- Canada

- /

- Metals and Mining

- /

- TSXV:VUL

Discover 3 TSX Penny Stocks With At Least CA$7M Market Cap

Reviewed by Simply Wall St

The Canadian market is currently navigating a complex landscape, with bond yields playing a significant role in shaping investment strategies. As investors assess their portfolios, penny stocks remain an intriguing option, offering potential growth opportunities despite their somewhat outdated label. These smaller or newer companies can provide value and growth potential when backed by strong financials, making them worth consideration for those seeking under-the-radar investments.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.33 | CA$121.5M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.55 | CA$939.87M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.13 | CA$370M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$237.23M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$178.48M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$2.03 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 950 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Kelso Technologies (TSX:KLS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kelso Technologies Inc. develops, produces, and distributes proprietary equipment for transportation applications in the United States and Canada, with a market cap of CA$7.35 million.

Operations: Kelso Technologies generates revenue of $11.14 million from the design, production, and distribution of proprietary products for the rail sector.

Market Cap: CA$7.35M

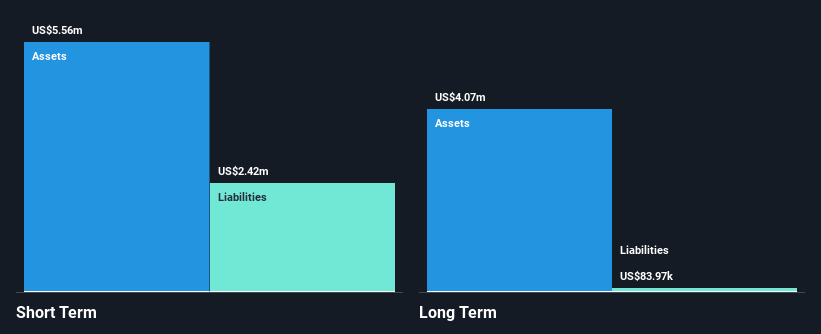

Kelso Technologies, with a market cap of CA$7.35 million, operates in the rail sector and reported US$8.07 million in sales for the first nine months of 2024, showing modest growth from the previous year. Despite being debt-free and having assets that cover its liabilities, Kelso remains unprofitable with increasing losses over the past five years at an annual rate of 39.4%. Its cash runway is less than a year if current free cash flow trends persist. The management team is relatively new, which might impact strategic stability moving forward.

- Click here to discover the nuances of Kelso Technologies with our detailed analytical financial health report.

- Gain insights into Kelso Technologies' historical outcomes by reviewing our past performance report.

Silver One Resources (TSXV:SVE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silver One Resources Inc., along with its subsidiary, focuses on acquiring, exploring, and developing mineral properties in the United States, with a market cap of CA$49.75 million.

Operations: Silver One Resources Inc. does not report any revenue segments as it is primarily engaged in the acquisition, exploration, and development of mineral properties in the United States.

