- Canada

- /

- Electrical

- /

- TSXV:FCLI

Top 3 TSX Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

The Canadian stock market is experiencing a robust year, with the TSX up more than 17%, mirroring global trends of economic growth and favorable central bank policies. In such a thriving market, identifying stocks that blend affordability with growth potential becomes crucial. Penny stocks, though often seen as niche investments in smaller or newer companies, can still offer promising opportunities when backed by strong financial health.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.66 | CA$620.8M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$183.06M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.33 | CA$119.2M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$4.71M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.35 | CA$314.9M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.44 | CA$227.75M | ★★★★★☆ |

| Amerigo Resources (TSX:ARG) | CA$1.77 | CA$290.15M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.17M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.12 | CA$126.75M | ★★★★☆☆ |

Click here to see the full list of 948 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Full Circle Lithium (TSXV:FCLI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Full Circle Lithium Corp. is a specialty chemical recycling and processing company operating in the United States and Canada, with a market cap of CA$16.41 million.

Operations: No revenue segments have been reported.

Market Cap: CA$16.41M

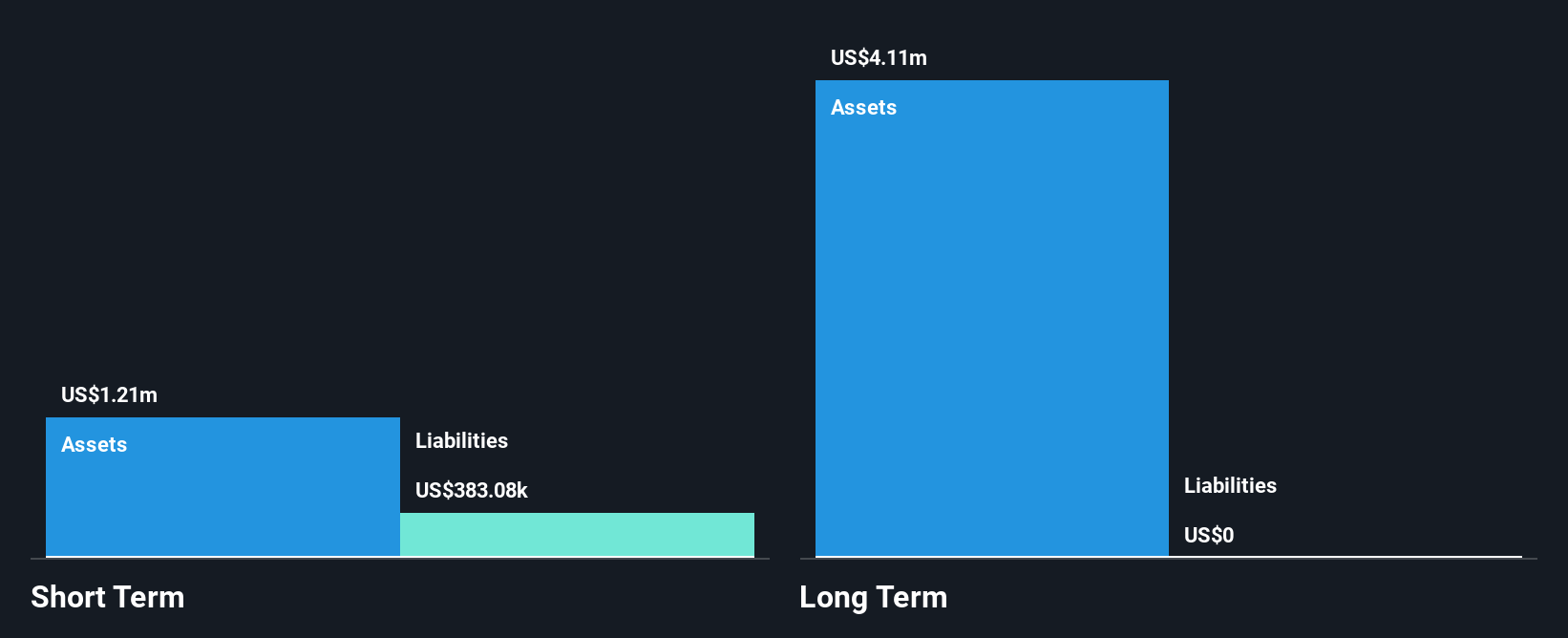

Full Circle Lithium Corp., with a market cap of CA$16.41 million, is pre-revenue and has reported minimal sales of US$10K for the third quarter ending July 31, 2024. The company remains unprofitable with a net loss of US$865,847 for the same period. Despite having no long-term liabilities or debt over the past five years, its cash runway is less than a year given current free cash flow trends. Shareholders have experienced dilution in the past year as shares outstanding increased by 9.2%. The stock's price has been highly volatile recently and lacks stability in financial performance metrics.

