- Canada

- /

- Metals and Mining

- /

- TSXV:THX

TSX Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

As Canadian investors navigate a landscape marked by potential tax changes on U.S. dividends and rising bond yields, attention is increasingly turning to how these factors might influence investment strategies. Penny stocks, though often considered a relic of past market eras, continue to offer intriguing opportunities due to their affordability and growth potential. By focusing on companies with strong financials, investors can uncover promising prospects among these smaller or newer market players.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.76 | CA$74.85M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.75 | CA$124.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.20 | CA$133.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.70 | CA$485.67M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.22 | CA$636.86M | ✅ 4 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.80 | CA$4.57M | ✅ 2 ⚠️ 5 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.74 | CA$168.16M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.61 | CA$558.14M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.63 | CA$131.96M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.6M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 906 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Tantalus Systems Holding (TSX:GRID)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tantalus Systems Holding Inc. is a technology company that offers smart grid solutions in Canada and the United States with a market cap of CA$120.44 million.

Operations: The company generates revenue from Connected Devices and Infrastructure, amounting to $29.62 million, and Utility Software Applications and Services, totaling $17.20 million.

Market Cap: CA$120.44M

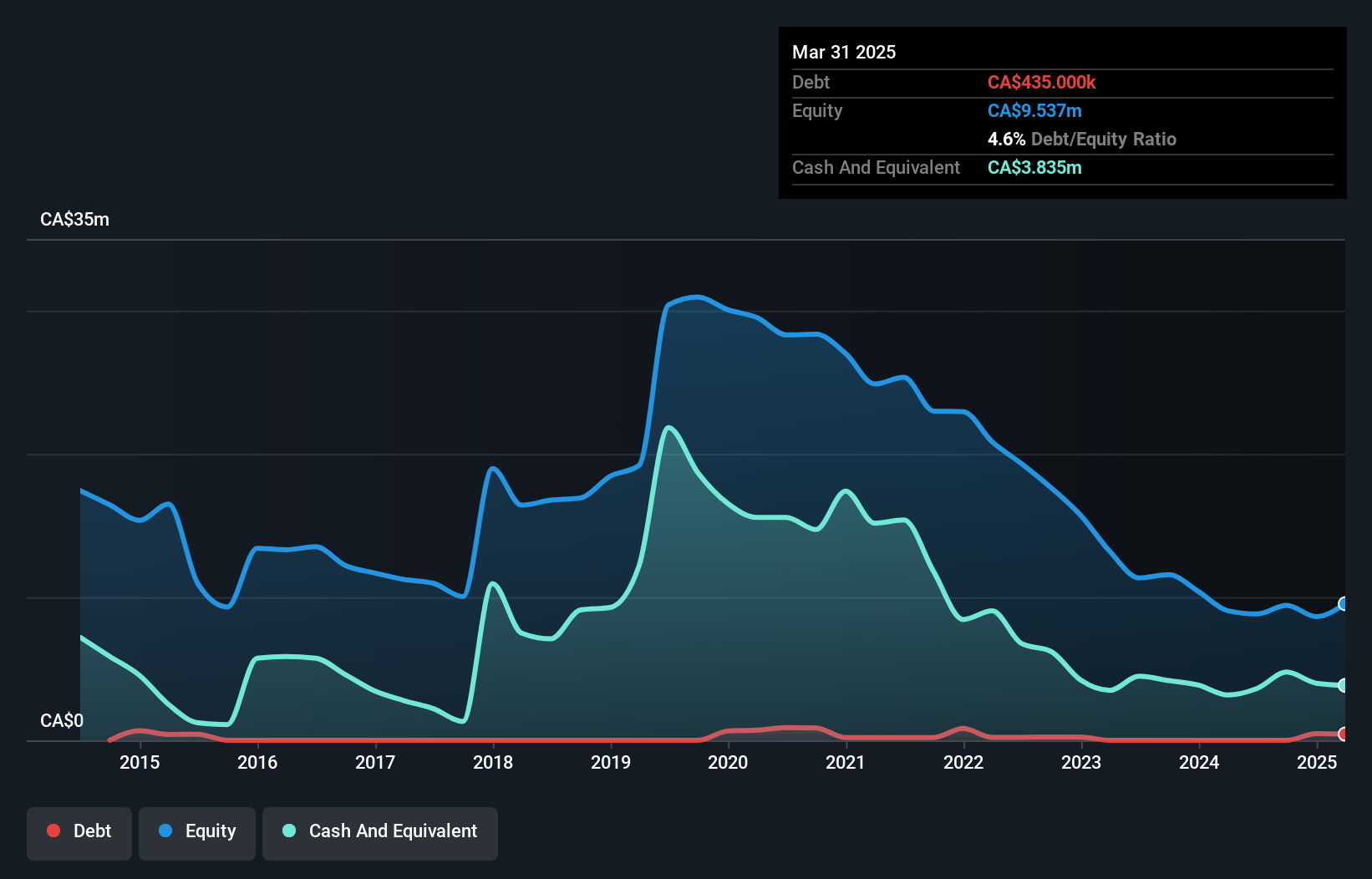

