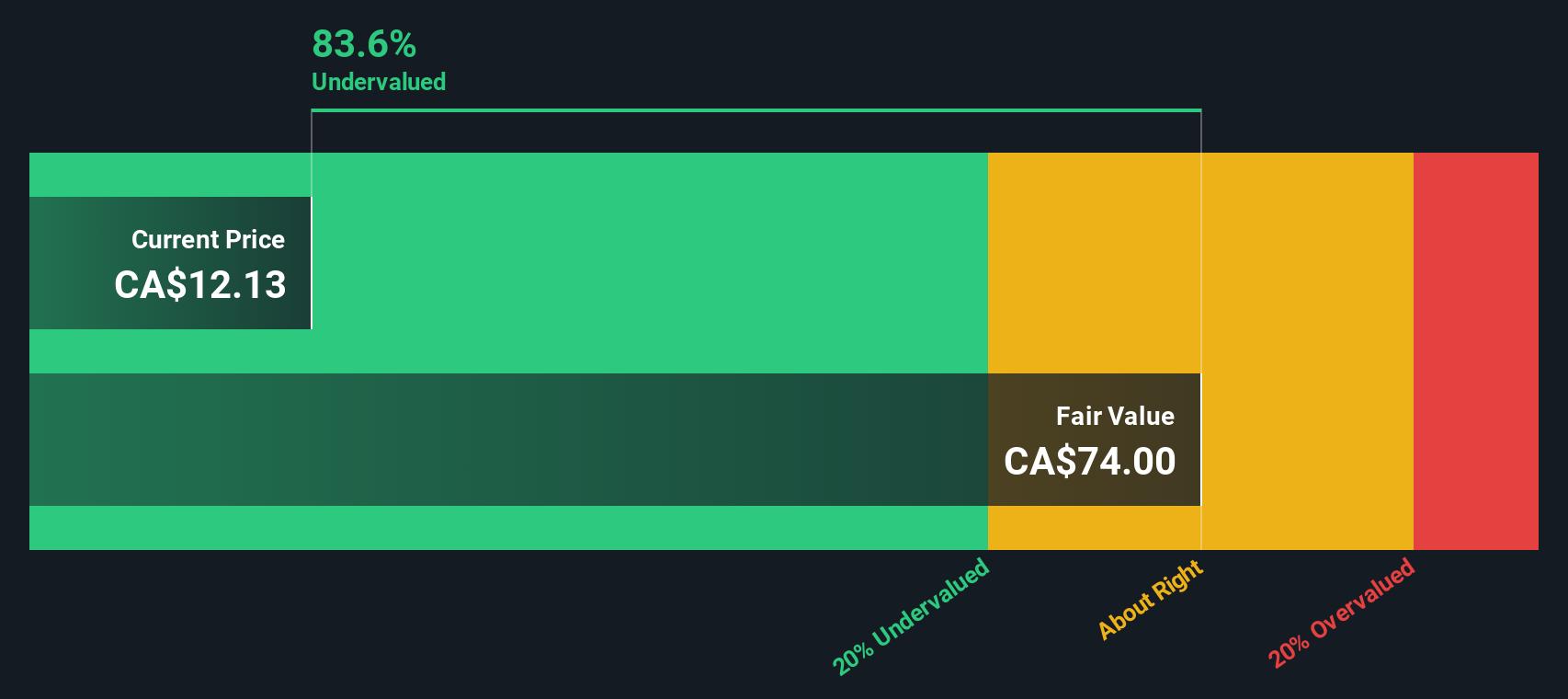

Black Diamond Group (TSX:BDI)

Simply Wall St Value Rating: ★★★★★★

Overview: Black Diamond Group specializes in providing workforce accommodation and modular space solutions, with a market cap of CA$0.44 billion.

Operations: The company's revenue is primarily derived from Workforce Solutions and Modular Space Solutions, with recent figures showing a gross profit margin of 46.06%. Over the analyzed periods, the company experienced fluctuations in net income margin, reaching as high as 8.45% but also recording negative margins in earlier years. Operating expenses have consistently been a significant portion of costs, impacting overall profitability.

