- Canada

- /

- Aerospace & Defense

- /

- TSX:XTRA

Xtract One Technologies (TSX:XTRA) Losses Narrow, Undervalued Against Peers Heading Into Earnings Season

Reviewed by Simply Wall St

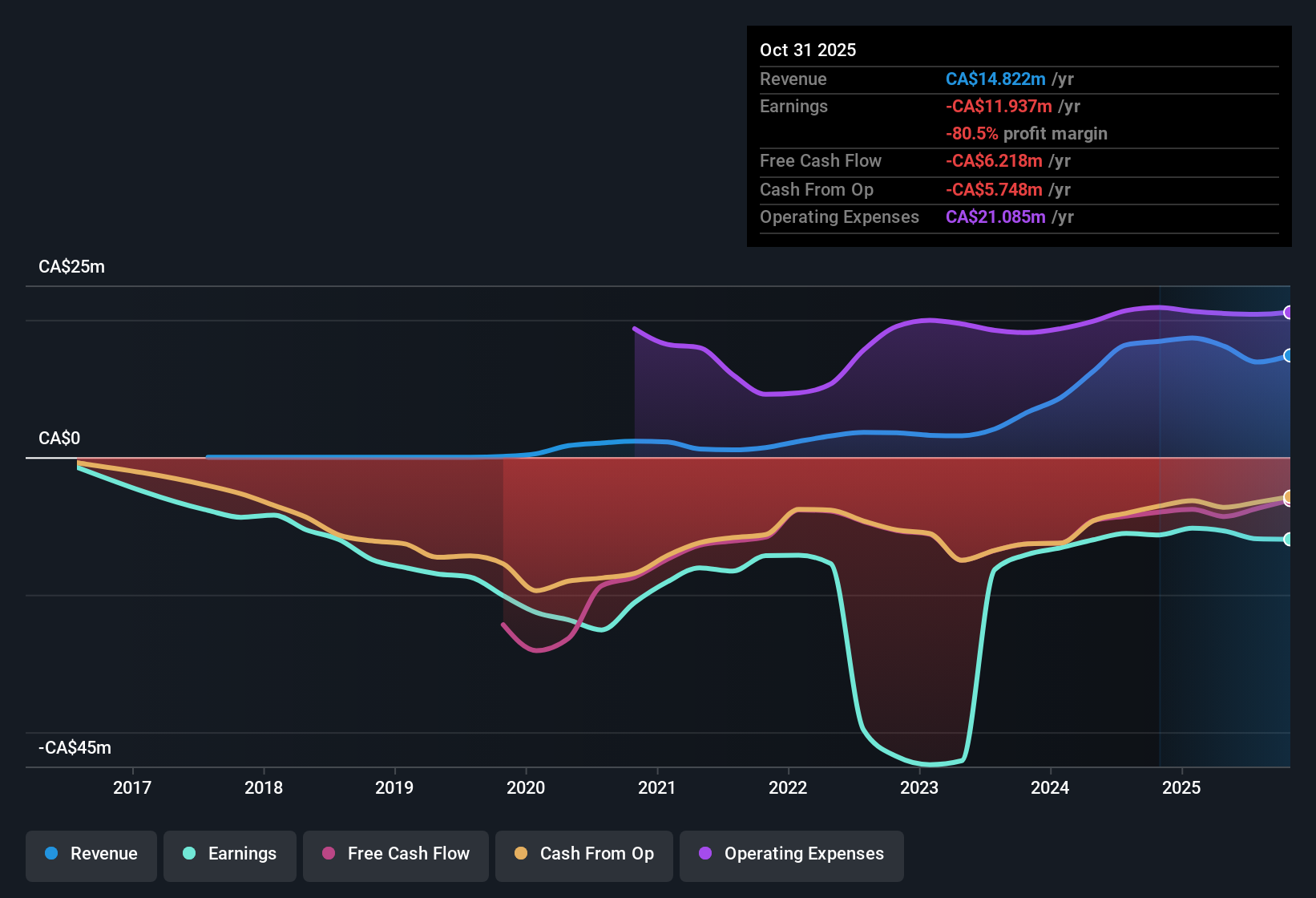

Xtract One Technologies (TSX:XTRA) remains unprofitable, but annual losses have narrowed by 9.7% per year over the last five years. Shares trade at CA$0.71, notably below the company’s estimated fair value of CA$1.6. While not yet profitable, the consistent reduction in losses could prompt investors to see operational improvement on the horizon.

See our full analysis for Xtract One Technologies.Next, we will see how these figures stack up against the narratives shaping market sentiment, highlighting where the latest results support or upend consensus views.

See what the community is saying about Xtract One Technologies

Margins Hold Up Under Pressure

- Gross margins reached 70%, reflecting solid cost control amid the company’s expansion into new products and markets.

- Analysts' consensus view highlights that strong margins, combined with strategic moves such as launching the One Gateway product and using channel partners, support the case for improved efficiency and operational leverage in the coming years.

- The One Gateway product has generated significant interest across education and manufacturing sectors, suggesting further upside for margins if adoption continues.

- Channel partners now account for around 50% of systems deployed, raising the likelihood of sustained cost advantages at scale.

- Consensus narrative notes that as Xtract One ramps up manufacturing, there is some risk of margin compression, which places extra emphasis on execution over the next year.

- Improved margins may increase investor confidence that the company will weather financial headwinds, but a slip here could reinforce bears’ focus on profitability concerns.

Backlog Underpins Growth Potential

- The company reported a booking backlog of $37 million, significantly above the recent quarterly bookings of $13.5 million and nearly 11 times its estimated annual revenue run rate.

- According to analysts' consensus view, this backlog provides visibility on future growth, yet a key tension is the need for timely installation. If delays occur, expected revenue could be pushed out, heightening short-term volatility.

- Legislation-driven demand in healthcare and international markets, especially with new rules in California and Europe, further underscores the growth runway.

- However, the backlog contains a significant portion of agreements pending installation, and bears highlight that deferrals could disrupt forecasts if deployment schedules slip.

Trading Below DCF Fair Value Despite Premium to Industry

- Xtract One’s share price of CA$0.71 is below its calculated DCF fair value of CA$1.60. The stock trades at a price-to-sales multiple of 10.6x versus the North American Aerospace & Defense industry average of 3.2x, though it is well below its peer group multiple of 25.9x.

- The analysts' consensus view considers this mixed valuation backdrop, noting that upside appears tied to management delivering the projected 48.4% annual revenue growth, which could justify premium pricing if successful.

- The consensus analyst price target is CA$1.08, giving roughly 52% upside from current levels if forecasts are met.

- At the same time, bulls and bears alike are watching for delivery against growth targets, as a failure to narrow losses or realize the backlog may pressure the valuation further.

- Investors looking for outperformance will want to see tangible progress converting backlog to revenues before the premium to industry averages can be justified.

- With margin risks and peer comparisons a factor, this balance of growth potential against sector benchmarks is central to the current valuation case.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Xtract One Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the numbers? Share your perspective and shape a narrative in just minutes. Do it your way.

A great starting point for your Xtract One Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

While Xtract One’s growth potential draws interest, uncertainty remains around its ability to consistently convert backlog to revenues and maintain margins as it scales.

If you value steadier expansion and want to sidestep these volatility risks, consider companies with consistent results and explore our stable growth stocks screener (2095 results) that have delivered reliable growth through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:XTRA

Xtract One Technologies

Engages in the research, development, and commercialization integrated, layered, artificial intelligence powered threat detection gateway solutions, with the aim of enhancing public safety in the United States, Japan, France, the United Kingdom, and Canada.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)