Tantalus Systems Holding Inc., with a market cap of CA$120.44 million, is currently unprofitable but has shown improved financial stability by maintaining positive shareholder equity and having more cash than total debt. Recent earnings reports indicate revenue growth, with Q1 2025 sales increasing to US$11.9 million from US$9.4 million the previous year, though it still reported a net loss of US$0.651 million. The company has filed a CAD 50 million Shelf Registration, potentially to bolster its financial position further. Despite auditor concerns about its ability to continue as a going concern, Tantalus maintains sufficient cash runway for over three years due to positive free cash flow growth.

- Navigate through the intricacies of Tantalus Systems Holding with our comprehensive balance sheet health report here.

- Gain insights into Tantalus Systems Holding's future direction by reviewing our growth report.

EnWave (TSXV:ENW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EnWave Corporation designs, constructs, markets, and sells vacuum-microwave dehydration machinery for the food, cannabis, and biomaterial industries globally with a market cap of CA$39.44 million.

Operations: EnWave Corporation has not reported specific revenue segments.

Market Cap: CA$39.44M

EnWave Corporation, with a market cap of CA$39.44 million, has demonstrated significant sales growth, reporting CA$3.69 million in Q2 2025 compared to CA$0.663 million a year ago, and achieving net income of CA$0.764 million from a prior loss. The company is leveraging its Radiant Energy Vacuum technology through strategic partnerships like the expanded agreement with Creations Foods for pet treats and MicroDried®'s increased production capacity for fruit ingredients. Despite being unprofitable overall, EnWave's positive cash flow and sufficient short-term assets position it well to cover liabilities while pursuing further growth opportunities in diverse markets.

- Click here and access our complete financial health analysis report to understand the dynamics of EnWave.

- Review our historical performance report to gain insights into EnWave's track record.

Thor Explorations (TSXV:THX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Thor Explorations Ltd., along with its subsidiaries, operates as a gold producer and explorer with a market capitalization of CA$485.67 million.

Operations: The Segilola Mine Project generated $193.13 million in revenue.