PE: 22.2x

Black Diamond Group, a small Canadian company, recently reported third-quarter sales of C$101.19 million, down from C$117.52 million the previous year, with net income falling to C$7.37 million from C$13.56 million. Despite high debt levels and reliance on external borrowing, insider confidence is evident through recent share purchases by executives in the past quarter. The company forecasts earnings growth of 24% annually and increased its quarterly dividend by 17%, signaling potential future value for investors seeking growth opportunities in smaller markets.

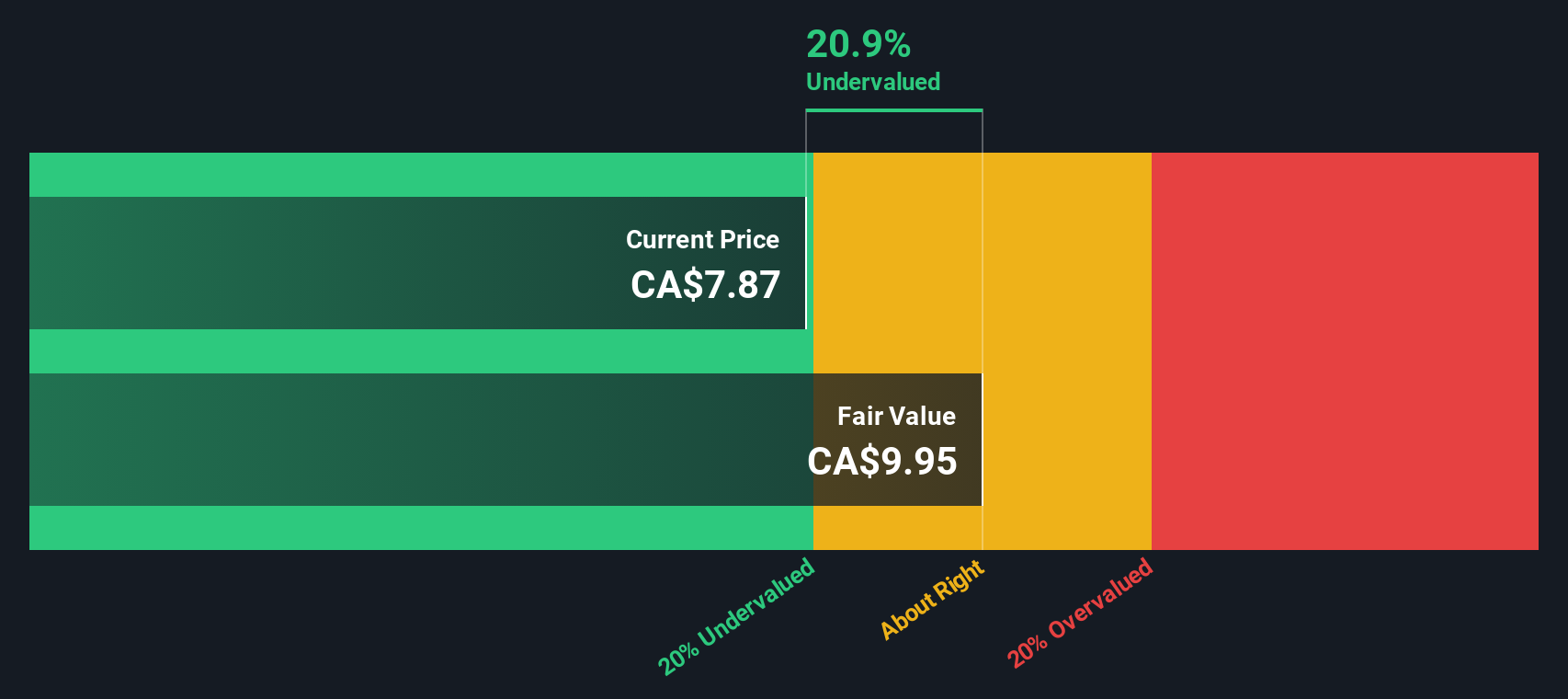

Nexus Industrial REIT (TSX:NXR.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nexus Industrial REIT is a Canadian real estate investment trust focused on owning and managing industrial properties, with a market capitalization of approximately CA$1.15 billion.

Operations: The company generates revenue primarily from investment properties, with recent figures reaching CA$172.86 million. The gross profit margin has shown a consistent trend around 71%, demonstrating efficient cost management relative to revenue. Operating expenses have been relatively stable, contributing to a net income margin that fluctuates significantly due to non-operating expenses and other financial activities.

PE: 13.0x

Nexus Industrial REIT, a Canadian small cap, has seen insider confidence with recent share purchases. Despite a challenging financial position due to reliance on external borrowing and interest payments not fully covered by earnings, the company is focused on growth. Earnings are projected to rise 12% annually, although profit margins have declined from last year's 91% to 25%. Recent Q3 results showed sales of C$45.53 million but a net loss of C$45.99 million. Strategic board appointments aim to bolster expertise in real estate and finance sectors for future prospects.

- Click here and access our complete valuation analysis report to understand the dynamics of Nexus Industrial REIT.

Assess Nexus Industrial REIT's past performance with our detailed historical performance reports.

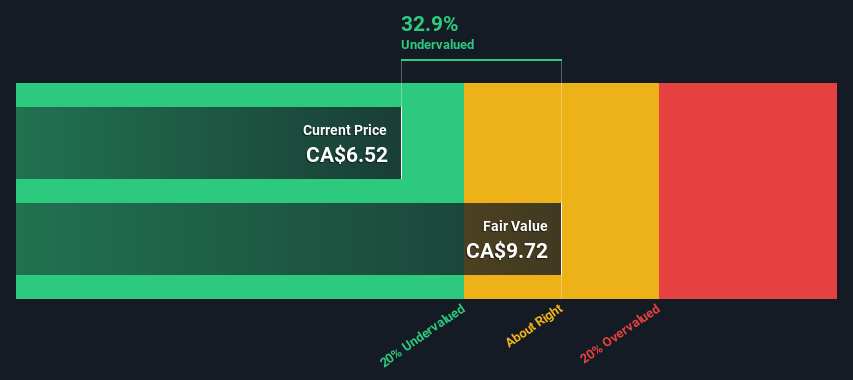

Sagicor Financial (TSX:SFC)

Simply Wall St Value Rating: ★★★★★★

Overview: Sagicor Financial operates as a financial services provider with key segments in life insurance and financial services across the Caribbean, USA, and Jamaica, with a market capitalization of $1.23 billion.

Operations: Sagicor Financial's revenue streams primarily include Sagicor Jamaica, Sagicor Life, and Sagicor Life USA. Over recent periods, the company has seen fluctuations in its gross profit margin, with a notable peak at 52.64% in September 2023. Operating expenses have varied but are consistently significant relative to gross profit.

PE: 1.2x

Sagicor Financial, a Canadian company with small capitalization, recently reported a turnaround in its financial performance. For Q3 2024, net income reached US$59.05 million from a loss of US$3.53 million the previous year, signaling improved profitability despite forecasted earnings declines over the next three years. Insider confidence is evident as Gilbert Palter acquired 225,000 shares for approximately US$1.26 million in November 2024. However, reliance on external borrowing poses funding risks without customer deposits to stabilize liabilities.

- Click here to discover the nuances of Sagicor Financial with our detailed analytical valuation report.

Explore historical data to track Sagicor Financial's performance over time in our Past section.

Next Steps

- Unlock more gems! Our Undervalued TSX Small Caps With Insider Buying screener has unearthed 18 more companies for you to explore.Click here to unveil our expertly curated list of 21 Undervalued TSX Small Caps With Insider Buying.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexus Industrial REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NXR.UN

Nexus Industrial REIT

A growth-oriented real estate investment trust focused on increasing unitholder value through the acquisition of industrial properties located in primary and secondary markets in Canada, and the ownership and management of its portfolio of properties.

Undervalued established dividend payer.