Market Cap: CA$49.75M

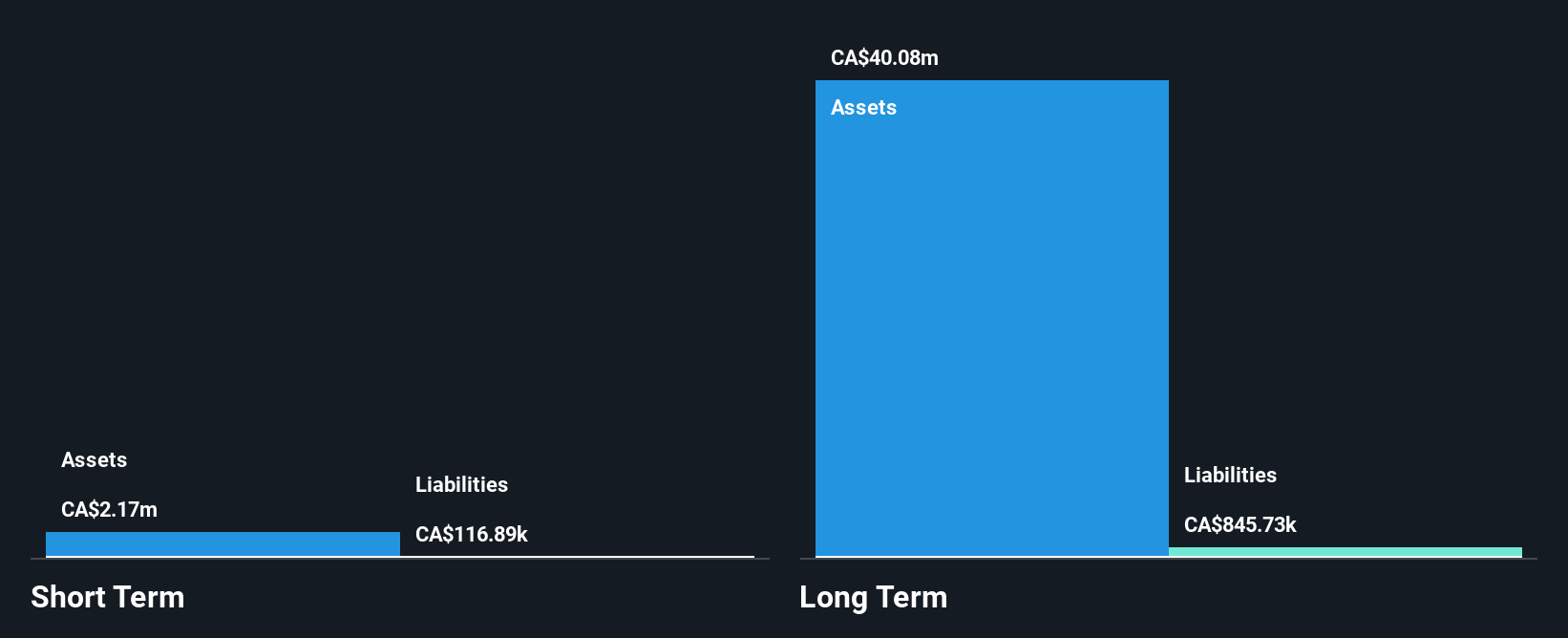

Silver One Resources, with a market cap of CA$49.75 million, is pre-revenue and unprofitable, having reported a net loss of CA$1.54 million for the first nine months of 2024. Despite this, the company has a seasoned management team and remains debt-free with short-term assets surpassing liabilities by a substantial margin. Recent developments include its addition to the S&P/TSX Venture Composite Index and commencement of drilling at its Phoenix Silver Project in Arizona. The project shows promising high-grade silver potential, though exploration covers less than half the property so far.

- Get an in-depth perspective on Silver One Resources' performance by reading our balance sheet health report here.

- Examine Silver One Resources' past performance report to understand how it has performed in prior years.

Vulcan Minerals (TSXV:VUL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vulcan Minerals Inc. is a precious and base metals exploration company focused on acquiring, evaluating, and exploring mineral properties in Newfoundland and Labrador, with a market cap of CA$16.16 million.

Operations: No revenue segments have been reported for this exploration-focused company.

Market Cap: CA$16.16M

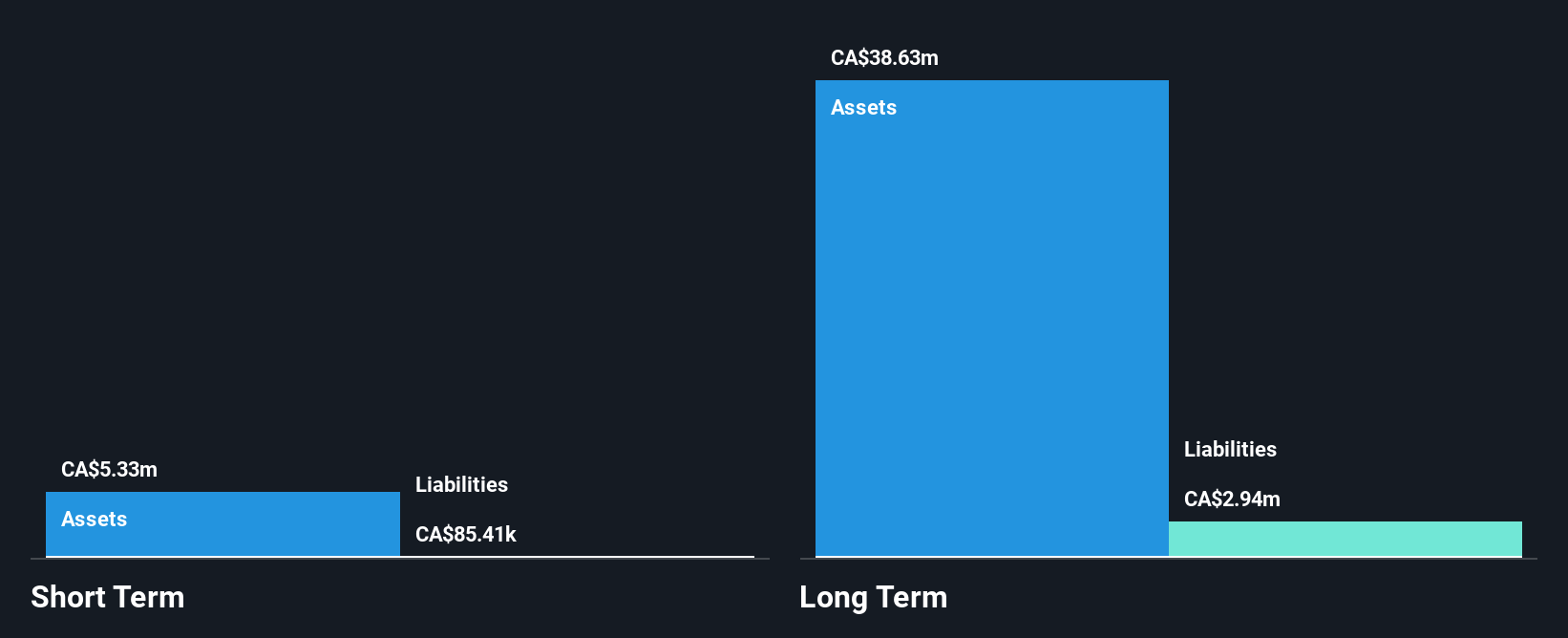

Vulcan Minerals Inc., with a market cap of CA$16.16 million, is a pre-revenue exploration company focused on mineral properties in Newfoundland and Labrador. Despite being unprofitable, Vulcan remains debt-free with short-term assets significantly exceeding liabilities. Recent updates highlight ongoing drilling at the McNeilly zone of its Colchester Property and promising sampling results at the Carbonear project, indicating potential for copper-gold and zinc-lead deposits respectively. The board is experienced, averaging 6.3 years in tenure, providing stability as Vulcan advances its exploration efforts without shareholder dilution over the past year.

- Click to explore a detailed breakdown of our findings in Vulcan Minerals' financial health report.

- Explore historical data to track Vulcan Minerals' performance over time in our past results report.

Where To Now?

- Discover the full array of 950 TSX Penny Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:VUL

Vulcan Minerals

A precious and base metals exploration company, engages in the acquisition, evaluation, and exploration of mineral properties in Newfoundland and Labrador.

Flawless balance sheet low.

Market Insights

Community Narratives