- Click to explore a detailed breakdown of our findings in Full Circle Lithium's financial health report.

- Assess Full Circle Lithium's future earnings estimates with our detailed growth reports.

Green Impact Partners (TSXV:GIP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Green Impact Partners Inc. operates in North America, offering water, waste, and solids treatment and recycling services with a market cap of CA$73.73 million.

Operations: The company generates revenue of CA$157.99 million from its Water & Solids Recycling & Energy Product Optimization segment.

Market Cap: CA$73.73M

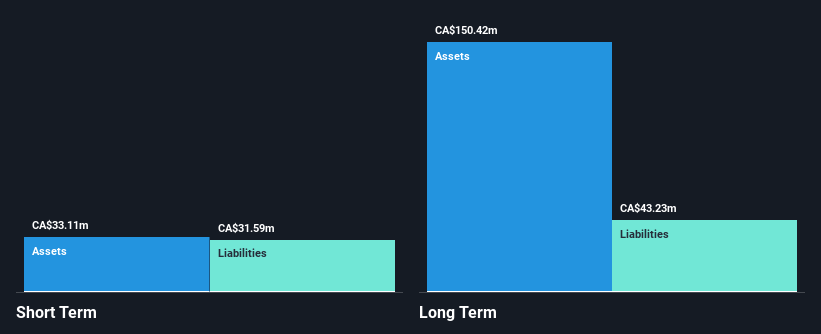

Green Impact Partners Inc., with a market cap of CA$73.73 million, operates in the water and waste recycling sector, reporting CA$41.14 million in sales for Q2 2024 but remains unprofitable with a net loss of CA$5.55 million. The company's short-term assets cover its short-term liabilities but not its long-term ones, indicating some financial strain. Despite stable weekly volatility and no recent shareholder dilution, it faces challenges with profitability not expected within three years. Its net debt to equity ratio is satisfactory at 16.9%, and it has a cash runway extending over three years if current cash flow trends persist.

- Jump into the full analysis health report here for a deeper understanding of Green Impact Partners.

- Gain insights into Green Impact Partners' outlook and expected performance with our report on the company's earnings estimates.

Tower Resources (TSXV:TWR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tower Resources Ltd. is involved in the acquisition, evaluation, and exploration of mineral properties in Canada with a market cap of CA$14.80 million.

Operations: Tower Resources Ltd. currently does not report any revenue segments.

Market Cap: CA$14.8M

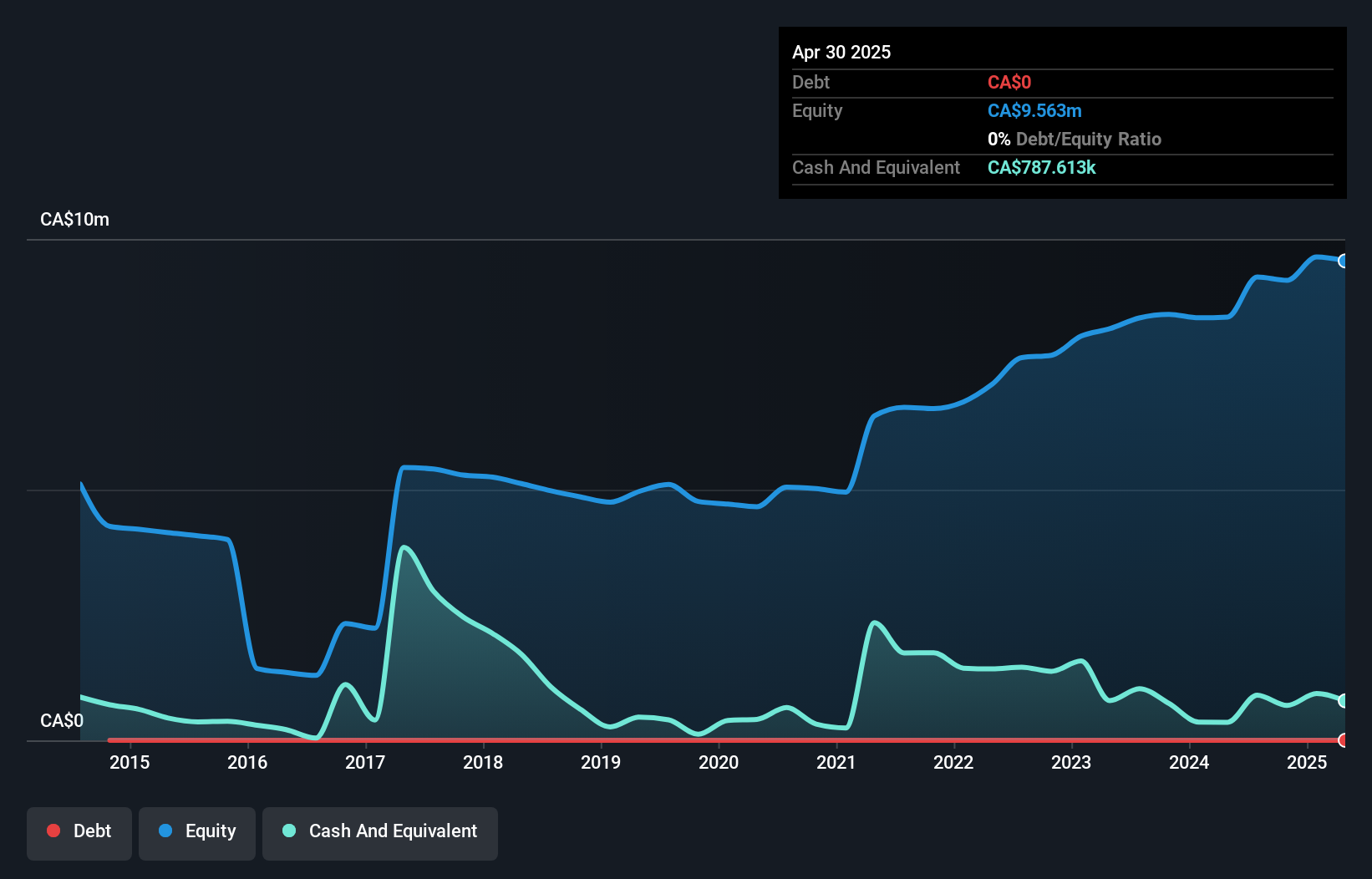

Tower Resources Ltd., with a market cap of CA$14.80 million, is pre-revenue and focused on mineral exploration in Canada. Recent drilling at the Rabbit North property has shown promising gold mineralization, notably intercepting 6.06 g/t Au over 4.27m in the Lightning-Thunder trend. Despite its unprofitability, Tower Resources has no debt and reduced losses by 14.8% annually over five years, reflecting some financial resilience. The management team is experienced with an average tenure of 6.5 years, though shareholders faced dilution last year as shares outstanding grew by 7.3%. The company holds less than a year's cash runway if current cash flow trends persist.

- Click here to discover the nuances of Tower Resources with our detailed analytical financial health report.

- Learn about Tower Resources' historical performance here.

Where To Now?

- Access the full spectrum of 948 TSX Penny Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:FCLI

Full Circle Lithium

Operates as a specialty chemical recycling and processing company in the United States and Canada.

Moderate with adequate balance sheet.