- Canada

- /

- Electrical

- /

- TSXV:NBM

January 2025's Promising Penny Stocks On The TSX

Reviewed by Simply Wall St

As 2025 begins, the Canadian market is navigating a landscape shaped by recent U.S. policy shifts, with the TSX index showing resilience amid potential economic changes. For investors looking beyond well-known stocks, penny stocks—often smaller or newer companies—can present intriguing opportunities. These stocks may be considered outdated by some, but their potential for growth and affordability remains relevant in today's investment climate.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.44 | CA$965.98M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.61 | CA$432.92M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.44 | CA$124.04M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.35 | CA$231.32M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.48 | CA$13.75M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$632.68M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$179.61M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.18 | CA$228.22M | ★★★★☆☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Discovery Silver (TSX:DSV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Discovery Silver Corp. is a mineral exploration company focused on the exploration and development of polymetallic mineral deposits, with a market cap of CA$392.45 million.

Operations: Discovery Silver Corp. does not report any revenue segments.

Market Cap: CA$392.45M

Discovery Silver Corp., with a market cap of CA$392.45 million, is pre-revenue and currently unprofitable, having reported a net loss of CA$5.27 million in Q3 2024. Despite this, the company benefits from an experienced board and management team, with no significant shareholder dilution recently. Analysts suggest potential stock price growth of over 100%. However, its cash runway is less than a year if free cash flow continues to decrease at historical rates. Discovery Silver remains debt-free and has short-term assets exceeding liabilities but faces challenges achieving profitability within the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Discovery Silver.

- Learn about Discovery Silver's historical performance here.

Lithium Chile (TSXV:LITH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lithium Chile Inc. focuses on acquiring and developing lithium properties in Chile and Argentina, with a market cap of CA$150.62 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$150.62M

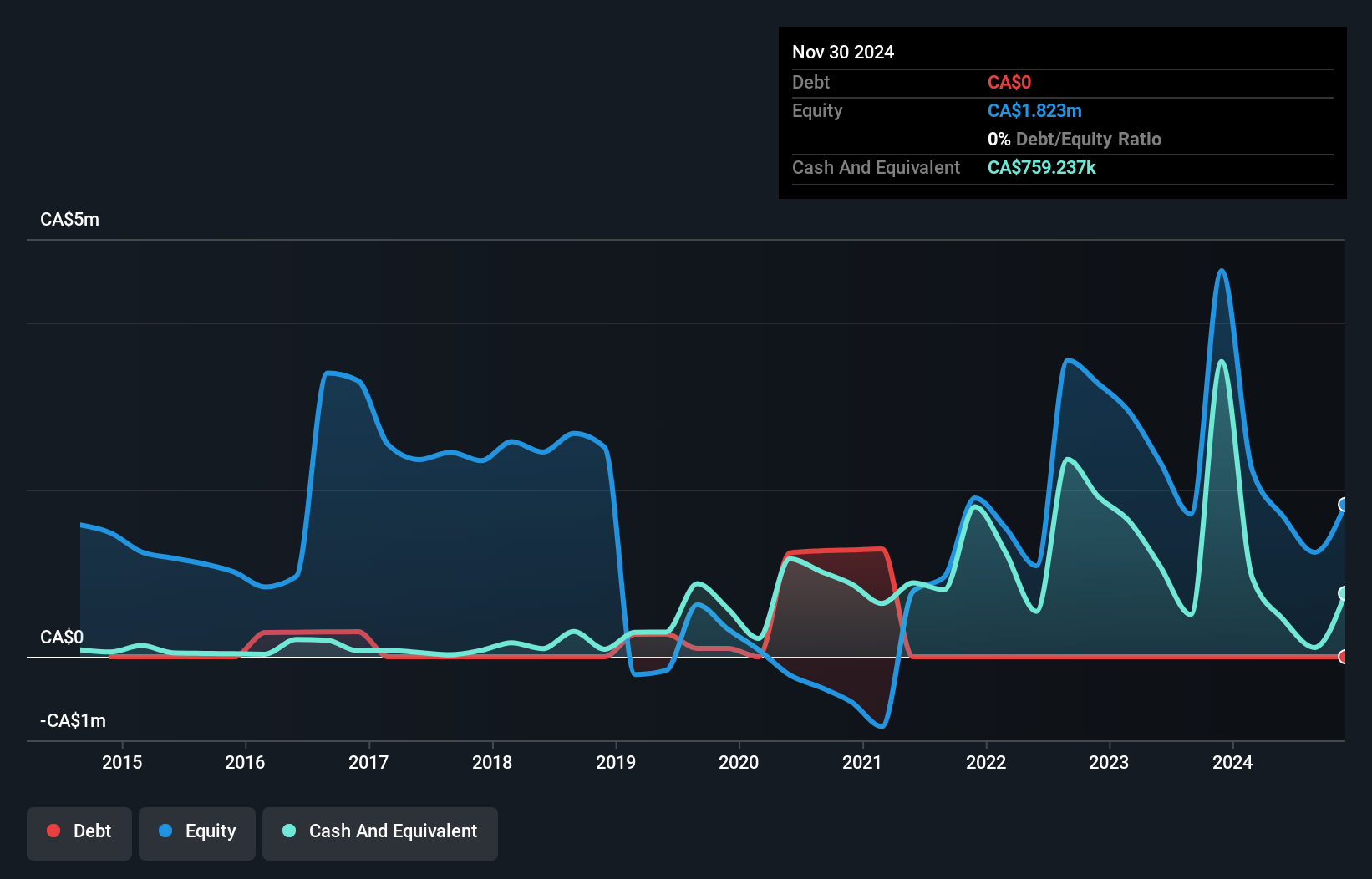

Lithium Chile Inc., with a market cap of CA$150.62 million, is pre-revenue and debt-free, indicating financial prudence. The company recently expanded its stake in the Salar de Arizaro project to 80%, enhancing its strategic position with a reported pre-tax NPV of US$3.8 billion. Despite minimal revenue, Lithium Chile has achieved profitability over five years, with earnings growing by 146.5% last year alone—outpacing industry averages significantly. Its experienced board and management team contribute to stable governance without significant shareholder dilution recently, while short-term assets comfortably cover liabilities.

- Dive into the specifics of Lithium Chile here with our thorough balance sheet health report.

- Gain insights into Lithium Chile's past trends and performance with our report on the company's historical track record.

NEO Battery Materials (TSXV:NBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NEO Battery Materials Ltd. manufactures silicon anode materials for lithium-ion batteries used in electric vehicles, electronics, and energy storage systems in Canada, with a market cap of CA$121.39 million.

Operations: Currently, there are no reported revenue segments for NEO Battery Materials Ltd.

Market Cap: CA$121.39M

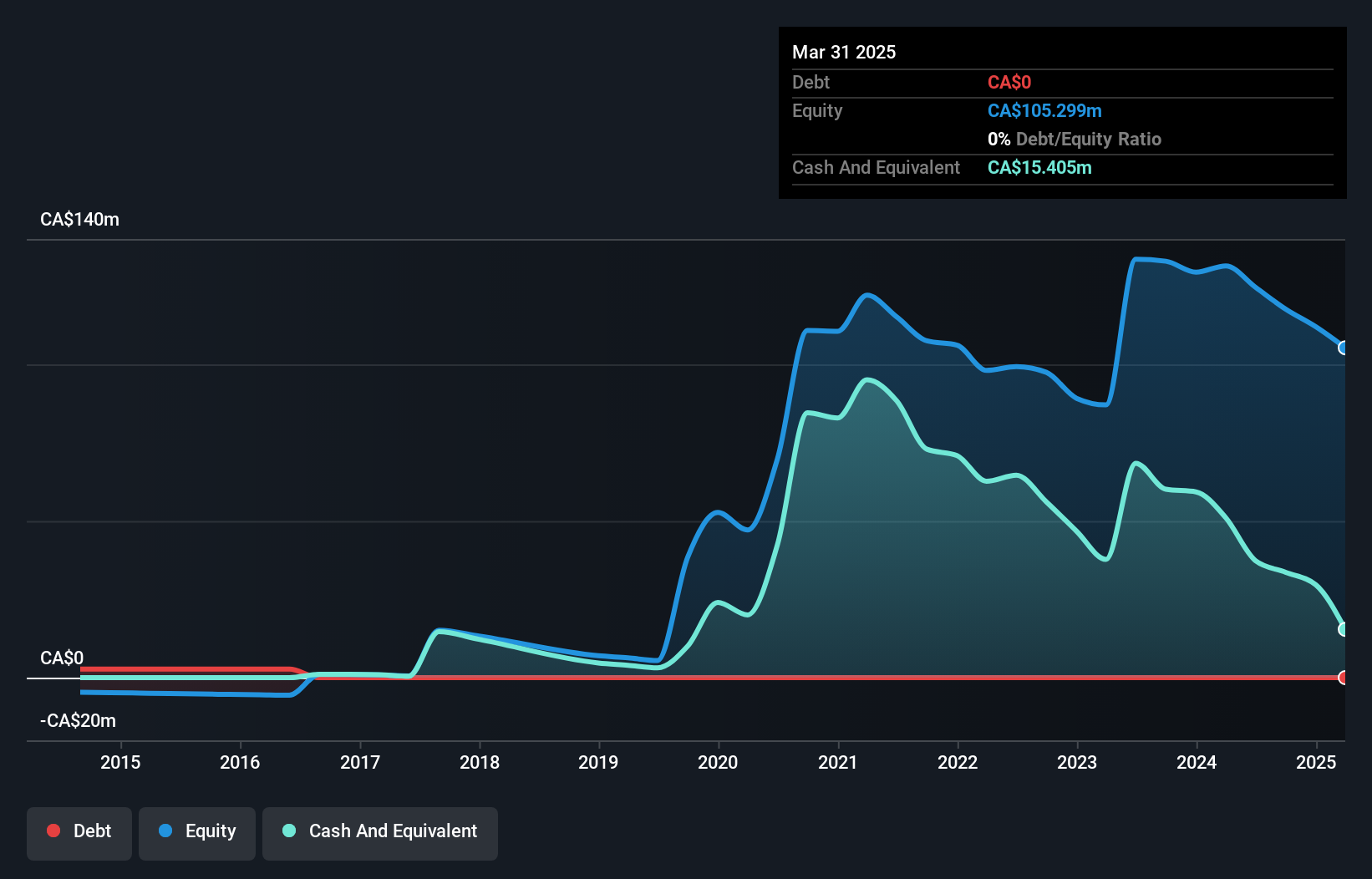

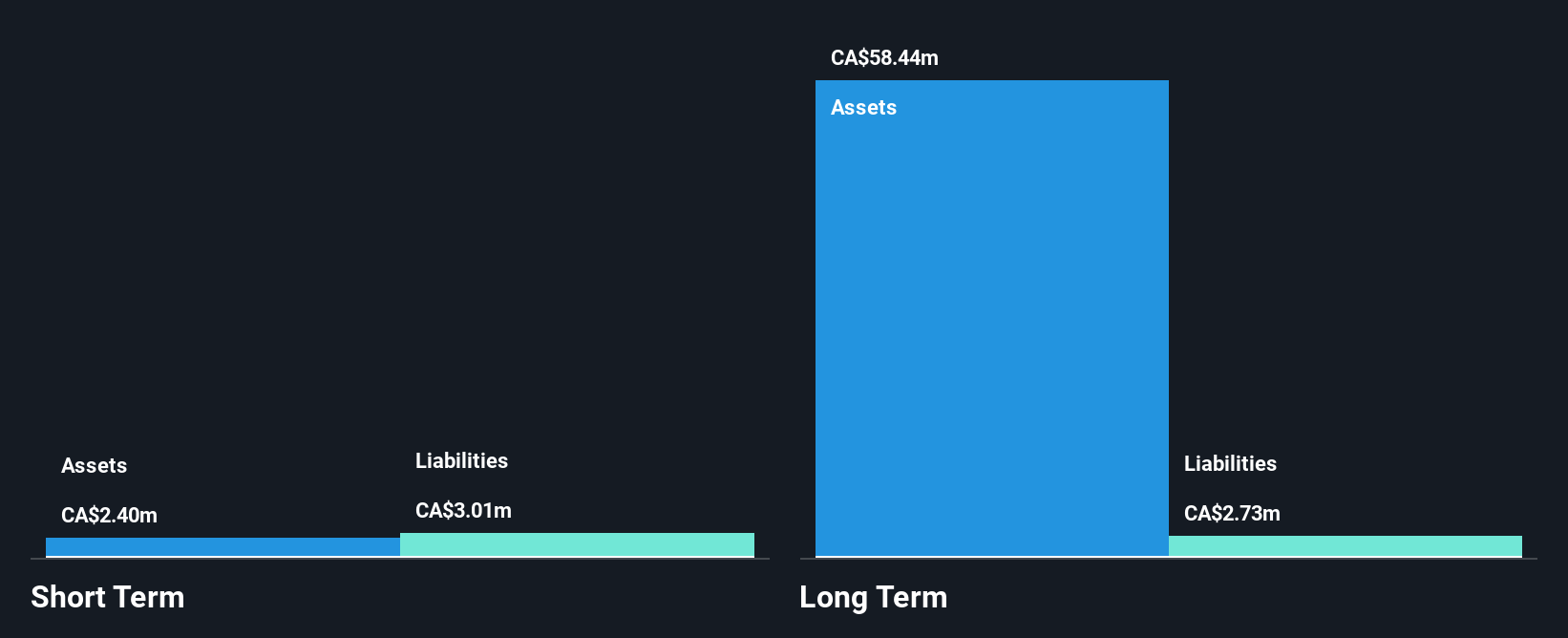

NEO Battery Materials Ltd., with a market cap of CA$121.39 million, is pre-revenue and debt-free, focusing on silicon anode materials for lithium-ion batteries. Recent strategic moves include being added to the S&P/TSX Venture Composite Index and launching the NBMSiDE P-300 product, which targets high-performance applications in space and eVTOL industries. Despite its unprofitable status, NEO has formed key alliances to enhance its technological capabilities and expand market reach. However, challenges remain with short-term liabilities exceeding assets and a volatile share price. The board's experience supports governance amid ongoing efforts to commercialize its innovations.

- Click here to discover the nuances of NEO Battery Materials with our detailed analytical financial health report.

- Review our historical performance report to gain insights into NEO Battery Materials' track record.

Summing It All Up

- Get an in-depth perspective on all 934 TSX Penny Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEO Battery Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NBM

NEO Battery Materials

NEO Battery Materials Ltd. focus on manufacturing of silicon anode materials for lithium-ion batteries in electric vehicles, electronics, and energy storage systems in Canada.

Excellent balance sheet slight.

Market Insights

Community Narratives