Market Cap: CA$485.67M

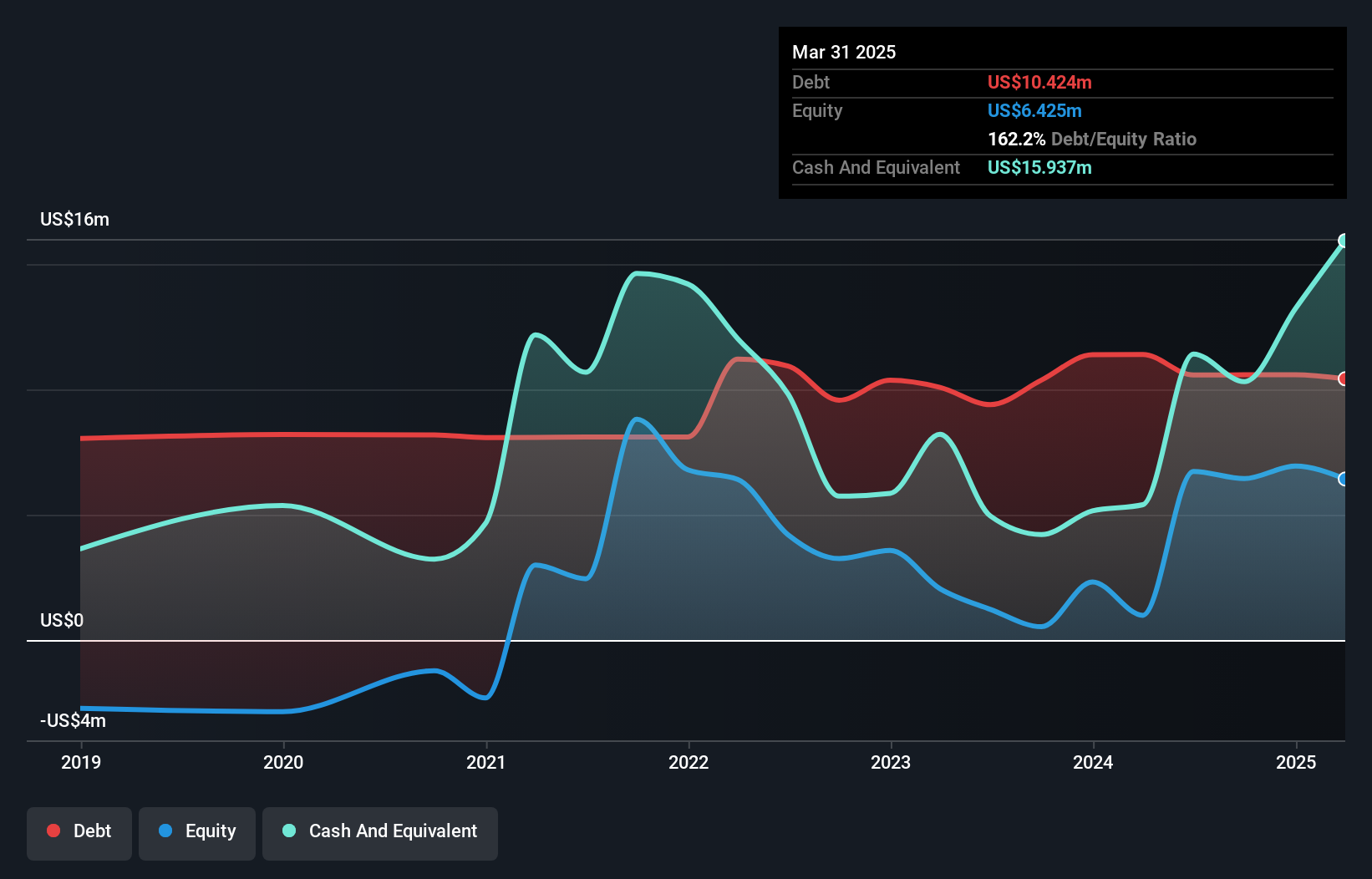

Thor Explorations Ltd., with a market cap of CA$485.67 million, has shown remarkable earnings growth, outpacing the industry with a 738.8% increase over the past year, driven by revenue from its Segilola Mine Project. The company's net profit margin improved significantly to 47.2%, and it maintains an outstanding return on equity of 45.3%. Despite short-term assets not covering liabilities, Thor's debt is well-managed and covered by operating cash flow. Recent positive drilling results at the Douta-West licence highlight potential for resource expansion, complementing Thor's strategic dividend policy aimed at balancing growth and shareholder returns.

- Click to explore a detailed breakdown of our findings in Thor Explorations' financial health report.

- Learn about Thor Explorations' future growth trajectory here.

Turning Ideas Into Actions

- Dive into all 906 of the TSX Penny Stocks we have identified here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thor Explorations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:THX

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives