Shareholders May Be More Conservative With First Hydrogen Corp.'s (CVE:FHYD) CEO Compensation For Now

Key Insights

- First Hydrogen will host its Annual General Meeting on 14th of November

- CEO Balraj Mann's total compensation includes salary of CA$480.0k

- The overall pay is 48% above the industry average

- First Hydrogen's total shareholder return over the past three years was 596% while its EPS was down 60% over the past three years

Despite strong share price growth of 596% for First Hydrogen Corp. (CVE:FHYD) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 14th of November. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

Check out our latest analysis for First Hydrogen

Comparing First Hydrogen Corp.'s CEO Compensation With The Industry

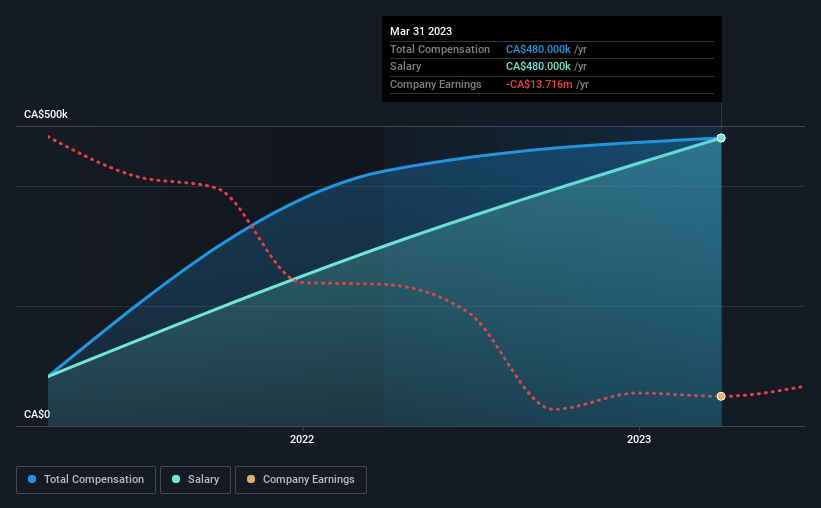

Our data indicates that First Hydrogen Corp. has a market capitalization of CA$141m, and total annual CEO compensation was reported as CA$480k for the year to March 2023. That's a notable increase of 13% on last year. It is worth noting that the CEO compensation consists entirely of the salary, worth CA$480k.

For comparison, other companies in the Canadian Machinery industry with market capitalizations below CA$274m, reported a median total CEO compensation of CA$325k. Accordingly, our analysis reveals that First Hydrogen Corp. pays Balraj Mann north of the industry median. Moreover, Balraj Mann also holds CA$1.4m worth of First Hydrogen stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$480k | CA$300k | 100% |

| Other | - | CA$125k | - |

| Total Compensation | CA$480k | CA$425k | 100% |

On an industry level, roughly 85% of total compensation represents salary and 15% is other remuneration. At the company level, First Hydrogen pays Balraj Mann solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

First Hydrogen Corp.'s Growth

Over the last three years, First Hydrogen Corp. has shrunk its earnings per share by 60% per year. In the last year, its revenue has collapsed effectively to zero.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has First Hydrogen Corp. Been A Good Investment?

We think that the total shareholder return of 596%, over three years, would leave most First Hydrogen Corp. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

First Hydrogen pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 3 warning signs for First Hydrogen you should be aware of, and 2 of them shouldn't be ignored.

Switching gears from First Hydrogen, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:FHYD

First Hydrogen

Focuses on zero-emission vehicles, green hydrogen production and distribution, and supercritical carbon dioxide extractor systems primarily in Canada.

Medium-low with weak fundamentals.

Market Insights

Community Narratives